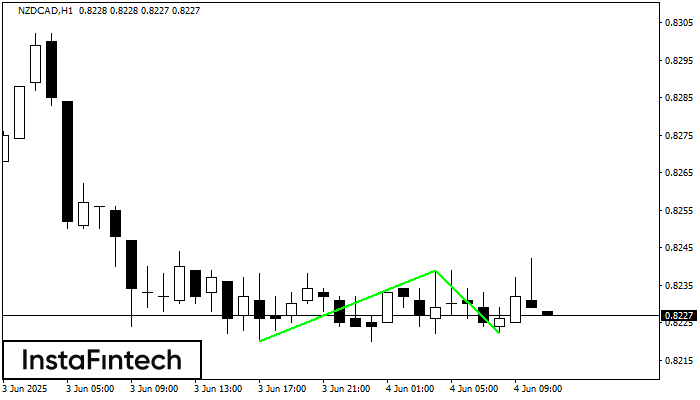

Double Bottom

was formed on 04.06 at 10:00:11 (UTC+0)

signal strength 4 of 5

The Double Bottom pattern has been formed on NZDCAD H1; the upper boundary is 0.8239; the lower boundary is 0.8222. The width of the pattern is 19 points. In case of a break of the upper boundary 0.8239, a change in the trend can be predicted where the width of the pattern will coincide with the distance to a possible take profit level.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Inverse Head and Shoulder

was formed on 20.06 at 10:21:06 (UTC+0)

signal strength 1 of 5

According to M5, USDCHF is shaping the technical pattern – the Inverse Head and Shoulder. In case the Neckline 0.8169/0.8165 is broken out, the instrument is likely to move toward

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bearish Rectangle

was formed on 20.06 at 10:10:53 (UTC+0)

signal strength 1 of 5

According to the chart of M5, EURUSD formed the Bearish Rectangle. The pattern indicates a trend continuation. The upper border is 1.1519, the lower border is 1.1510. The signal means

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bullish Symmetrical Triangle

was formed on 20.06 at 08:55:18 (UTC+0)

signal strength 1 of 5

According to the chart of M5, USDJPY formed the Bullish Symmetrical Triangle pattern. The lower border of the pattern touches the coordinates 145.24/145.39 whereas the upper border goes across 145.49/145.39

The M5 and M15 time frames may have more false entry points.

Open chart in a new window