See also

23.05.2025 09:29 AM

23.05.2025 09:29 AMA necessary project at the wrong time. The House of Representatives has approved Donald Trump's tax cut initiative. The President hopes it will help stimulate the economy and offset shortcomings in trade policy. The problem is that investors are now focused on fiscal concerns following the U.S. credit rating downgrade. Fears that the plan could inflate the budget deficit by $2.7 trillion over 10 years are prompting a pullback in the S&P 500.

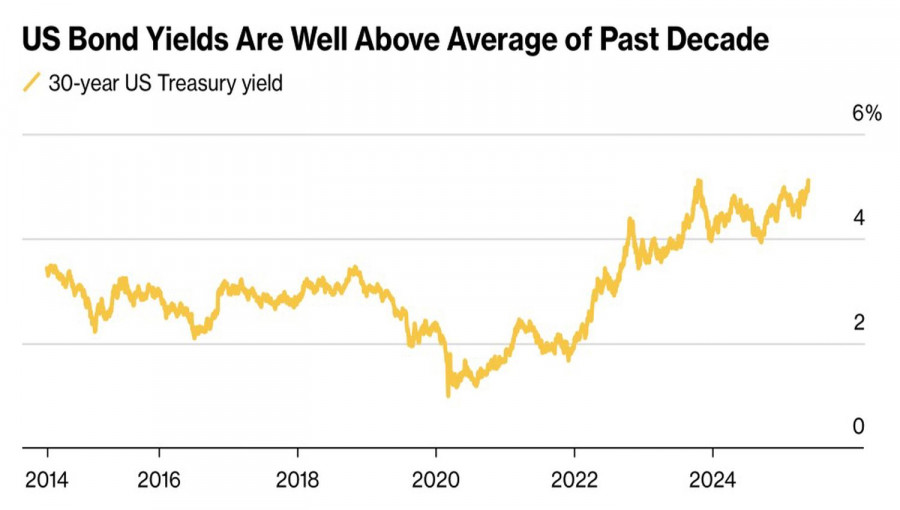

A larger deficit implies increased issuance of U.S. Treasuries, whose yields are surging rapidly. This comes as no surprise — investors are demanding higher returns. The effects are being felt in other markets as well, including Europe and Asia, drawing comparisons to the U.S. in the 1990s, the Eurozone in the 2010s, and the UK in 2022, when sovereign debt crises forced governments to abandon their plans.

Moody's, in its downgrade, warned that U.S. federal debt could rise from the current 100% to 134% of GDP by 2025. If the White House fails to address the issue urgently, the bond yield rally will persist — bad news for consumers, who face higher loan interest rates, and for the Treasury, which must pay more on its borrowings. Ultimately, the broader economy will suffer.

As Washington rolls back tariffs and Treasury yields climb, UBS and Goldman Sachs recommend a barbell strategy: buying consumer-driven stocks while selling real estate equities sensitive to rising borrowing costs. The spread between the two sectors has risen to its highest level since 2023.

Fiscal worries have reawakened market volatility, which had subsided following the U.S.-China trade truce. This environment will likely persist as investors seek clarity on budget deficit risks. Even without a default on Treasuries, demand for them is unlikely to increase, especially from foreign investors. High yields may persist for an extended period — a bearish signal for the S&P 500.

So is it any wonder that the broad stock index ignored the positive May U.S. Composite PMI and FOMC member Christopher Waller's statement that the Federal Reserve will resume its monetary easing cycle in the second half of the year, provided tariffs stabilize around 10%? When fear rules the market, good news gets ignored.

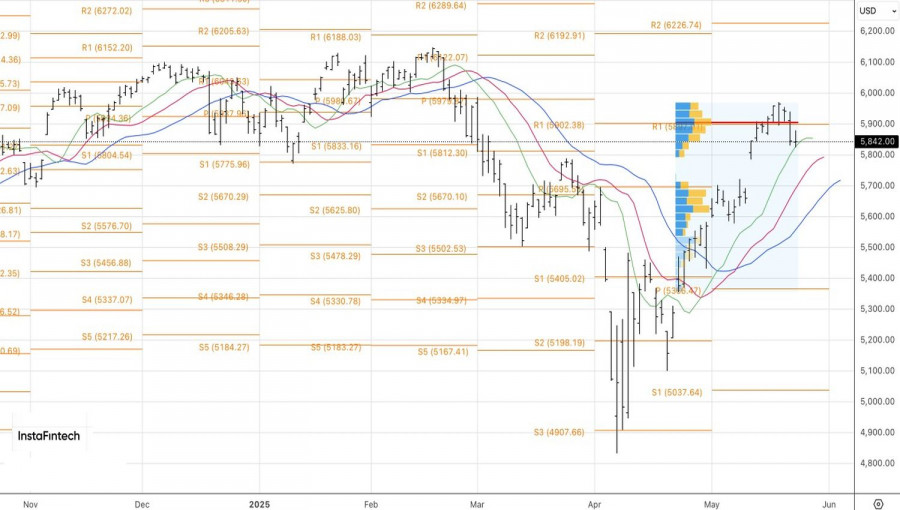

The S&P 500 formed a doji bar following a wide-range bar on the daily chart, indicating uncertainty. It makes sense to add to short positions if prices fall below 5825 and consider returning to long positions on a breakout above the 5905 resistance level.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.