See also

22.07.2025 09:10 AM

22.07.2025 09:10 AMDespite the looming August 1 deadline, when the White House's sweeping import tariffs are set to take effect, the S&P 500 keeps hitting new record highs. Step by step, the broad equity index continues its bullish run. Wells Fargo Securities expects it to hit the 7,007 mark by year-end, powered by tech giants. Winners keep winning, the firm says.

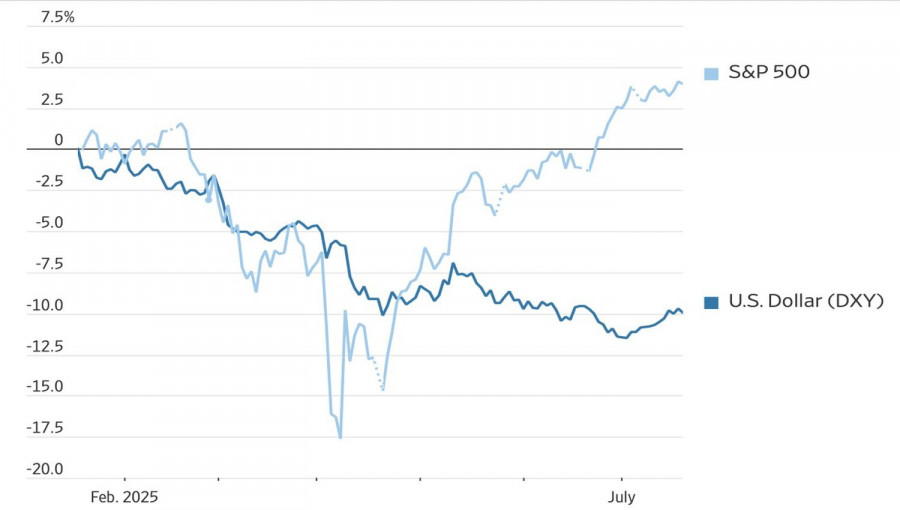

Morgan Stanley recommends holding US stocks in the long term and predicts that the S&P 500 will reach 7,200 by mid-2026. Goldman Sachs argues that the weakening US dollar in the first half of this year will help offset tariff-related downside. And that dynamic is clearly playing out.

S&P 500 and US dollar performance

The US domestic market is massive, with just 13% of corporate profits coming from overseas. Still, S&P 500 companies are highly globalized. Goldman Sachs estimates that 28% of the revenue is foreign-sourced. A weaker dollar boosts American firms' competitiveness and improves financial outcomes.

No surprise, then, that 83% of S&P 500 companies reporting Q2 results so far have exceeded expectations. That compares with five- and ten-year averages of 78% and 75%, respectively. Granted, the estimates were set low. As July wraps up, with both forecasts and actual data factored in, earnings growth stands at 5.6%, marking the weakest pace since 2023.

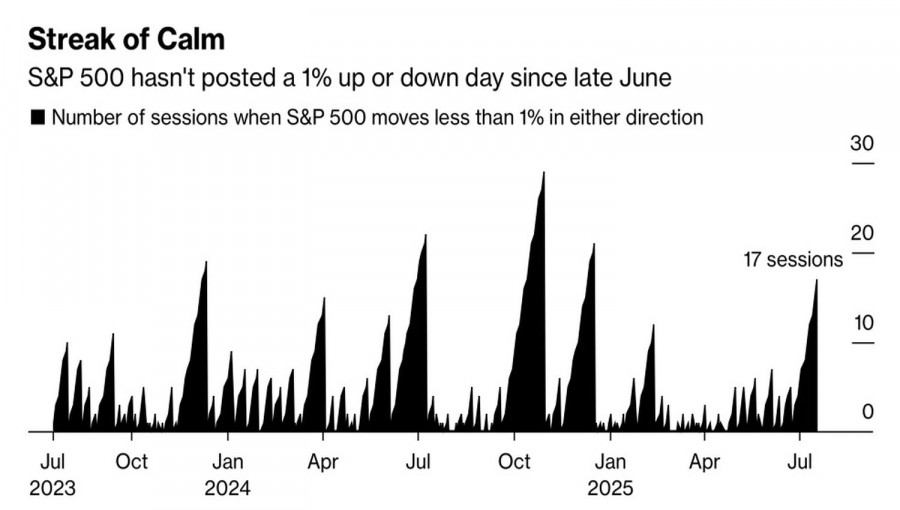

Solus Alternative Asset Management is sounding the alarm: the share of S&P 500 companies trading above their 20- and 50-day moving averages has declined. That signals that upward momentum is fizzling out. So does the S&P 500's 17-day streak without a single move of 1% or more in either direction—its longest streak of calm since December.

Dynamics of S&P 500 streaks without 1% up or down days

Such is the nature of markets: calm spells give way to storms, while turbulence often yields to quiet waters. But when the surface is still, trouble may be lurking below. The S&P 500's slow grind is making investors uneasy.

This is especially true as August 1 approaches. Experts have dubbed August 1, the date when new US tariffs are set to kick in, "Zombie Liberation Day." Unlike America's April 2 "Liberation Day," this one isn't sparking panic. But it should. In the first half of the year, tariffs helped boost global growth by front-loading US import demand. In the second half, they may drag on global GDP.

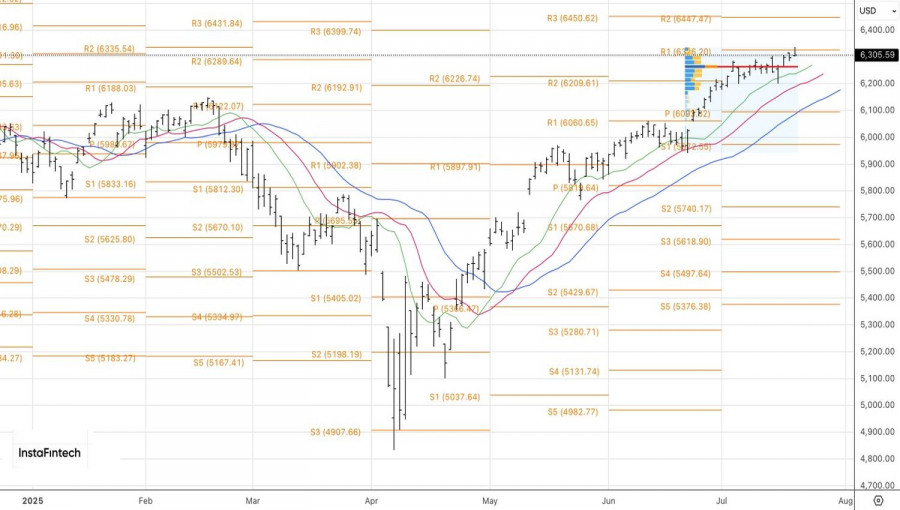

Technically, the S&P 500 has hit record highs on three separate occasions over the past three days. However, it failed to hold above those levels. That signals weak buying pressure and could set the stage for a pullback. A drop below 6,265 would be a sell trigger. For now, as long as the index remains above fair value, holding long positions makes sense.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.