06.05.2025 05:49 PM

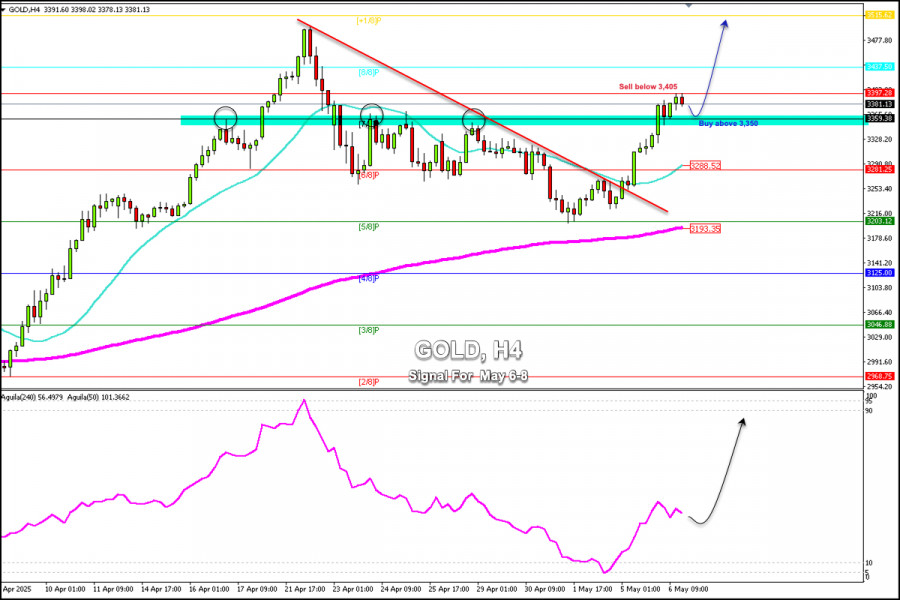

06.05.2025 05:49 PM在美國交易時段早期,黃金交易價格約在3,381,從此前大約3,397的高點回落。作為避險資產,由於全球地緣政治緊張局勢,黃金顯得情緒不安。

在技術面上,黃金顯示出看漲的偏向。未來幾天可能持續上漲,達到心理關口3,500,甚至可能觸及位於3,515的+1/8 Murray。

黃金達到倦怠水平。未來幾天,我們可能預期會有技術性回調,向位於3,359的關鍵支撐位靠攏。這個區域可以作為重新買入的點位,黃金可能達到3,437,接近8/8 Murray,最終達到3,515。

貴金屬的前景依然看漲,所以我們會在任何回調中尋找買入機會,並且只要它保持在位於3,281的6/8 Murray水平之上。

鷹派指標顯示出積極的信號,因此每當出現技術性回調時,我們將在未來幾天尋找買入機會。

You have already liked this post today

*这里的市场分析是为了增加您对市场的了解,而不是给出交易的指示。

英國昨天發佈的五月就業數據顯示,失業率從4.5%上升至4.6%,失業救濟申請人數增加了33,100人。因此,英鎊下跌了50點。

在過去的七個交易日中,銀價出現了顯著的上漲,但其增長潛力仍遠未耗盡。38.500 的目標——價格通道的上邊界——依然有效。

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

电子邮件/短信

通知

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.