See also

18.06.2025 09:46 AM

18.06.2025 09:46 AMBitcoin and Ethereum plunged following the latest escalation in the Middle East and the increasing likelihood that the United States will be drawn into the conflict. Bitcoin dropped from $107,600 to $103,600, while Ethereum fell from a high of $2,605 to $2,465. However, during today's Asian session, both cryptocurrencies slightly recovered.

Meanwhile, U.S. Treasury Secretary Scott Bessent stated that the stablecoin market could reach $3.7 trillion by the end of the decade. With the successful adoption of the GENIUS Act, a significant increase in private sector demand for U.S. government bonds is expected. This would help reduce government borrowing costs, curb national debt growth, and improve global consumer access to dollar-based digital asset ecosystems.

This ambitious forecast and legislative initiative reflect the growing recognition of stablecoins as a key component of the modern financial system.

The projected growth of the stablecoin market is largely attributed to their ability to provide stability and transaction efficiency in the digital space, making them attractive to retail and institutional investors. The GENIUS Act aims to create a favorable regulatory environment for the development of the stablecoin market in the U.S.

Previously, the U.S. "Crypto Czar" David Sacks also stated that the adoption of a stablecoin law would significantly increase demand for U.S. government bonds from stablecoin issuers.

Moving forward, I will continue to buy Bitcoin and Ethereum on large pullbacks, anticipating a continuation of the intact medium-term bull market.

For short-term trading, refer to the strategies below:

Scenario #1: Buy Bitcoin today at $105,500, targeting a rise to $106,300. Exit long positions around $106,300 and open short positions on a bounce. Before buying on a breakout, ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is above zero.

Scenario #2: Buy Bitcoin from the lower boundary of $104,800 if there is no market reaction to its breakout, aiming for a rebound to $105,500 and $106,300.

Scenario #1: Sell Bitcoin today at $104,900, targeting a drop to $103,600. Exit short positions around $103,600 and open long positions on a bounce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario #2: Sell Bitcoin from the upper boundary of $105,500 if there is no market reaction to its breakout, aiming for a drop to $104,800 and $103,600.

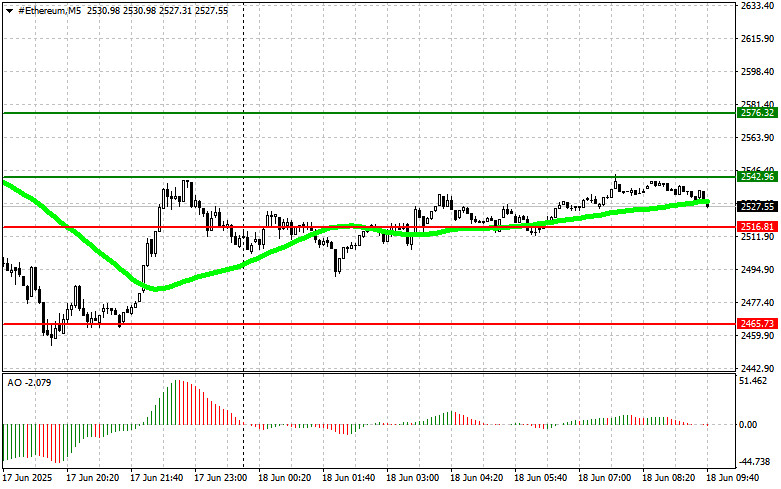

Scenario #1: Buy Ethereum today at $2,542, targeting a rise to $2,576. Exit long positions around $2,576 and open short positions on a bounce. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario #2: Buy Ethereum from the lower boundary of $2,516 if there is no market reaction to its breakout, aiming for a rebound to $2,542 and $2,576.

Scenario #1: Sell Ethereum today at $2,516, targeting a drop to $2,465. Exit short positions around $2,465 and open long positions on a bounce. Before breakout selling, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario #2: Sell Ethereum from the upper boundary of $2,542 if there is no market reaction to its breakout, targeting a decline to $2,516 and $2,495.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin and Ether performed well today in terms of buying following a pause in yesterday's bear market. Demand has returned to the cryptocurrency market, especially after geopolitical tensions eased somewhat

Bitcoin continued trading within a sideways channel, dropping to the $104,000 area yesterday before recovering to a more acceptable level of $104,500. Ethereum also showed no clear directional movement. Despite

The Ripple cryptocurrency on its 4-hour chart appears to be moving in a ranging - sideways condition where it is currently stuck at the Support Bullish Rejection Block area level

Yesterday, Bitcoin and Ethereum remained under pressure, failing to receive support from major players despite attempts to break through key resistance levels. After dipping to around $130,400, Bitcoin is currently

The wave pattern on the 4-hour chart of BTC/USD has become more complicated in recent months. We observed a corrective downward structure that completed near the $75,000 mark. After that

Bitcoin came under significant pressure yesterday following the escalation of tensions in the Middle East. The likelihood of U.S. involvement in a military conflict has increased significantly, which puts pressure

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.