Vea también

21.05.2025 11:15 AM

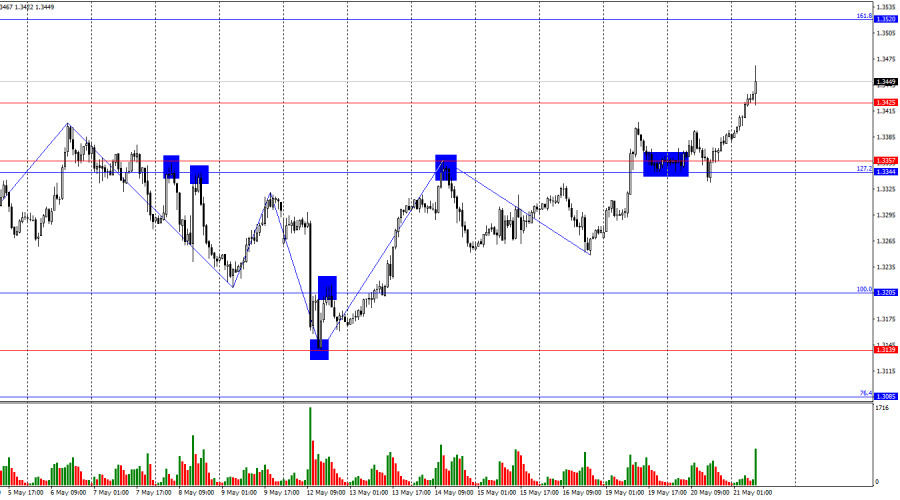

21.05.2025 11:15 AMOn the hourly chart, the GBP/USD pair on Tuesday made two bounces from the support zone of 1.3344–1.3357, reversed in favor of the pound, and rose above the 1.3425 level. As a result, the upward movement may continue today toward the next Fibonacci retracement level of 161.8% – 1.3520. A consolidation below 1.3425 would favor the U.S. dollar and a decline toward the support zone of 1.3344–1.3357.

The wave structure has become more complex following the latest bullish push. The most recent upward wave broke above the previous high, while the last completed downward wave failed to break the previous low. As a result, the "bearish" trend has now turned "bullish." It will be difficult for bulls to push much higher above 1.3425 without new headlines from Donald Trump about raising or introducing new import tariffs. Still, bears have recently demonstrated only weakness and passivity.

There was no significant news background on Tuesday, but on Wednesday morning, the UK released an interesting inflation report. Let's start with the fact that the Bank of England just a week ago cut interest rates, citing declining inflation. And today it was revealed that the headline Consumer Price Index rose from 2.6% to 3.5% in April. Clearly, this is the economy's response to Donald Trump's tariffs. Bank of England Governor Andrew Bailey had warned that inflation would rise amid trade wars. And here we are. The only question is, why did the Bank of England cut rates if it anticipated rising inflation?

The core CPI rose from 3.4% to 3.8% year-over-year. In both cases, trader expectations were exceeded. The pound began to rise overnight, as if many professional traders had advance knowledge of the inflation increase. One way or another, the bulls are back in attack mode, now with a solid informational foundation. Just this week, the U.S. credit rating was downgraded, and UK inflation has risen—making further monetary easing by the Bank of England unlikely in the near future.

