Vea también

08.07.2025 02:14 PM

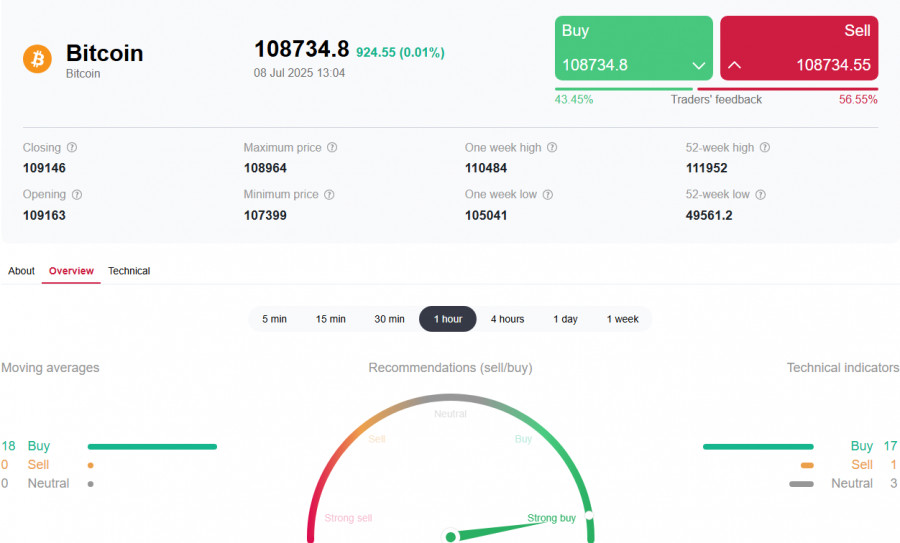

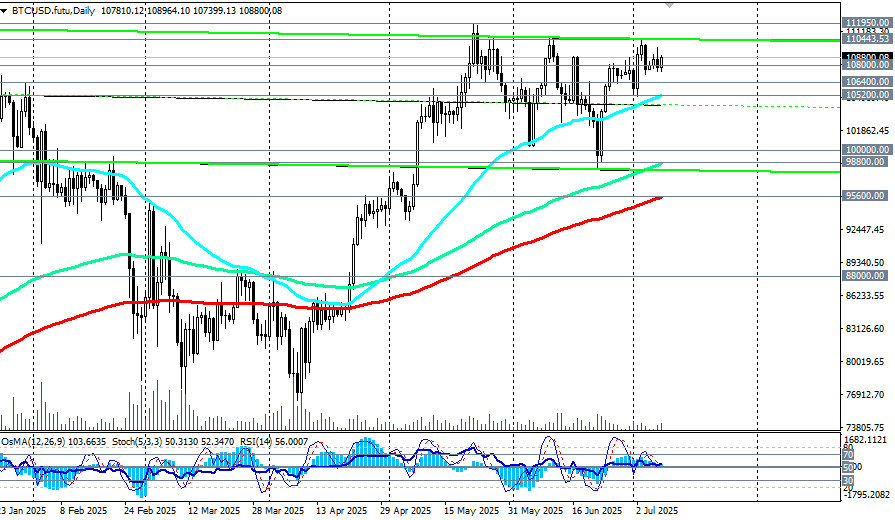

08.07.2025 02:14 PMBTC/USD is rising again today after yesterday's dip, overall maintaining its bullish momentum. Fundamentally, conditions continue to support BTC/USD growth in the medium term.

The global economic and market landscape remains uncertain. The move out of risk assets has pushed US Treasury yields higher, which in turn supports the US dollar. However, concerns about the impact of rising import prices could weigh negatively on the dollar in the longer term, economists say, especially if import tariffs are raised further.

Meanwhile, as the US dollar sees an upward correction amid market uncertainty, investors appear to be shifting their focus back to the crypto market.

