Vea también

25.08.2025 04:57 AM

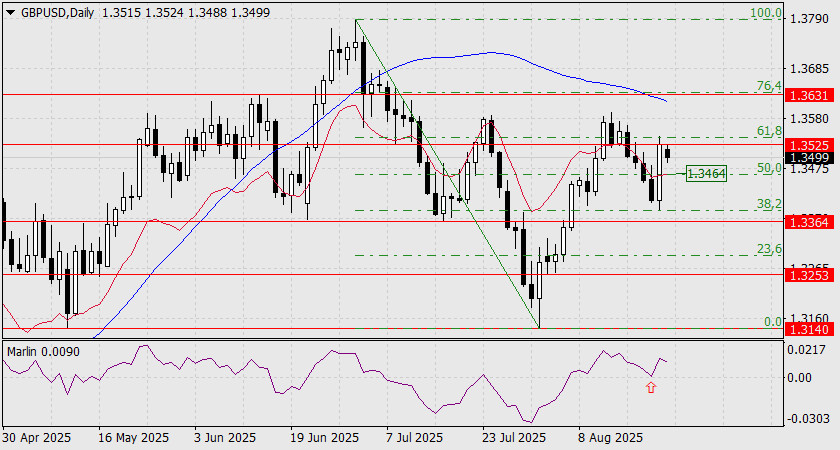

25.08.2025 04:57 AMAt Jerome Powell's speech in Jackson Hole, the pound gained more than 110 pips and reached the 1.3525 level. The upward impulse was reinforced by the Marlin oscillator's signal line reversing upward from the neutral zero line. But already today, the price has started to turn down from resistance. With two Federal Reserve rate cuts by the end of the year already largely priced in, speculators are left without additional fuel.

On the daily chart, Friday's candlestick precisely worked out the Fibonacci 38.2%–61.8% range. From this, we can conclude that a move below the 50.0% retracement level (1.3464), together with a drop under the balance line, opens the target at 1.3364—the lower boundary of the 1.3364–1.3525 range. A break below 1.3364 would then open the way to 1.3253.

On the H4 chart, resistance at 1.3525 was reinforced by the MACD line (blue), making the attack on it unsuccessful. The price has now returned below the balance line and consolidated there. A consolidation below 1.3464 would allow a push toward 1.3364. However, the Marlin oscillator is still in positive territory, and with a public holiday in the UK today, recovery of lost ground may take some time.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.