Vea también

09.06.2025 05:15 AM

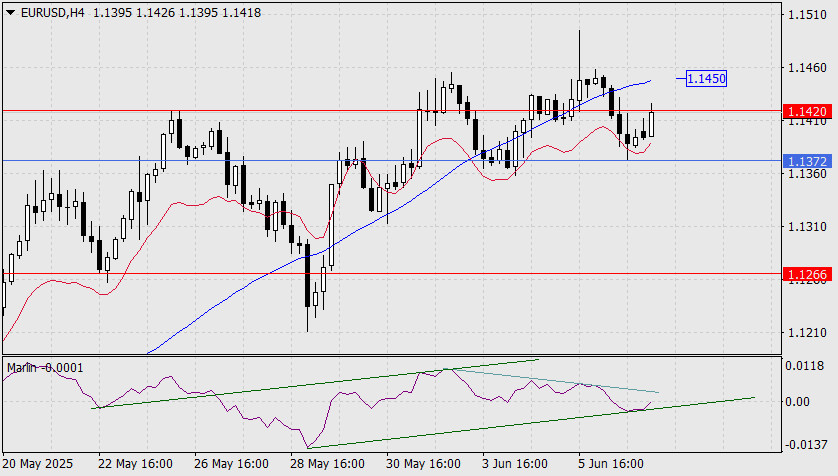

09.06.2025 05:15 AMModerately optimistic US employment data revived the dollar, causing it to rise by 0.44%. The euro dropped by 50 pips. A divergence with the stock market occurred as the S&P 500 rose by 1.03%. However, one day of decoupling is not enough to push the euro out of its risk-on pursuit, especially since, technically, there is no such process at the moment — Friday's decline was precisely halted at the daily MACD line (1.1372).

The price needs to consolidate below Friday's low to reach 1.1266. The Marlin oscillator has also not left the growth territory.

However, for the possibility of advancing upward toward the target level of 1.1535, the price must consolidate above 1.1420. Here, the stock market could lend support, maintaining resilience even after Tesla's epic stock plunge. Beyond that, we expect growth toward 1.1692.

On the H4 chart, the divergence has played out, and the Marlin oscillator has secured a position in negative territory. At the same time, Marlin has formed a new ascending channel (in green), suggesting the divergence may have already been completed. A stronger confirmation of the expected growth would be a breakout above the MACD line around the 1.1450 mark.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.