EURPLN (Euro vs Polish Zloty). Exchange rate and online charts.

Currency converter

07 Jul 2025 01:23

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

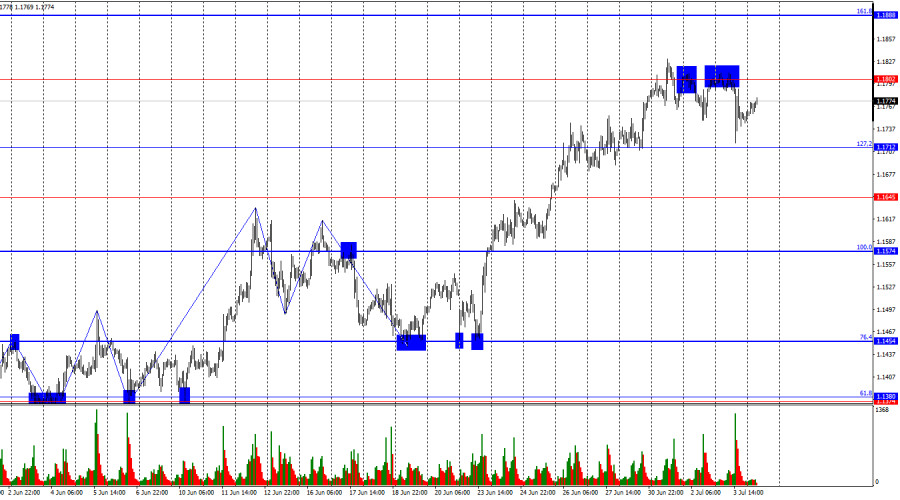

EUR/PLN is a popular currency pair on Forex. Poland is an active trading partner with the EU. For this reason, EUR/PLN is favoured by the experienced traders who prefer stability and predictability of the euro area and Poland economies. The most intense bidding on this financial instrument is observed during the European sessions.

EUR/PLN is the cross rate against the U.S. dollar. Although the U.S. dollar obviously is not present at this currency pair, it still has a significant influence on it. By combining EUR/USD and USD/PLN price charts, it is possible to get an approximate EUR/PLN chart.

Both currencies are affected by the U.S. dollar, that is why it is better to monitor such U.S. indices as discount rate, GDP, unemployment, new created workplaces and other to correctly predict the further movement of the pair. Is necessary to note that the discussed currencies can react differently to the changes observed in the U.S. economy, therefore, EUR/PLN may be a specific indicator for these currencies.

Poland is going to introduce the euro in near future. At the same time, there are numerous internal problems that exist in the country (the budget deficit, high external debt, etc.) as well as the global economic crisis that prevent it from adopting the European currency on schedule. The European Central Bank announced strict conditions for the euro adoption. Thus, Poland will be able to join the euro area after fulfilling all the requirements.

Poland is a developed industrial country with high living standards. The main economic sectors are engineering, metallurgy, chemical and coal industries. Poland has robust automotive and shipbuilding industries at the shipyards of the Baltic Sea. The country is rich in mineral resources: coal, copper, lead, natural gas, etc. Due to the great amount of hydrocarbons, Polish economy is fully supplied with electricity. The factors that could affect the Polish zloty significantly are the country's international rating as well as the state of Polish and European leading industries.

If you trade cross rates, remember that brokers usually set a higher spread on such pairs compared to the majors. So before you start working with the cross rates, it get acquainted with the conditions offered by the broker to trade with specified trade instrument.

See Also

- Technical analysis / Video analytics

Forex forecast 04/07/2025: EUR/USD, GBP/USD, USD/JPY, SP500 and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, SP500 and BitcoinAuthor: Sebastian Seliga

