Vea también

23.08.2023 01:50 PM

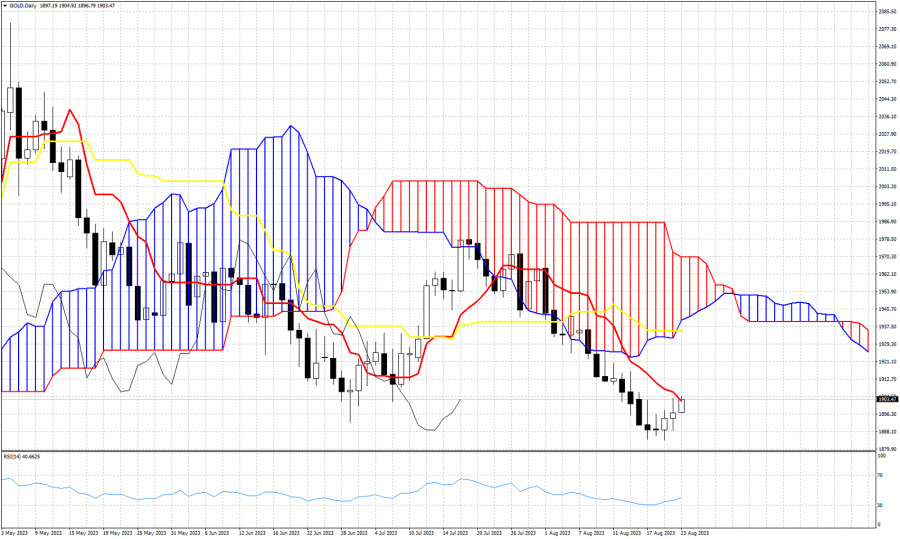

23.08.2023 01:50 PMGold price is trading just above $1,900, in a positive near term momentum for a third straight day. In Ichimoku cloud terms in the Daily chart, trend remains bearish as price remains below the Daily Kumo (cloud). In the daily chart price is now challenging the tenkan-sen (red line indicator) resistance. If price breaks above $1,905, we could see a continuation of this bounce towards the kijun-sen (yellow line indicator) that provides resistance at $1,935. The kijun-sen is now where the lower cloud boundary is found. As long as we trade below the cloud, trend remains bearish. However it is highly probable to see price bounce and back test the cloud from below. The Chikou span (black line indicator) remains below th candlestick pattern (bearish), but is turning upwards following the price. As long as Gold holds above $1,890, there are increased chances of a bounce higher.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.