Vea también

16.06.2025 08:55 AM

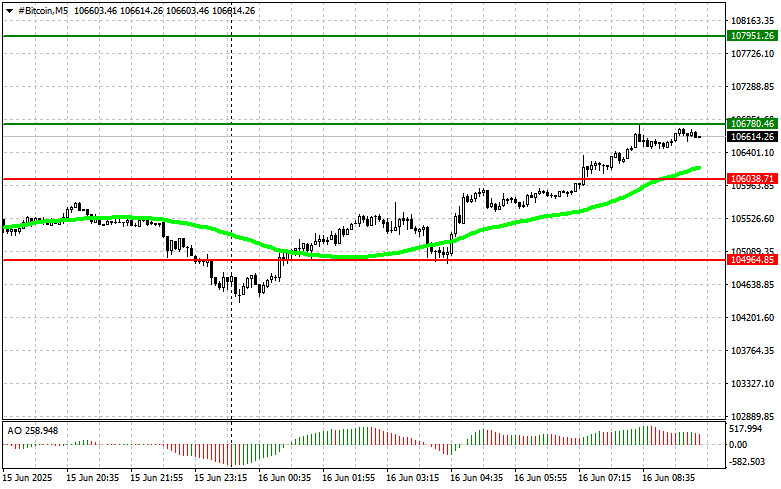

16.06.2025 08:55 AMBitcoin and Ethereum regained their positions following a major sell-off at the end of last week, which occurred after the outbreak of the military conflict between Iran and Israel. This morning, the price surged above $106,000 after a volatile weekend driven by the ongoing conflict.

The geopolitical instability caused by Israeli strikes on Iranian nuclear facilities briefly pushed BTC down by 4%, highlighting Bitcoin's sensitivity to risk-off events. However, the world's first cryptocurrency quickly recovered as investors increasingly view it as a hedge against geopolitical uncertainty.

A combination of institutional flows, macroeconomic data, and geopolitical risks shapes Bitcoin's current price movement. The crypto Fear & Greed Index currently sits at a moderate 61, reflecting optimistic yet cautious investor sentiment.

Institutional investors, previously cautious toward the crypto market, are gradually increasing their exposure to Bitcoin. This is reflected in growing trading volumes on regulated platforms, the expansion of crypto funds, and the development of specialized investment products. These capital inflows support Bitcoin's price, reduce volatility, and add greater stability to the market.

Geopolitical risks—such as conflicts, trade wars, and political instability—also play a role in shaping Bitcoin's price. During heightened uncertainty, investors may seek refuge in Bitcoin, viewing it as an asset independent of political influence. However, large-scale geopolitical crises can spark panic across markets and trigger sell-offs in all assets, including cryptocurrencies.

As for the intraday strategy in the crypto market, I will continue to act based on any major dips in Bitcoin and Ethereum, aiming to capitalize on the continued development of the medium-term bull market—which remains intact.

For short-term trading, the strategy and conditions are described below.

Scenario #1: I plan to buy Bitcoin today at the entry point near $106,700, targeting a rise to $107,900. Around $107,900, I will exit long positions and initiate a sell trade on the bounce.

Before entering a breakout trade, make sure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: Buy Bitcoin from the lower boundary of $106,000 if there is no market reaction to its breakout, targeting a move back to $106,700 and $107,900.

Scenario #1: I plan to sell Bitcoin today at the entry point around $106,000, targeting a decline to $104,900. Around $104,900, I will exit short positions and buy immediately on the bounce.

Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Sell Bitcoin from the upper boundary of $106,700 if there is no market reaction to its breakout, targeting a move back to $106,000 and $104,900.

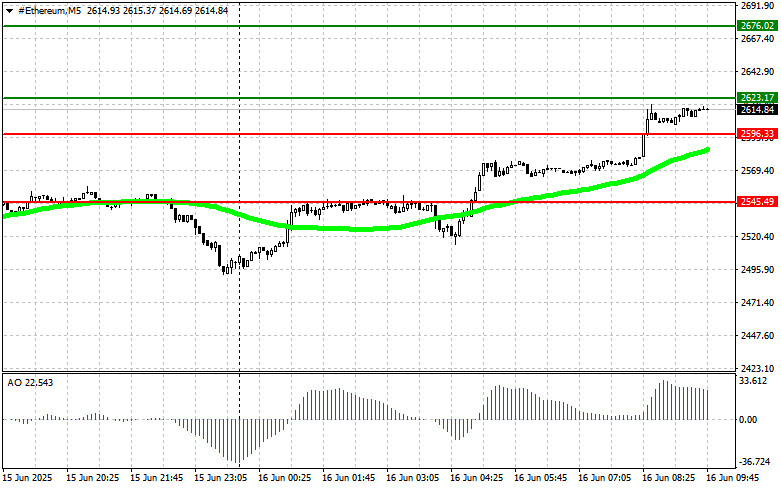

Scenario #1: I plan to buy Ethereum today at the entry point near $2623, targeting a rise to $2676. Around $2676, I will exit long positions and sell immediately on the bounce.

Before entering a breakout trade, make sure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: Buy Ethereum from the lower boundary of $2596 if there is no market reaction to its breakout, targeting a move back to $2623 and $2676.

Scenario #1: I plan to sell Ethereum today at the entry point around $2596, targeting a decline to $2545. Around $2545, I will exit short positions and buy immediately on the bounce.

Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Sell Ethereum from the upper boundary of $2623 if there is no market reaction to its breakout, targeting a move back to $2596 and $2545.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El Ethereum, mientras tanto, continúa sin moverse del sitio junto con el Bitcoin. Hemos visto toda una serie de desviaciones en el marco temporal de 4 horas, pero ninguna

El Bitcoin y el Ether subieron considerablemente al comienzo de la semana, recuperando casi por completo las pérdidas que sufrieron el pasado viernes en el momento del inicio del conflicto

InstaForex en cifras

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.