10:51 2025-07-04 UTC+2

4003

Bears remain on the runAuthor: Samir Klishi

10:53 2025-07-04 UTC+2

2203

USD/JPY. Analysis and ForecastAuthor: Irina Yanina

18:12 2025-07-04 UTC+2

2158

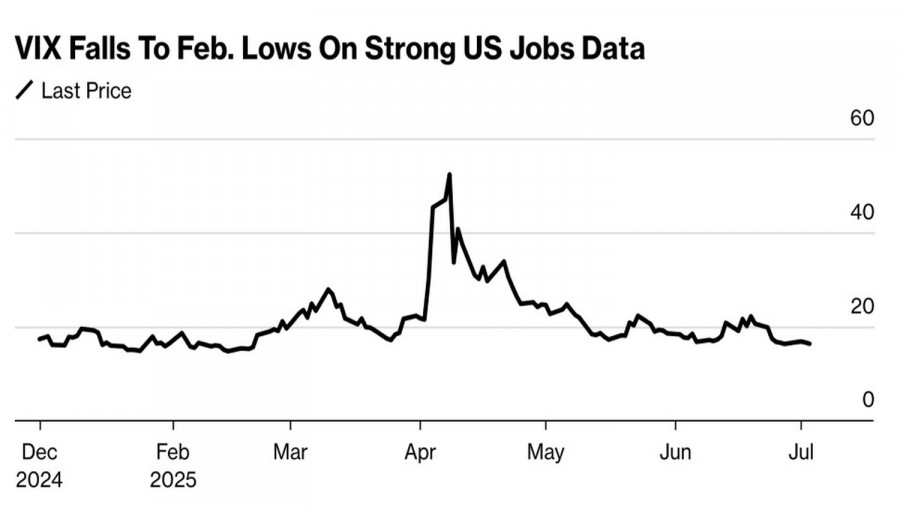

- The S&P 500 rose by 0.83%; the Nasdaq gained 1.02%; the Dow advanced by 0.77%. US job growth exceeded expectations in June. Tripadvisor rallied on Starboard Value's report. Synopsys and Cadence climbed as the US lifted restrictions on exports to China.

Author: Gleb Frank

13:11 2025-07-04 UTC+2

2098

June employment statistics mark a win for the S&P 500Author: Marek Petkovich

10:15 2025-07-04 UTC+2

2038

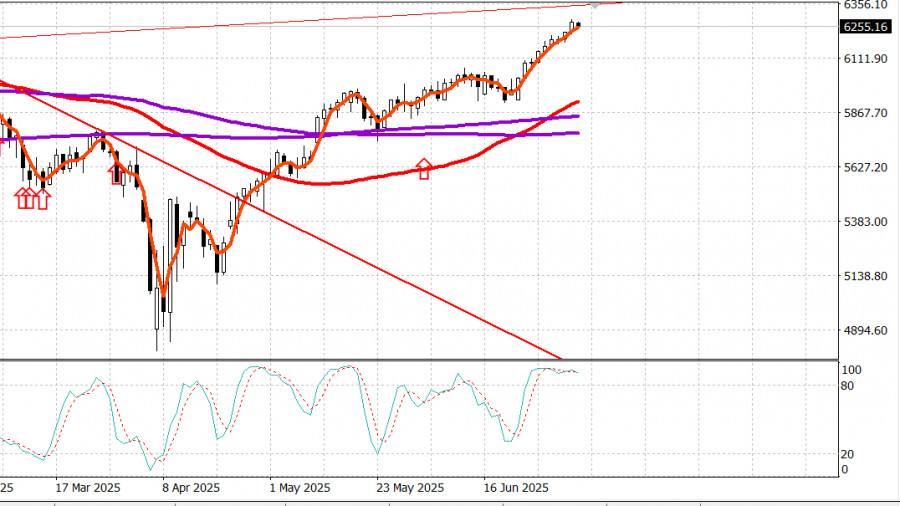

The S&P 500 and Nasdaq stock indices rose by 0.83% and 1.02%, respectively, hitting new all-time highs. Index futures, however, retreated due to concerns over the potential introduction of new tariffs, which added to uncertainty in the global marketAuthor: Ekaterina Kiseleva

12:45 2025-07-04 UTC+2

2038

- The S&P 500 bound for 6,300. Wall Street closes for long weekend at new highs

Author: Jozef Kovach

12:47 2025-07-04 UTC+2

1948

USD/JPY: Simple Trading Tips for Beginner Traders � July 4th (U.S. Session)Author: Jakub Novak

18:58 2025-07-04 UTC+2

1873

The Market is Preparing for Another ShockAuthor: Jakub Novak

09:55 2025-07-04 UTC+2

1843

- Technical analysis / Video analytics

Forex forecast 04/07/2025: EUR/USD, GBP/USD, USD/JPY, SP500 and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, SP500 and BitcoinAuthor: Sebastian Seliga

10:51 2025-07-04 UTC+2

4003

- USD/JPY. Analysis and Forecast

Author: Irina Yanina

18:12 2025-07-04 UTC+2

2158

- The S&P 500 rose by 0.83%; the Nasdaq gained 1.02%; the Dow advanced by 0.77%. US job growth exceeded expectations in June. Tripadvisor rallied on Starboard Value's report. Synopsys and Cadence climbed as the US lifted restrictions on exports to China.

Author: Gleb Frank

13:11 2025-07-04 UTC+2

2098

- June employment statistics mark a win for the S&P 500

Author: Marek Petkovich

10:15 2025-07-04 UTC+2

2038

- The S&P 500 and Nasdaq stock indices rose by 0.83% and 1.02%, respectively, hitting new all-time highs. Index futures, however, retreated due to concerns over the potential introduction of new tariffs, which added to uncertainty in the global market

Author: Ekaterina Kiseleva

12:45 2025-07-04 UTC+2

2038

- The S&P 500 bound for 6,300. Wall Street closes for long weekend at new highs

Author: Jozef Kovach

12:47 2025-07-04 UTC+2

1948

- USD/JPY: Simple Trading Tips for Beginner Traders � July 4th (U.S. Session)

Author: Jakub Novak

18:58 2025-07-04 UTC+2

1873

- The Market is Preparing for Another Shock

Author: Jakub Novak

09:55 2025-07-04 UTC+2

1843