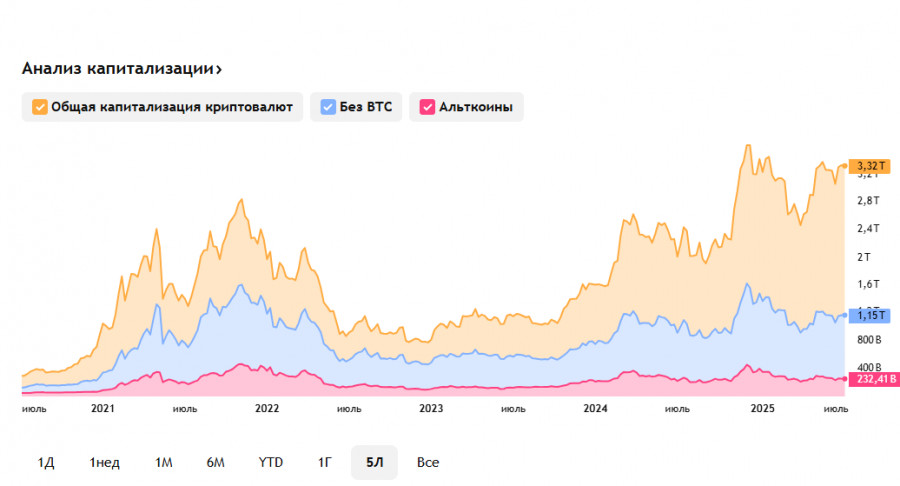

Today, the total cryptocurrency market capitalization reached $3.317 trillion, up 0.56% compared to yesterday. The altcoin market cap currently stands at $232.377 billion.

Despite this correction, the broader trend toward a weakening dollar remains intact. As the dollar is the primary counterparty in most currency, financial, and crypto pairs, any sustained weakness may prompt further investor rotation out of the greenback.

Economists note that the crypto market itself remains in a state of uncertainty, but the current environment holds potential for renewed upside.

Today, major altcoins and Bitcoin are strengthening. The BTC/USD pair is once again rising after yesterday's dip, continuing its bullish trajectory overall.

Historically, July has shown positive returns, with Bitcoin averaging a 6% gain in the month over the past 10 years. While consolidation remains the base case, economists say a modest upside movement in July cannot be ruled out. In fact, average Bitcoin returns in June over the past decade were close to zero, while July averaged around 6%. If the Federal Reserve signals a shift toward easing, that could serve as fuel for further gains.

Investors are also evaluating potential market implications of Donald Trump's statement about imposing an additional 10% tariff on imports from any country supporting what he called "anti-American" BRICS policies. His aggressive rhetoric is driving investors away from the dollar and toward alternative assets, including digital currencies.

Elon Musk also drew attention with remarks amid his ongoing dispute with President Trump, emphasizing that his newly founded "America" political party would further promote the adoption of digital assets.

Despite increased market volatility, BTC remains in a bullish phase, with BTC/USD currently trading around $108,800.

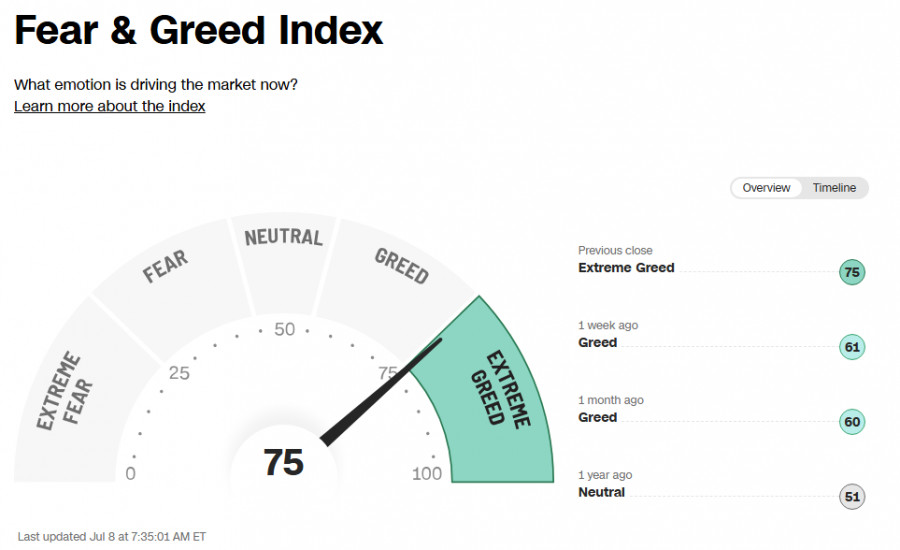

Meanwhile, the so-called Investor Fear & Greed Index holds steady at around 75, firmly within the "Extreme Greed" zone. Overall, fundamental factors continue to support BTC/USD growth in the medium term.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.