Vea también

18.06.2025 06:50 AM

18.06.2025 06:50 AMVery few macroeconomic reports are scheduled for Wednesday. However, the UK will release a very important inflation report for May, which will be significant for traders and the British pound. Let us recall that a month ago, inflation in the UK sharply jumped by nearly 1%, so for the time being, there will be no talk of a rate cut by the Bank of England. Today's report should show whether the spike in May was a one-off or inflation continues to rise. The consumer price index will also be published in the eurozone, but only the second estimate for May, which is unlikely to differ from the first. In the U.S., only secondary reports are expected.

Only the Federal Reserve meeting stands out among the fundamental events on Wednesday. Although the Fed's decision is already known, traders will closely watch the dot plot to understand whether sentiment among FOMC members regarding the key rate for 2025–2026 has changed. As a reminder, the previous dot plot showed expectations of two rate cuts this year. Jerome Powell's press conference will also be important.

We believe the market focuses primarily on the trade war, for which there are still no signs of resolution. Additionally, current concerns include mass unrest in the U.S., Trump's controversial "One Big Beautiful Bill," the presence or absence of progress in trade negotiations with 75 countries, new tariffs, and increases in existing ones. The dollar could have counted on support from the Israel-Iran conflict, in which the U.S. is directly involved, but we believe the greenback will not benefit significantly from this unfortunate situation.

During the third trading day of the week, both currency pairs may show high volatility. The market will focus on the Iran-U.S. conflict and the Fed meeting. Additionally, attention will be paid to the UK inflation report. Thus, strong movements and sharp price reversals may occur in the morning, afternoon, and evening.

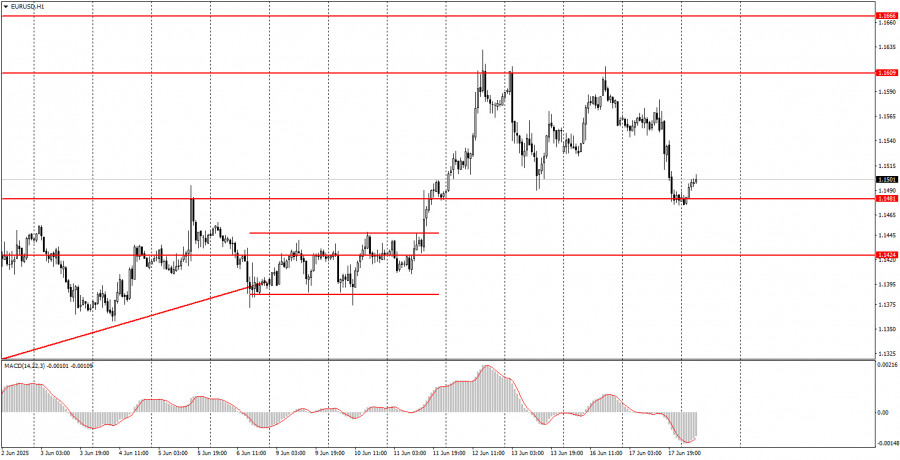

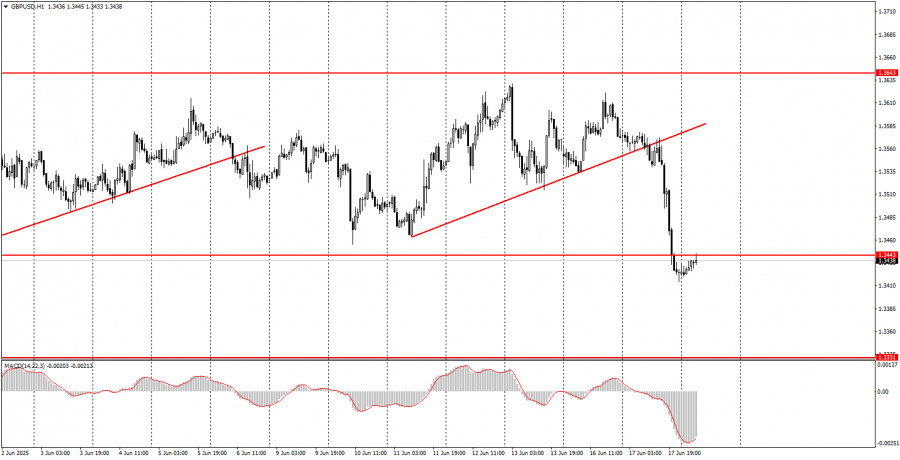

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El par de divisas EUR/USD continuó el viernes con un movimiento descendente suave y débil. Como ya hemos mencionado muchas veces, el movimiento actual es una corrección en estado puro

El par de divisas EUR/USD durante el martes mantuvo un ánimo de corrección. No hubo eventos macroeconómicos en este día, sin embargo, Donald Trump "leyó toda la lista" de países

El par de divisas GBP/USD durante el lunes descendió ligeramente, pero todavía no se puede hablar de una tendencia bajista. Desde el punto de vista técnico, el par permanece

El par de divisas EUR/USD se negoció durante el lunes con una inclinación bajista, aunque probablemente no hubo motivos de peso para el fortalecimiento del dólar. Recordemos que durante

El par de divisas GBP/USD también se mantuvo en el mismo lugar durante el viernes, ya que en ese día la sesión comercial estadounidense, en esencia, no funcionaba. No hubo

Nuestra nueva app para su verificación rápida y cómoda

Nuestra nueva app para su verificación rápida y cómoda

Video de entrenamiento

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.