Xem thêm

18.06.2025 02:16 PM

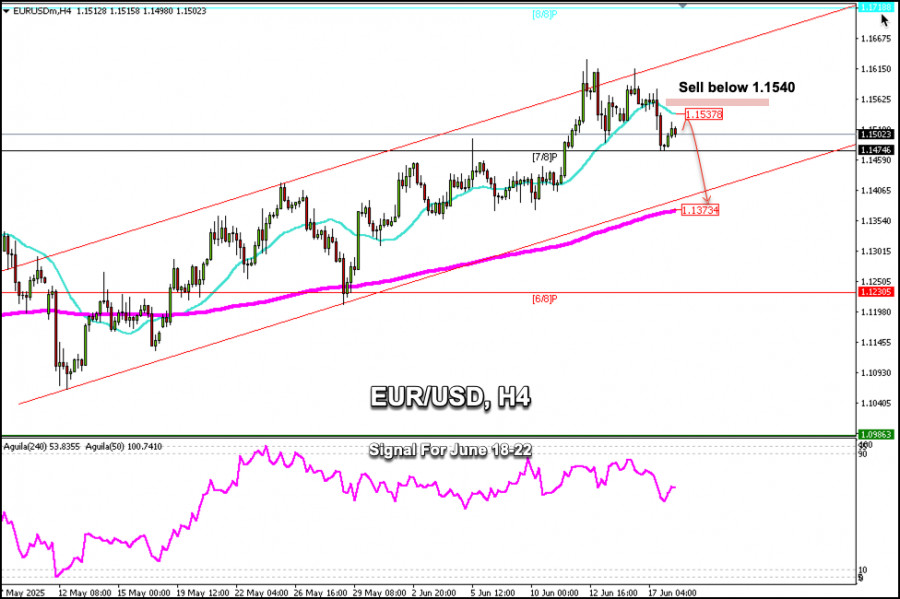

18.06.2025 02:16 PMEarly in the American session, the euro is trading under bearish pressure around 1.1502, below the 21-SMA and within the uptrend channel formed since early May.

If the euro price consolidates below the 21 SMA located at 1.1537 in the coming hours, it will be seen as a selling opportunity. Targets could be at the bottom of the uptrend channel or around 1.1406, and it could even reach the 200-EMA around 1.1373.

The Federal Reserve will announce its interest rate decision. The official funds rate is expected to be unchanged; however, we should pay close attention to the press conference, as this could trigger a strong move for the US dollar, which could, in turn, affect the euro's strength.

Technically, the EUR/USD pair could experience a strong technical correction in the coming days and could even close the gap it left at 1.1140.

A break below the 200 EMA could confirm the downward acceleration, and we could expect the first target hit at the Murray 6/8 at 1.1230. Eventually, EUR/USD could reach 1.1120.

The eagle indicator is giving a negative signal, which suggests that the euro could continue its fall in the coming days. Therefore, we will look for opportunities to sell below 1.1540 or below the 21 SMA.

You have already liked this post today

*Phân tích thị trường được đăng tải ở đây có nghĩa là để gia tăng nhận thức của bạn, nhưng không đưa ra các chỉ dẫn để thực hiện một giao dịch.