See also

21.05.2025 06:47 PM

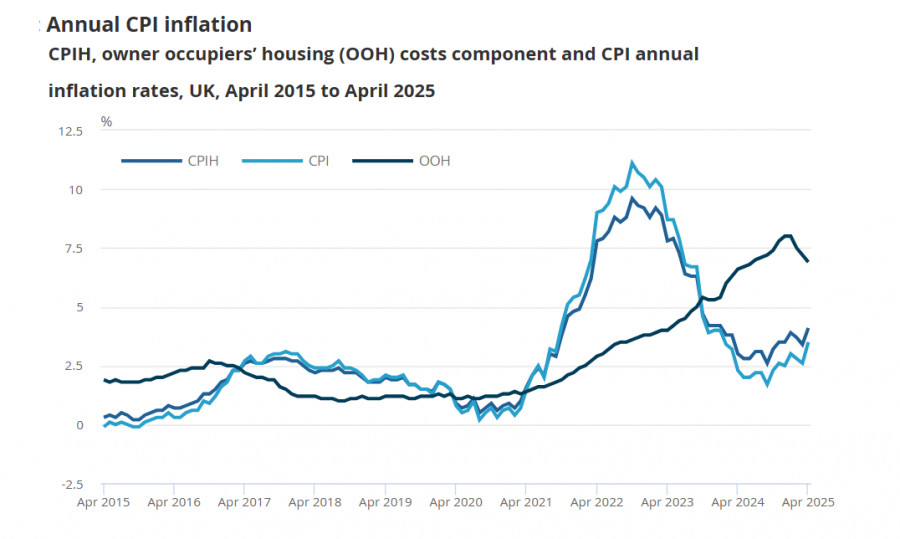

21.05.2025 06:47 PMThe UK Consumer Price Index (CPI) rose from 2.6% to 3.5% in April, surprising the market, which had expected an increase to 3.3%. The core CPI also exceeded forecasts, and the Retail Price Index showed significant growth as well.

The annual inflation rate exceeded 3% for the first time since March 2024. Although a spike in inflation was expected due to base effects, the actual surge was much stronger than anticipated.

The Bank of England clearly foresaw such a development when it cut interest rates by a quarter point two weeks ago, while issuing a far more hawkish statement than markets expected. Now the pound has every reason to try to resume its bullish trend—especially given the string of discouraging news from the United States.

U.S. President Donald Trump failed to persuade Republicans to support his sweeping tax reform proposals. The Republican majority in the House of Representatives remains divided, and markets reacted to the comments of several party members who remain skeptical and continue to oppose the bill—with a selloff in the dollar and a drop in equity indexes.

Trump has limited time to push his reforms through Congress. Failure to do so weakens his position in trade negotiations with key partners—including the UK. Overall, the situation for the U.S. dollar now looks unconvincing, and the pound may seize the opportunity to initiate another bullish impulse.

On Thursday, several Bank of England officials are scheduled to speak, and they will likely face questions regarding the accelerated inflation. On Friday, UK retail sales data will be released. If those figures also show strong growth, expectations for Bank of England rate adjustments will be revised upward, giving the pound fresh momentum for another leg higher.

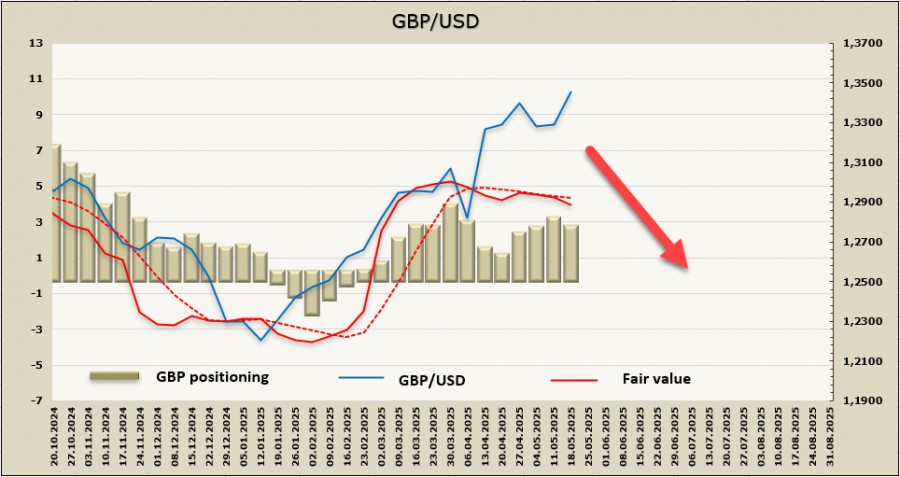

The net long position on the pound fell by £179 million last reporting week, down to £2.26 billion. Positioning remains moderately bullish, but the fair value estimate has lost momentum and slipped below the long-term average.

Last week, we suggested that the pound had a good opportunity to attempt another bullish push—and that is exactly what happened today following the data release. However, this alone is unlikely to sustain a continued rally, and a corrective pullback is expected. Support lies at 1.3140, and for now, there is every reason to believe the pound will not fall below this level. At the same time, high inflation could force the Bank of England to revise its rate outlook, which would almost certainly trigger further appreciation in the pound. In that case, another bullish impulse toward 1.3650 or higher could follow. But this is a less probable scenario, which would require clear weakness in the U.S. dollar.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.