See also

11.06.2025 12:21 AM

11.06.2025 12:21 AMIn war, all methods are justified. U.S.–China trade negotiations are ongoing in London, and everything is being utilized—from education to rocket engines. Washington is prepared to make concessions, including lifting restrictions on exporting various goods, such as software and ethanol. In exchange, Beijing must remove barriers to rare earth material shipments to the U.S. Will it work? No one knows. Unsurprisingly, EUR/USD is swinging back and forth.

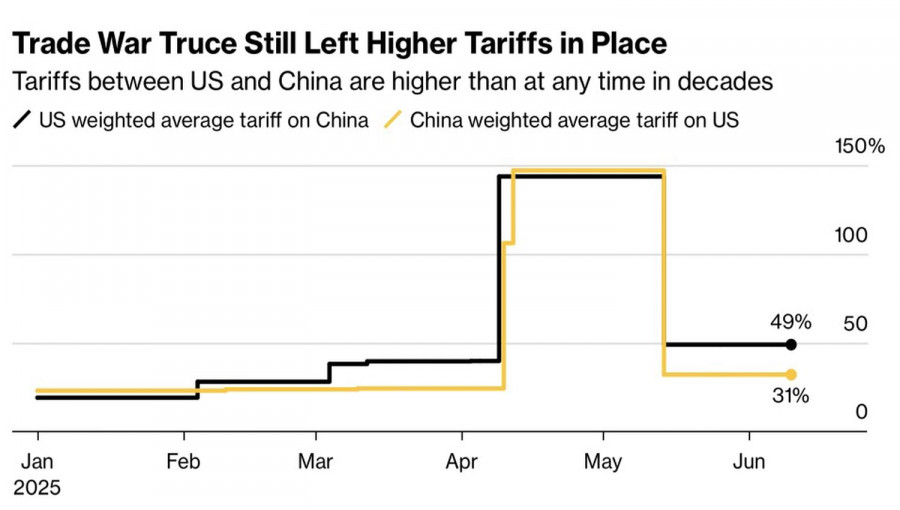

Markets are optimistic about the dialogue between global powers. Not only are U.S. indexes rising, but Chinese equity markets are also gaining. China no longer looks like the punching bag it was during Donald Trump's first trade war. Forewarned is forearmed: instead of increasing import tariffs, China targets U.S. pressure points—rare earth elements being a prime example.

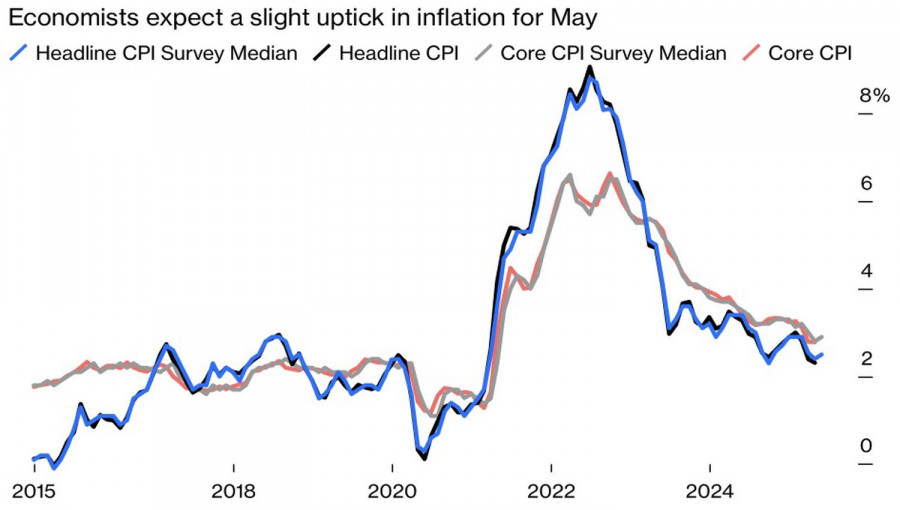

Investors believe the worst is behind us. From now on, it will all depend on how the already-imposed tariffs affect both economies. In particular, markets are watching inflation trends. Bloomberg analysts expect consumer prices to accelerate in August. That's no surprise—on U.S. Independence Day, the White House went all-in on import tariffs. Consumers, meanwhile, are lowering their inflation expectations thanks to optimism about a truce between the U.S. and China.

If inflation remains subdued, the Federal Reserve will have room to cut the federal funds rate—something Trump has been pressuring Jerome Powell to do. Such a scenario would be negative for the U.S. dollar. In the past, Fed monetary policy easing has led directly to a bullish trend in EUR/USD.

Conversely, if inflation does start to accelerate—as the Fed expects—rates will need to be held steady for longer. Bears on the EUR/USD pair will be encouraged and ready to strike back. A correction cannot be ruled out. No wonder EUR/USD behaves like a caged tiger ahead of crucial CPI and PPI data releases.

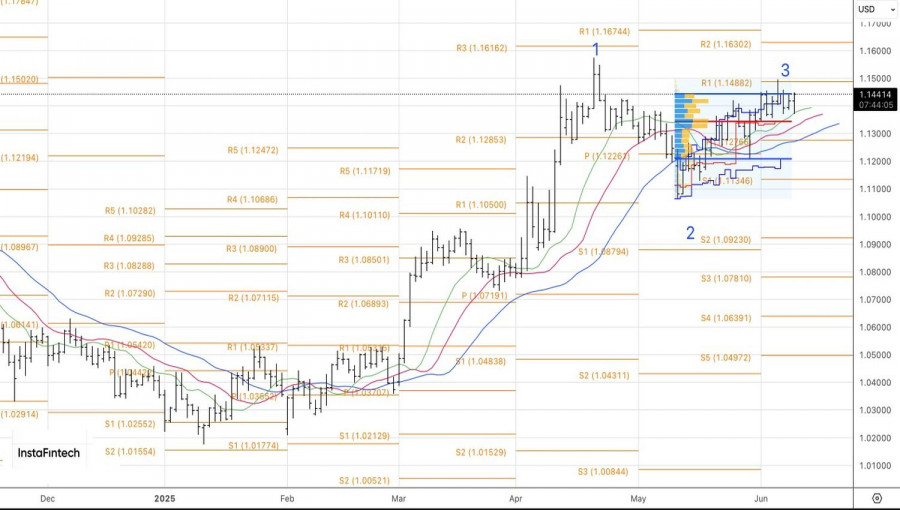

Still, even if the euro faces a short-term pullback, it's too early to declare the end of the pair's upward trend against the U.S. dollar. The White House's policy decisions have eroded trust in the greenback. Capital flows are now moving from North America to Europe—reversing a long-standing pattern. The euro's climb is serious and here to stay.

Technically, on the daily EUR/USD chart, bears failed to capitalize on the inside bar, which indicates weakness. If the market refuses to go where everyone expects it to, it's likely to move in the opposite direction. A breakout above the upper boundary of the internal bar and the fair value range near 1.1445, followed by consolidation, would signal the buying of the euro against the U.S. dollar.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.