Vea también

06.05.2025 07:03 PM

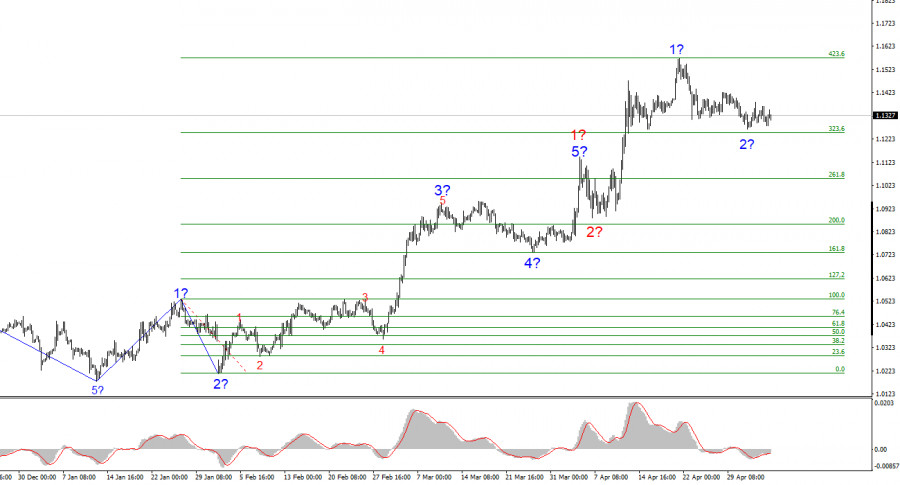

06.05.2025 07:03 PMThe wave pattern on the 4-hour EUR/USD chart has transitioned into a bullish structure. I believe there is little doubt that this transformation occurred solely due to the new trade policy adopted by the United States. Until February 28—when the sharp decline of the U.S. dollar began—the wave pattern presented a convincing downward trend, building a corrective wave 2. However, President Trump's weekly announcements of various tariffs took their toll. Demand for the U.S. currency plummeted, and now the entire trend segment, which began on January 13, has taken on an impulsive bullish form.

Moreover, the market didn't even manage to construct a convincing wave 2 within this trend segment. We saw only a minor pullback, smaller than the corrective waves within wave 1. That said, the U.S. currency may continue to weaken unless Donald Trump reverses his current trade policy. We've already seen an instance where news flow reshaped the wave structure—another such shift is certainly possible.

The EUR/USD rate remained nearly flat throughout Monday and Tuesday. Although there were some market movements during the day, they were limited in amplitude. The market either cannot decide on a direction or does not want to—most likely the latter, as no one wants to take risks ahead of the Federal Reserve's meeting.

Typically, just days before a Fed meeting, it's already clear what direction the regulator's monetary policy will take. Economic indicators, if they do shift, tend to do so very slowly. Therefore, if an economic slowdown is emerging, it's usually evident well before a central bank meeting. However, in recent months, the economic situation has been changing rapidly. The U.S. economy recently posted 2.5–3% quarterly growth, but is now contracting by 0.3%. Not long ago, America was the most attractive country for business and immigration—now the situation has nearly reversed.

Trump had been introducing tariffs nearly every week for two months, but now negotiations have taken center stage. However, these negotiations aren't necessarily with countries that could help stabilize the U.S. economy. What lies ahead for the American economy in the coming years remains unclear. Will there be trade deals with the EU and China? That too remains unknown. As a result, the Fed is unlikely to draw hasty conclusions, but it may adopt a more dovish tone given the likely economic slowdown. In my view, the presumed construction of wave 2 within wave 3 is nearing its end.

Based on my EUR/USD analysis, I conclude that the pair continues to build a bullish trend segment. In the near term, the wave structure will depend entirely on the stance and actions of the U.S. President—this should always be kept in mind. The formation of wave 3 of the bullish trend has begun, with targets potentially reaching as high as the 1.25 level. Achieving these targets will depend solely on Trump's policies. At present, wave 2 within wave 3 appears close to completion. Therefore, I consider buying opportunities with targets above the 1.1572 level, which corresponds to the 423.6% Fibonacci level.

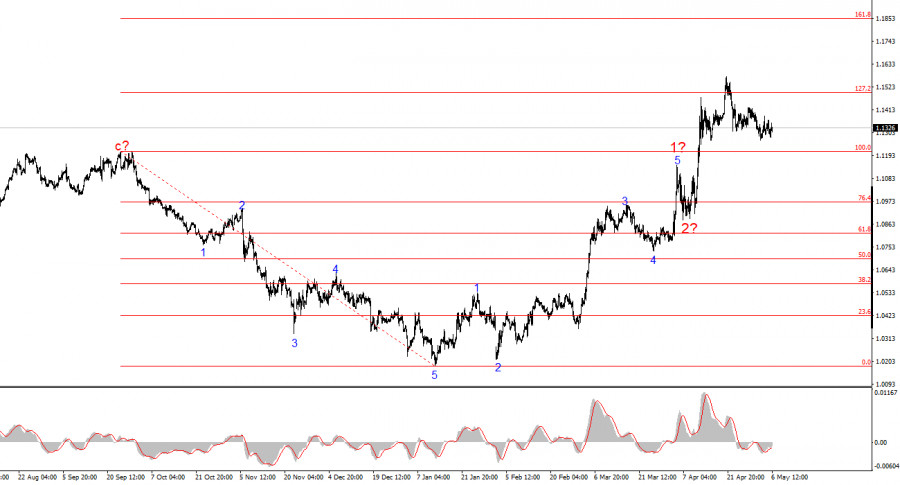

On the higher wave scale, the pattern has also shifted to a bullish orientation. We are likely facing a long-term upward wave sequence, although news flow directly related to Donald Trump could once again flip everything upside down.

Core Principles of My Analysis

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Lo más probable es que se esté formando una tendencia alcista mayor en el panorama global del SP500, cuya estructura es similar a la del impulso. Si nos fijamos

La estructura de ondas del instrumento GBP/USD sigue siendo bastante complicada y muy confusa. Alrededor del nivel de 1.2822, que corresponde al 23.6% de Fibonacci y está cerca del pico

El patrón de onda para el instrumento GBP/USD sigue siendo bastante complicado y confuso. Un intento exitoso de romper el nivel de Fibonacci del 50,0% en abril indicó

El patrón de onda para el instrumento GBP/USD sigue siendo bastante complicado. El intento exitoso de romper el nivel de Fibonacci del 50,0% en abril indicó que el mercado está

El patrón de onda del gráfico de 4 horas para el instrumento EUR/USD se mantiene sin cambios. En este momento, estamos observando la construcción de la onda esperada

Indicador de

patrones gráficos.

¡Note cosas

que nunca notará!

Gráfico Forex

versión web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.