Vea también

13.05.2025 04:49 AM

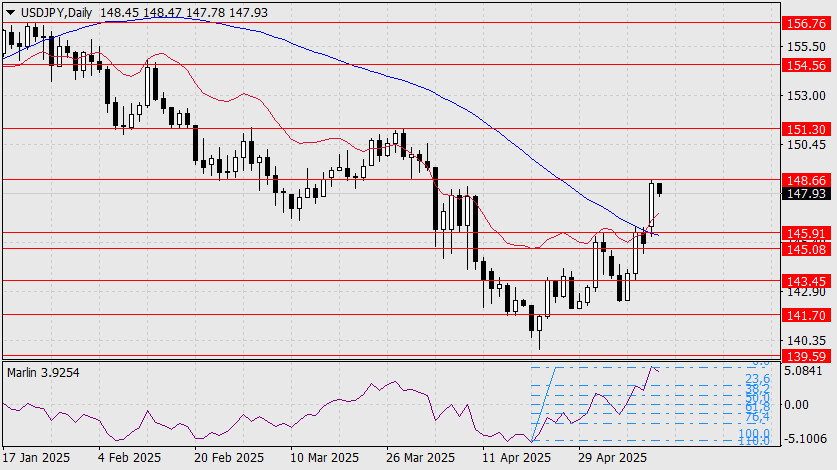

13.05.2025 04:49 AMThe USD/JPY pair made a sharp and powerful move yesterday, covering more than three figures and precisely reaching the target level of 148.66, the low from last December. The trick lies in the price opening the market with an 80-pip gap, jumping over the resistance at the upper boundary of the 145.08/91 range and the resistance from the MACD indicator line on the daily scale.

This price spike appears to be a false move, suggesting that we can soon expect the price to fall below the MACD line, fill the gap, and consolidate below the target range. Consequently, we anticipate a continued decline toward the support at 143.45.

A notable technical point involves the Marlin oscillator: its four-day rise from the zero line exactly mirrors the move from the April 22 low to the zero line. The oscillator now looks ready to retrace that move toward the neutral zero line, which would coincide with the price holding below 145.08.

An alternative scenario would be a rise to the target level of 151.30 (the March 28 high), but this is only possible if the price consolidates above 148.66.

There are no clear reversal signals on the four-hour timeframe yet. It's only possible to assume that Marlin is beginning to turn from the overbought zone. We await further market cooling and the formation of reversal signals (a pattern or model).

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.