See also

21.07.2025 12:03 PM

21.07.2025 12:03 PMGold rose at the opening of the Asian session on Monday as traders evaluated differing views among U.S. Federal Reserve officials on how President Donald Trump's tariff policy might affect inflation, increasingly leaning toward a dovish stance.

This price jump reflects a broader picture of uncertainty surrounding the global economy and monetary policy. Investors traditionally turn to gold in times of turbulence, and the current situation is no exception. Diverging opinions within the Fed on the future course of monetary policy are adding fuel to the fire. On one side, some advocate keeping interest rates at current levels, citing potential inflationary pressures stemming from Trump's trade policies. On the other, supporters of more aggressive action warn that delaying rate hikes could entrench inflation expectations. This uncertainty over the Fed's next steps is prompting traders to act cautiously and seek safety in haven assets such as gold.

The precious metal rose by 0.5%, reaching nearly 3366 dollars per ounce after Fed Governor Christopher Waller last week expressed support for a rate cut, while Governor Michelle Bowman also signaled readiness for such a move. Meanwhile, other Fed officials, including Adriana Kugler, maintained a more cautious tone due to concerns over persistent inflation driven by tariffs. Lower interest rates generally benefit gold, as it does not yield interest.

The divergence in views also coincides with ongoing pressure from Trump on Fed Chair Jerome Powell, whose term ends in May 2026. The White House is reportedly evaluating potential successors and has pledged to choose someone who would lower interest rates. Last week, the president also denied media reports claiming he had spoken with Treasury Secretary Scott Bessent, who had allegedly warned him about market backlash if Powell were dismissed.

On the trade front, European Union representatives are expected to meet this week to develop a contingency plan in the event of a failure to reach a deal with the U.S. It is clear that many investors will be watching for progress in negotiations with a number of trade partners ahead of the August 1 deadline set by Trump for imposing so-called reciprocal tariffs. A negative outcome could support further gold gains. So far this year, gold has risen by more than a quarter as geopolitical tensions and concerns over dollar-denominated assets have triggered a flight to safe havens.

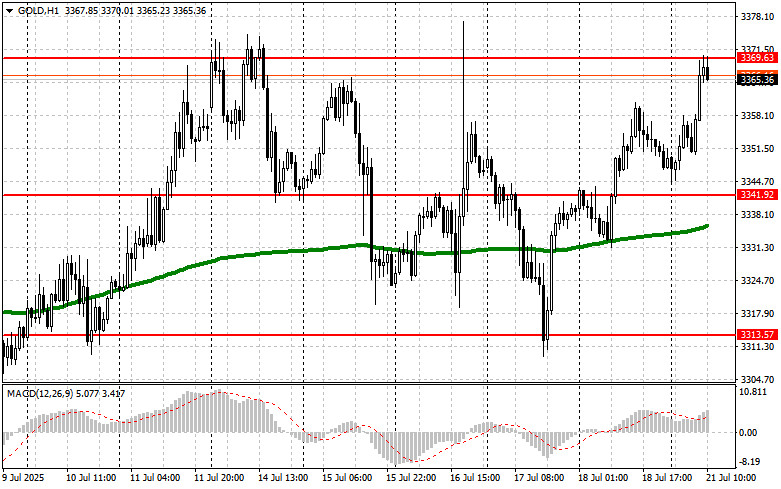

As for the current technical outlook for gold, buyers need to reclaim the nearest resistance at 3369. This would open the way for a move toward 3400, although breaking above that level could prove difficult. The furthest upside target stands at 3444. In the event of a decline, bears will try to take control around the 3341 level. A breakout below that range would deal a serious blow to the bulls' positions and push gold toward the 3313 low, with the potential to reach 3291.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.