See also

29.07.2025 09:26 AM

29.07.2025 09:26 AMThe devil is in the details. The muted reaction of the S&P 500 to arguably Donald Trump's most monumental trade deal speaks volumes. Some believe the market had anticipated a 15% tariff agreement against the European Union following the U.S. deal with Japan. However, the scale of foreign trade is not comparable. Additionally, the EU is expected to invest $600 billion in the U.S. economy and purchase $750 billion worth of energy products. Such terms should have sent the broad stock index skyrocketing. Unfortunately, it behaved more modestly.

Donald Trump must be pleased. The S&P 500 has logged its sixth consecutive record high. One more all-time high, and the stock market will match its performance from 2021. The White House is doing everything possible to make that happen. Commerce Secretary Howard Lutnick claims that the most likely scenario following the Stockholm negotiations is an extension of the U.S.–China trade truce. Washington is signing a trade agreement with the EU.

The easing of trade uncertainty is having a positive impact on S&P 500 forecasts. Oppenheimer Asset Management has raised its outlook for the broad stock index by the end of 2025 from 5950 to 7100. This is the highest forecast among Bloomberg experts and implies a third consecutive year of 20% growth. The U.S. stock market hasn't seen such a winning streak since the 1990s. Morgan Stanley forecasts the S&P 500 to reach 7,200 in 12 months.

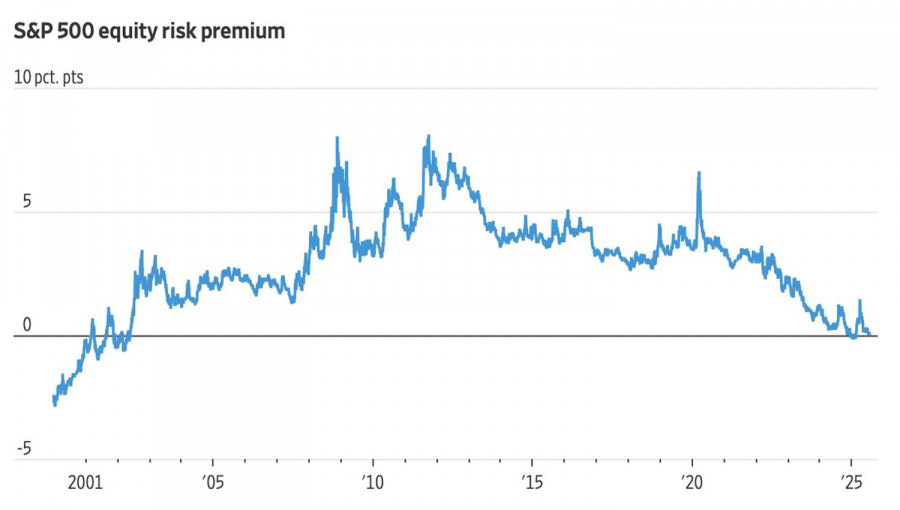

The subdued response of the broad stock index to the U.S.–EU trade deal further confirms existing market concerns about a bubble. It's not just about overvalued fundamentals, including the P/E ratio. The equity risk premium—calculated as the difference between projected S&P 500 returns and the yield on 10-year U.S. Treasuries—is close to zero. This means the additional return for holding riskier assets has all but vanished. Investors view this as an unhealthy sign.

The euro's decline following the release of details on the U.S.–EU trade agreement could further fuel the rally in the broad stock index. Europe must invest $600 billion in the U.S. economy. This could reduce interest in the EuroStoxx 600 and reverse the capital flow from the the U.S. to the EU. Why shouldn't American exceptionalism make a comeback?

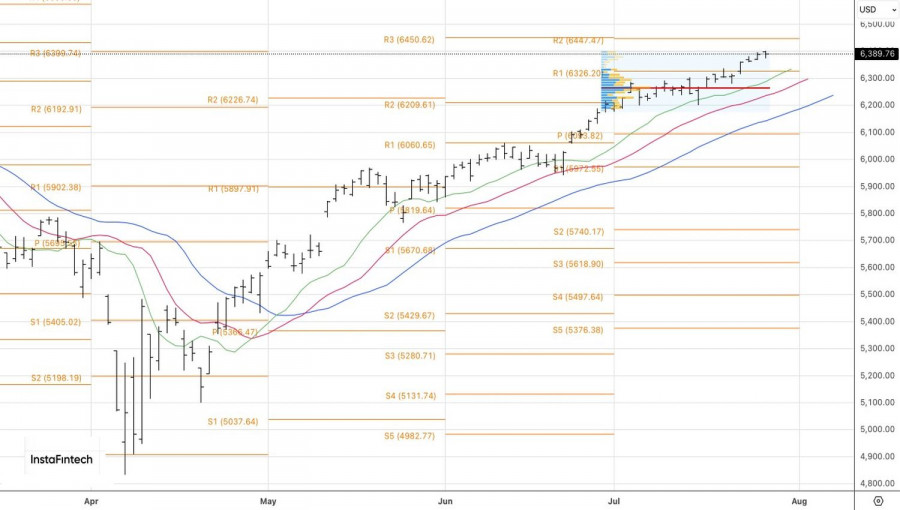

Technically, on the daily chart, the S&P 500 continues its upward movement toward the target of 6450. Long positions initiated from 6051 and 6270 should be maintained. The key support level is the pivot point at 6325.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.