Veja também

24.07.2025 08:28 AM

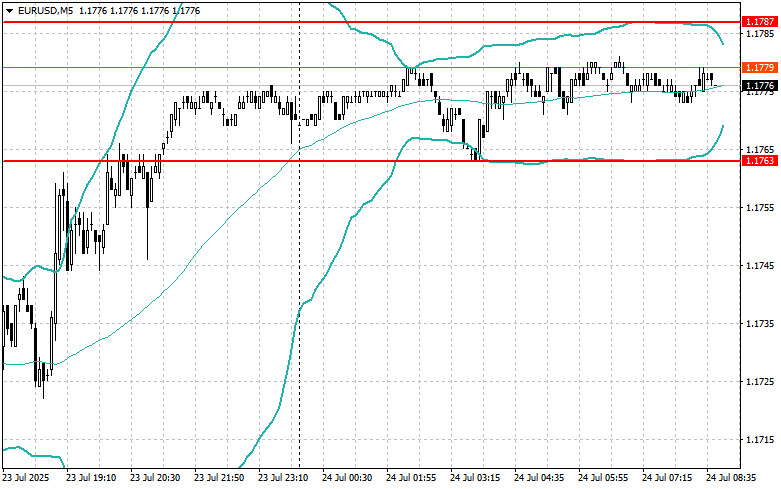

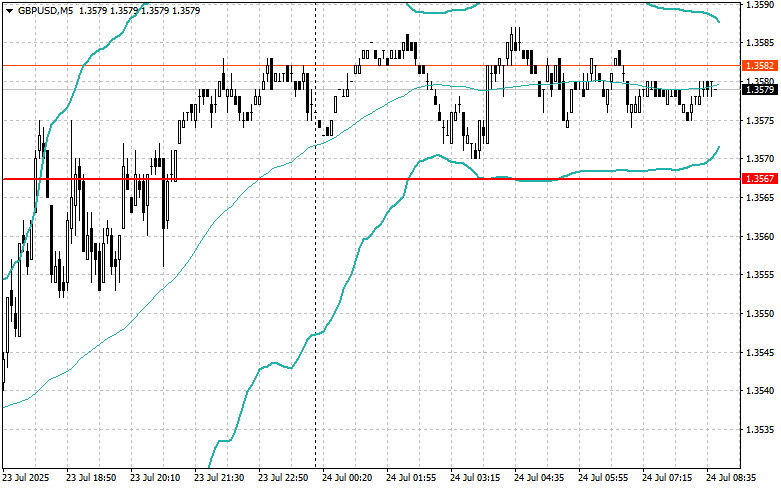

24.07.2025 08:28 AMThe euro and the pound continued to rise yesterday—and at a fairly decent pace. Despite the upcoming important European Central Bank meeting, traders continued to open long positions in risk assets.

The sharp decline in U.S. existing home sales negatively affected the U.S. dollar, leading to further gains in the euro and the British pound. A drop in real estate demand—especially in the secondary market—is traditionally seen as an indicator of economic weakness in the U.S. Against this backdrop, traders concerned about growth prospects continued reallocating their assets into what they consider more stable currencies, such as the euro.

Today is expected to be quite significant, so many fundamental data releases will take a backseat. Market participants will focus their attention on the ECB's announcement of its key interest rate, followed by a press conference featuring Christine Lagarde. If the ECB clearly signals the end of the rate-cut cycle, the euro could strengthen further. However, if the door remains open for further monetary policy easing later this year, downward pressure on the euro may resume.

As for today's data, the Eurozone manufacturing and services PMIs for July could trigger a spike in volatility only if the figures significantly exceed or fall short of economists' expectations.

If the data aligns with economists' expectations, it's best to follow a Mean Reversion strategy. If the data is significantly better or worse than expected, the Momentum strategy is recommended.

Buying a breakout above 1.1785 could lead to growth toward 1.1825 and 1.1866.

Selling a breakout below 1.1765 could lead to a decline toward 1.1741 and 1.1714.

Buying a breakout above 1.3580 could lead to growth toward 1.3615 and 1.3643.

Selling a breakout below 1.3555 could lead to a drop toward 1.3516 and 1.3470.

Buying a breakout above 146.25 could push the dollar to 146.49 and 146.78.

Selling a breakout below 146.00 could result in a decline toward 145.90 and 145.63.

Look to sell after a failed breakout above 1.1787 on a return below that level.

Look to buy after a failed breakout below 1.1763 on a return above that level.

Look to sell after a failed breakout above 1.3592 on a return below that level.

Look to buy after a failed breakout below 1.3567 on a return above that level.

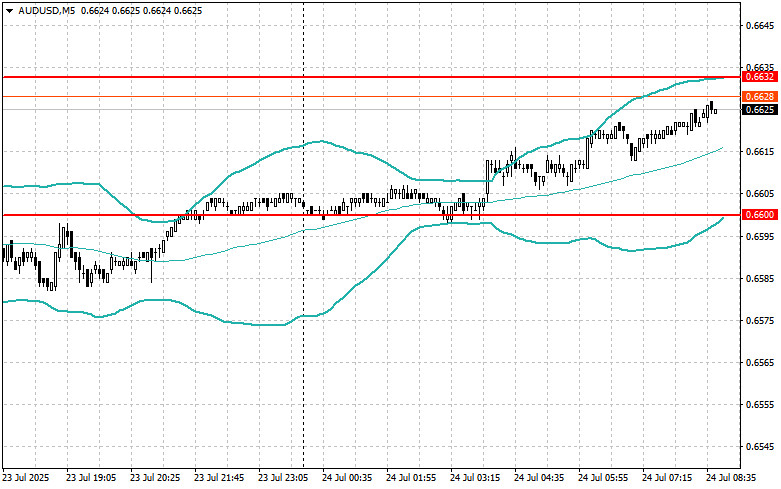

Look to sell after a failed breakout above 0.6632 on a return below that level.

Look to buy after a failed breakout below 0.6600 on a return above that level.

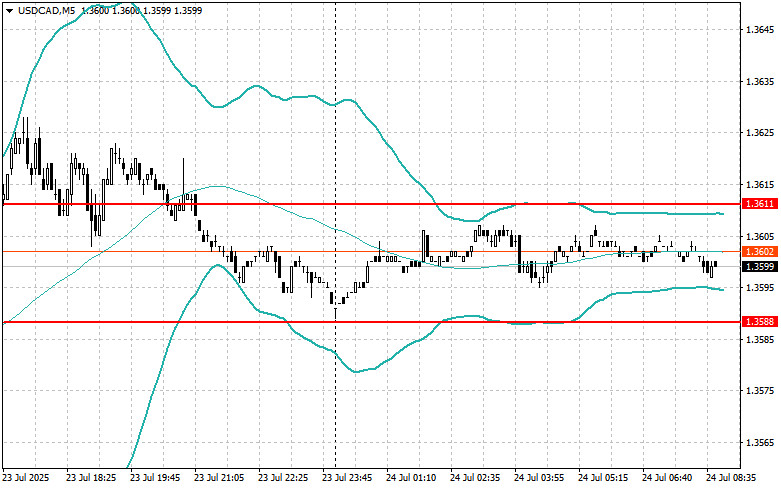

Look to sell after a failed breakout above 1.3611 on a return below that level.

Look to buy after a failed breakout below 1.3588 on a return above that level.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.