Vea también

14.05.2025 06:01 PM

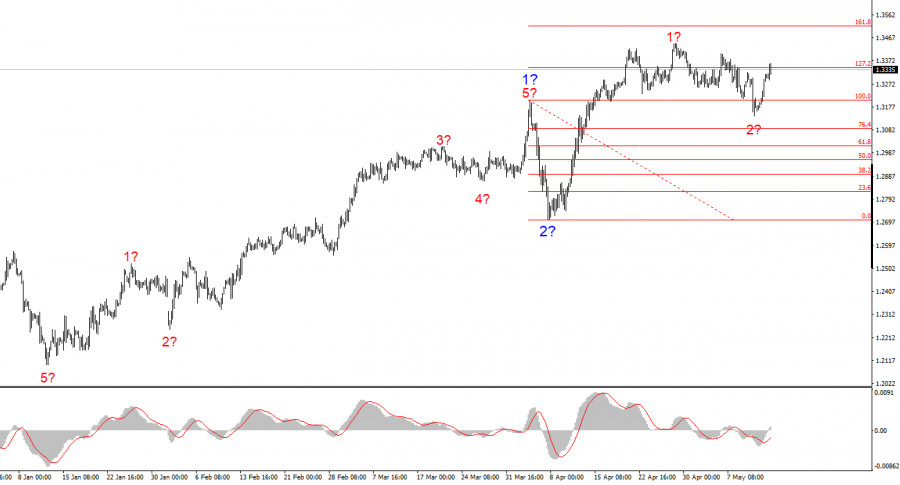

14.05.2025 06:01 PMThe wave structure for GBP/USD has also transformed into a bullish impulsive pattern—"thanks" to Donald Trump. The wave picture is almost identical to that of EUR/USD. Up until February 28, we observed the formation of a solid corrective structure that raised no alarms. However, after that, demand for the U.S. dollar began to plummet rapidly. This resulted in the development of a bullish five-wave structure. Wave 2 took the form of a single wave and is now complete. Therefore, we should now expect a new rally in the pound within wave 3, which has already been underway for three weeks.

Considering the fact that news from the UK had no impact on the strong rise of the pound, we can conclude that currency movements are being driven almost entirely by Donald Trump. If (theoretically) Trump's stance on trade policy changes, then the trend may also shift—this time to a bearish one. Therefore, in the coming months (or even years), close attention should be paid to every move from the White House.

The GBP/USD pair rose by 135 basis points on Tuesday and added another 20 on Wednesday. As a result, the pair is now trading even higher than where it opened on Monday. On Monday, demand for the U.S. dollar surged after the announcement of a tariff reduction agreement between China and the U.S. In my view, that was a very important development and could have supported sellers in the market—and it did, but only briefly.

The market now places far more emphasis on the Federal Reserve's monetary policy, even though just a week ago it seemed uninterested. A week ago, the Fed made no move toward a more dovish stance, and Jerome Powell once again stated the need to "wait, wait, and wait some more." In my view, the FOMC meeting results were far more hawkish than market participants had expected. Still, that didn't help the dollar much. Then on Tuesday, when the U.S. Consumer Price Index came in even weaker than expected, the market interpreted this as a virtual guarantee of multiple Fed rate cuts this year. As a result, demand for the dollar has been declining for the second consecutive day.

I don't believe this market reaction to recent events is entirely logical—but I have no authority to tell the market what to do. Here's the situation: the market takes every piece of negative news for the U.S. currency much more seriously than it does any positive news. I believe this is due exclusively to Donald Trump's policies—and not just his trade policies. Consequently, I do not expect sentiment to shift in the near term. As the initial steps toward trade war de-escalation have shown, even those can't change the market's current stance toward the dollar and the U.S. government.

The wave pattern for GBP/USD has shifted. We are now dealing with a bullish impulsive trend segment. Unfortunately, with Donald Trump in office, markets can expect plenty more shocks and reversals that do not align with wave structure or any form of technical analysis. Wave 3 of the uptrend is continuing to build, with the next targets at 1.3541 and 1.3714. Therefore, I continue to consider buying opportunities, as the market shows no signs of reversing the trend once again.

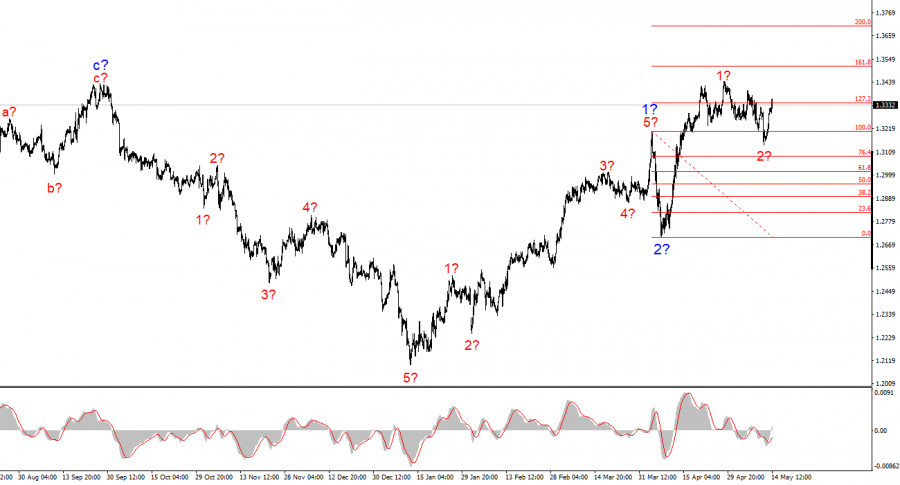

On the higher time frame, the wave pattern has also shifted upward. We can now assume the formation of a bullish trend segment, with nearby targets at 1.2782 and 1.2650.

Key Principles of My Analysis:

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Lo más probable es que se esté formando una tendencia alcista mayor en el panorama global del SP500, cuya estructura es similar a la del impulso. Si nos fijamos

La estructura de ondas del instrumento GBP/USD sigue siendo bastante complicada y muy confusa. Alrededor del nivel de 1.2822, que corresponde al 23.6% de Fibonacci y está cerca del pico

El patrón de onda para el instrumento GBP/USD sigue siendo bastante complicado y confuso. Un intento exitoso de romper el nivel de Fibonacci del 50,0% en abril indicó

El patrón de onda para el instrumento GBP/USD sigue siendo bastante complicado. El intento exitoso de romper el nivel de Fibonacci del 50,0% en abril indicó que el mercado está

El patrón de onda del gráfico de 4 horas para el instrumento EUR/USD se mantiene sin cambios. En este momento, estamos observando la construcción de la onda esperada

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.