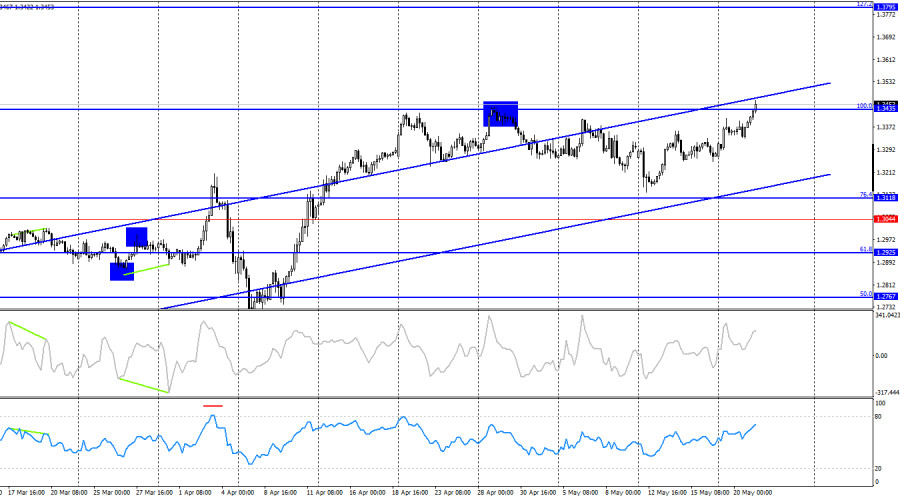

On the 4-hour chart, the pair has returned to the 100.0% Fibonacci level at 1.3435. A new rebound from this level would again favor the U.S. dollar and a decline toward 1.3118. A consolidation above 1.3435 would suggest a continued rise toward the next Fibonacci level of 127.2% – 1.3794. No signs of emerging divergences are seen today on any indicators.

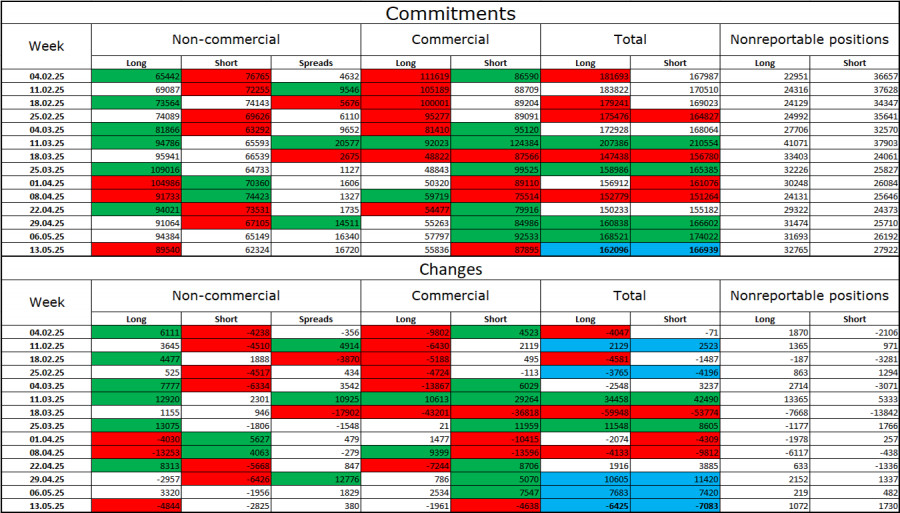

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became slightly less bullish over the last reporting week. The number of long positions held by speculators decreased by 4,844, while short positions declined by 2,825. Bears have long since lost the upper hand in the market. The gap between long and short positions now stands at 27,000 in favor of the bulls: 89,000 vs. 62,000.

In my view, the pound still has downward potential, but recent developments could lead the market to reverse course in the long term. Over the past three months, the number of long positions has increased from 65,000 to 92,000, while short positions have declined from 76,000 to 62,000. Under Donald Trump, confidence in the dollar has weakened, and COT reports show that traders have little appetite to buy the greenback.

News Calendar for the U.S. and the UK:

United Kingdom – Consumer Price Index (06:00 UTC)

Wednesday's economic calendar includes one key release, which is already available to traders. For the rest of the day, the informational background is expected to have no significant impact on sentiment.

GBP/USD Forecast and Trader Tips:

Selling the pair is possible today if a bounce from the 1.3435 level occurs on the 4-hour chart, with targets at 1.3344–1.3357 and 1.3205. Buying was previously possible on a breakout above the 1.3344–1.3357 zone with a target of 1.3425. That target has been reached. As long as the pair does not close below 1.3425, long positions can be held with a target of 1.3520.

Fibonacci level grids are drawn from 1.3205–1.2695 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

cuentas PAMM

InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.