Veja também

15.08.2025 05:01 AM

15.08.2025 05:01 AMYesterday's U.S. producer inflation data for July showed a sharp jump: 0.9% for the month and 3.3% y/y versus 2.4% y/y the previous month. The probability of a September Federal Reserve rate cut dropped from 96.6% to 90.2%.

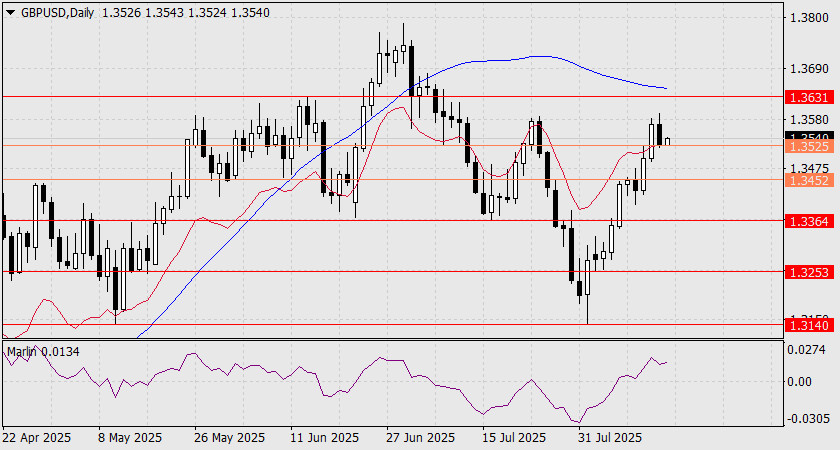

And while a 90% probability still all but guarantees a rate cut, markets saw a shift out of risk assets, including cryptocurrencies (Bitcoin -4.06%). The British pound fell by 45 pips, closing the day at the 1.3525 support level. For the decline to develop, the pound needs to break through the second intermediate level at 1.3452. The first target is 1.3364, and the second is 1.3253.

On the H4 scale, the MACD line is approaching the intermediate level at 1.3452, highlighting its importance for a bearish breakout. For now, the price needs to consolidate below yesterday's reached level of 1.3525. The Marlin oscillator is in negative territory, setting the price up for decisive action.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.