See also

20.05.2025 06:54 PM

20.05.2025 06:54 PMMarkets thrive on conspiracy theories more than anything else. Investors continue to believe that Donald Trump wants a weak dollar to boost the competitiveness of American manufacturers. It's no surprise that during U.S. trade talks with Japan and South Korea, the won and the yen surged. And now, a G7 summit is on the horizon. Why negotiate separately when we can repeat the events of 40 years ago, when the USD index collapsed following the Plaza Accord?

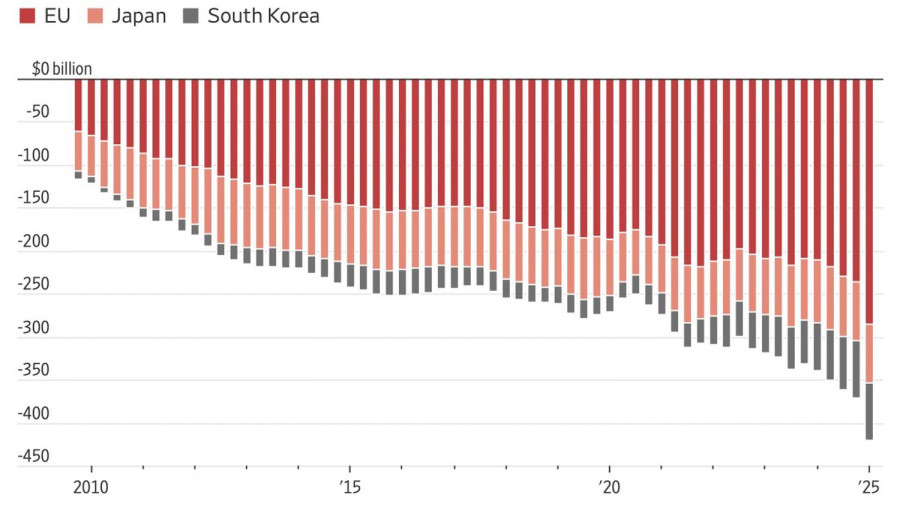

According to Citi, U.S. Treasury Secretary Scott Bessent will demand support from other countries in devaluing the dollar. In the context of lowered tariffs, this would become a key weapon in the fight to reduce America's trade deficit. Washington is likely to apply the most pressure on countries with significant trade surpluses with the U.S.

U.S. Foreign Trade Dynamics with Other Countries

Where there's smoke, there's fire? The euro is being supported by rumors that the ECB will begin a policy of strengthening the currency under U.S. pressure. Especially since Christine Lagarde is already laying the groundwork. According to her, the EUR/USD rally is the result of eroding trust in the dollar. It's no surprise that Danske Bank is forecasting a rise in the single currency to $1.20 within 12 months.

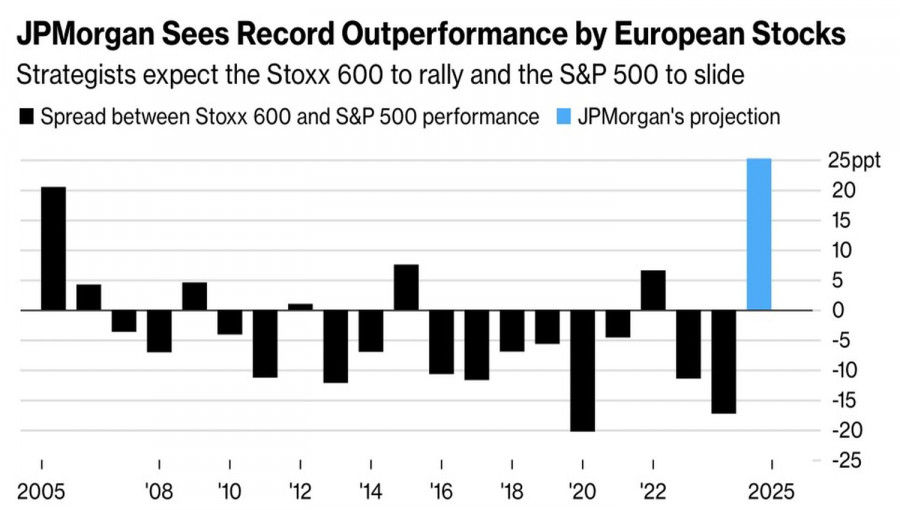

Credit Agricole is more cautious. The firm believes the EUR/USD rally has been too rapid, making the euro vulnerable to a correction. There are four main factors limiting further appreciation. The first is the slowdown in capital flows from North America to Europe. After the S&P 500 surged 23% from its April lows, investors began wondering whether they had exited U.S. equities too early.

Performance Ratio of European vs. U.S. Stock Markets

Despite Donald Trump's efforts, the armed conflict in Ukraine continues. Geopolitics still weighs on the eurozone and its currency due to geographical proximity. A stronger euro means reduced exports, slower economic growth, and lower inflation. In such conditions, the ECB would be forced to continue its monetary easing cycle, which restrains bullish pressure on EUR/USD.

Finally, Credit Agricole believes the euro is overvalued against the U.S. dollar based on bond yield differentials and other models—further reinforcing the risk of a correction in the main currency pair.

No one claims that the euro is flawless. However, at the root of its upward trend against the dollar lies a crisis of confidence in the latter. In such cases, minor weaknesses become almost imperceptible.

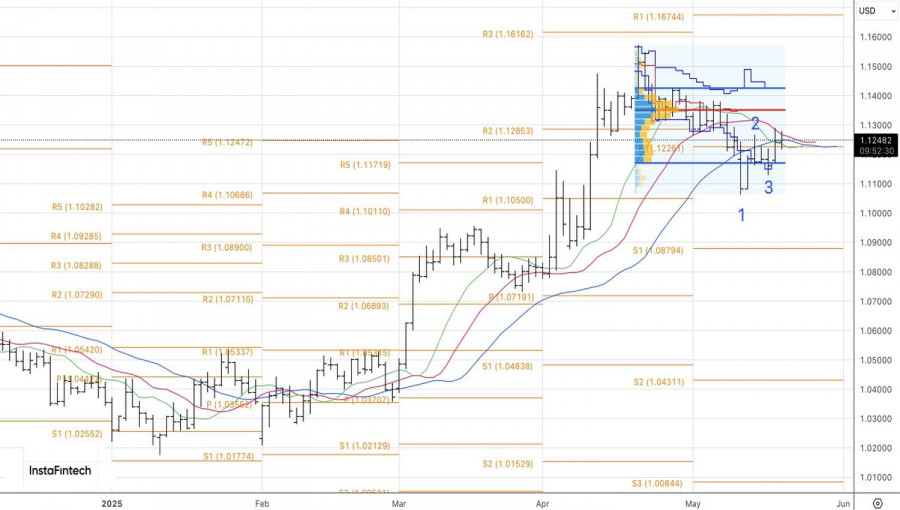

Technically, on the daily EUR/USD chart, a 1-2-3 pattern is playing out. The bulls' task is to break through dynamic resistance represented by the moving averages. A breakout above 1.1285 would justify adding to long positions opened from 1.1225.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.