Veja também

21.08.2025 05:50 AM

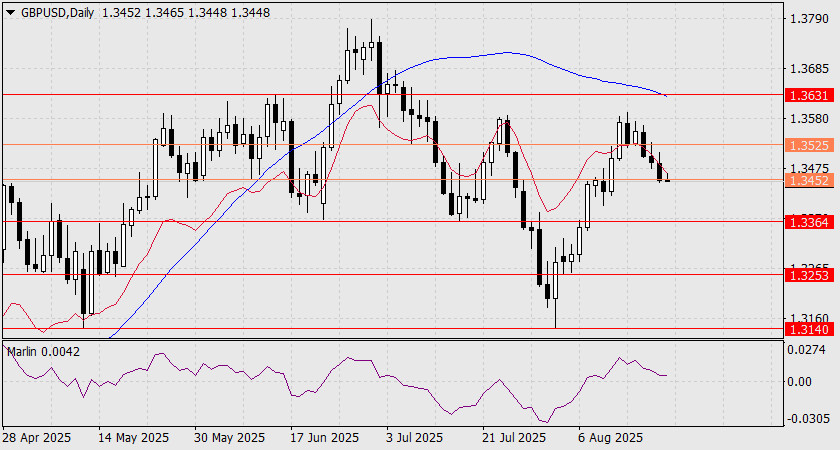

21.08.2025 05:50 AMYesterday, the British pound lost more than 30 pips and reached the intermediate support level of 1.3452. Inflation data showed increases in nearly all key indices: core CPI rose from 3.7% y/y to 3.8% y/y, headline CPI from 3.6% y/y to 3.8% y/y, the retail price index from 4.4% y/y to 4.8% y/y, while the housing price index fell from 3.9% y/y to 3.7% y/y.

Investors' disregard for the data can be attributed to their recent behavior: after the last rate cut on August 7, they bought the pound, but now they prefer to wait for Powell's speech in Jackson Hole at a comfortable support level from May and June.

On the H4 chart, the price has started consolidating at the 1.3452 level. The Marlin oscillator has ticked up slightly, which may indicate that traders are willing to continue the correction.

Consolidation below the current level would not give a clear signal of a breakout towards 1.3364, due to heightened attention to the Fed Chair's upcoming speech following the latest inflation data from both the U.S. and the U.K., as well as signs of a brewing split within the Fed. However, it would increase the probability of such a move.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.