Vea también

12.11.2025 10:41 AM

12.11.2025 10:41 AMYesterday, US stock indices ended mixed. The S&P 500 rose by 0.21%, while the Nasdaq 100 dropped by 0.25%. The Dow Jones Industrial Average surged by 1.18%.

Asian indices climbed alongside Treasury bonds after weaker US employment data strengthened expectations for a Federal Reserve interest rate cut. The MSCI Asia Pacific Index increased by 0.5%. Futures contracts for the S&P 500 and Nasdaq 100 also gained traction after shares of Advanced Micro Devices Inc. spiked by 4.8%. Futures indicated an opening rise for European stocks as well.

ADP Research's employment data signaled a slowdown in the labor market in the second half of October, leading to rising bond yields across the curve. The yield on 10-year bonds fell by three basis points to 4.08%, as traders raised their expectations for a Fed rate cut, estimating the likelihood at around 70% for the next month.

According to data published on Tuesday by ADP Research, American companies cut 11,250 jobs. According to the latest monthly report released last week, private sector employment increased by 42,000 in October after a decline in the previous two months.

However, despite the optimistic sentiment in the bond market, analysts urge caution. The slowdown in hiring is certainly an important signal, but it is not the only factor shaping Fed policy. Inflation remains above the target level, and any signs of its persistence could lead the regulator to maintain a tough stance on interest rates. In the short term, the bond market may continue to rise on expectations of rate cuts. However, long-term prospects remain uncertain, and investors should be prepared for potential yield fluctuations.

Support for the stock market comes from expectations surrounding the conclusion of the record-long shutdown of the US government, which is set to end today after the Senate approved a temporary funding measure. As the government resumes operations, a clearer picture of economic data is expected, which will be an important step for assessing the fundamental strength of economic activity in the US.

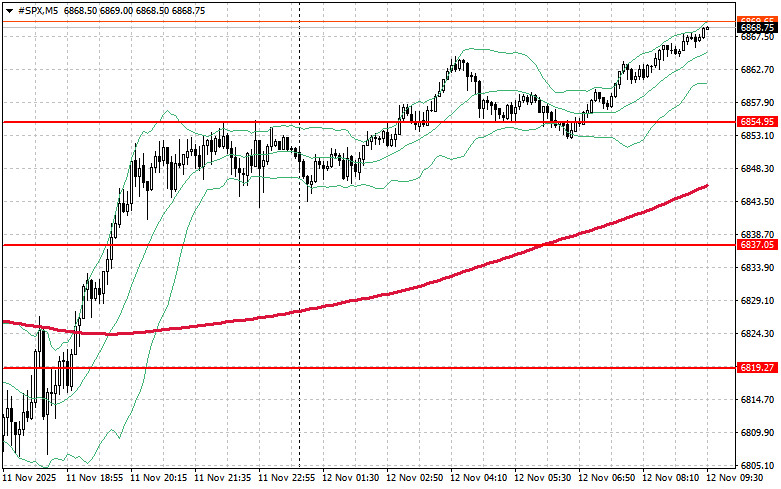

Regarding the technical picture of the S&P 500, the main task for buyers today will be to overcome the nearest resistance level of $6,837. This will help the index gain ground and pave the way fr a potential rise to the new level of $6,854. An equally important objective for bulls will be to maintain control above the $6,874 mark, which would strengthen buyers' positions. In the event of a downward move driven by reduced risk appetite, buyers must assert themselves around $6,819. A break below this level would quickly push the trading instrument back to $6,801 and open the path toward $6,784.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.