Vea también

02.09.2025 06:28 AM

02.09.2025 06:28 AMEUR/USD

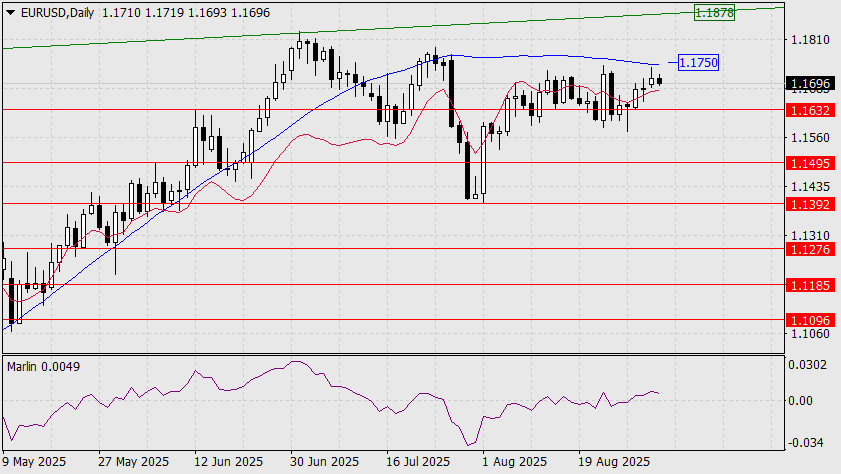

On Monday, the euro rose slightly, just short of the MACD indicator line, which confirmed the erratic nature of the current price development. If we consider that the index of business activity in the U.S. manufacturing sector for August, published today, may rise from 48.0 to 48.9 (as estimated by ISM), the decline of the euro, which started in the morning, is justified.

And if the price surpasses the nearest support at 1.1632, it will meet Friday's non-farm payroll with advance sentiment at 1.1495. At the same time, the Marlin oscillator is ready to move into negative territory if the price falls below 1.1632.

The price exit above the MACD line (1.1750) will sharply increase the probability of the price development according to the alternative scenario with the advancement to 1.1878.

On the four-hour chart, the price is still preparing to overcome the nearest obstacle, which is the MACD line (1.1632), to reach 1.1683. Here, as well as on a daily basis, the Marlin oscillator is declining ahead of schedule and is poised to enter the negative area before the price overcomes this support. We are awaiting the release of the Manufacturing PMI.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.