Veja também

15.08.2025 09:22 AM

15.08.2025 09:22 AMOn August 15, the US stock market extended its strong rally, with the major indices closing slightly higher. The S&P 500 gained 0.03%, the Nasdaq 100 added 0.01%, and the Dow Jones Industrial Average rose by 0.02%.

US Treasuries also inched up, partially recovering losses linked to higher inflation data, which had prompted traders to scale back expectations for a Federal Reserve rate cut next month. European stock futures climbed 0.5% today, while S&P 500 futures rebounded toward their recent highs. Oil prices steadied ahead of Friday's US–Russia presidential summit in Alaska.

In Asia, Hong Kong stocks fell 1% after data showed China's economy slowed in July, with weaker manufacturing output and retail sales underscoring the mounting pressure from Donald Trump's trade war. Japanese equities, meanwhile, rose 1.6% after the country's economy expanded faster than expected last quarter.In recent days, risk appetite had been buoyed by expectations of US monetary easing, with markets fully pricing in a quarter-point cut. However, after July's US producer inflation accelerated more than forecast, traders revised the probability of a September rate cut to around 90%, down from a full expectation.

This shift weighed on risk assets, as higher rates imply lower liquidity and reduced appeal for equities and other high-risk investments. The adjustment in Fed rate cut odds also strengthened the U.S. dollar, adding pressure on emerging markets and dollar-denominated commodities.

The immediate market impact was clear: stock indices softened and US Treasury yields rose. Investors turned more cautious, rebalancing portfolios toward safe-haven assets such as gold and government bonds.

Still, markets should not assume that rates will be cut aggressively given persistent US inflation concerns. The stronger-than-expected producer price index — suggesting companies are passing higher import costs from tariffs onto buyers — is a warning sign, though not yet critical.

On the geopolitical front, Russian President Vladimir Putin will seek to strengthen ties with Donald Trump today. On Wednesday, Putin praised Trump's efforts to mediate an end to the Ukraine conflict and pledged economic cooperation.

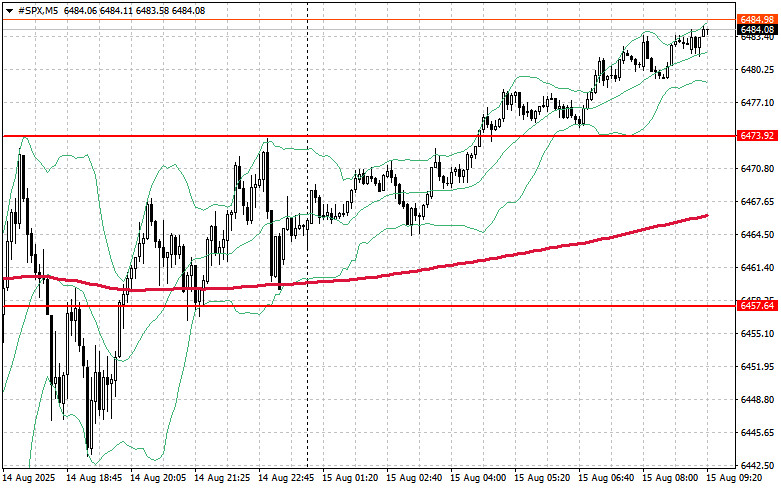

S&P 500 technical outlook

For today, buyers will aim to break the nearest resistance at $6,490, which would pave the way for a move toward $6,505. Regaining control over $6,520 would further reinforce bullish momentum. If risk appetite fades and the market moves lower, buyers are expected to defend the $6,473 area. A break below this level could quickly send the index down to $6,457 and open the way toward $6,441.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.