See also

11.08.2025 03:39 PM

11.08.2025 03:39 PMStrong global risk appetite and demand from specialized exchange-traded funds and crypto treasuries have allowed Bitcoin to make a bid for record highs. BTC/USD quotes came close to the all-time peak recorded in mid-July. The bulls seemed almost spooked by their own momentum and took a step back. However, a new record now appears to be only a matter of time.

According to Coingecko, crypto treasuries led by Michael Saylor's Strategy now hold $113 billion in reserves. Consulting firm Architect Partners revealed plans to purchase $79 billion worth of Bitcoin in 2025. Combined with capital inflows into ETFs focused on the sector's leading digital asset, these crypto treasury purchases are fueling demand and driving up prices.

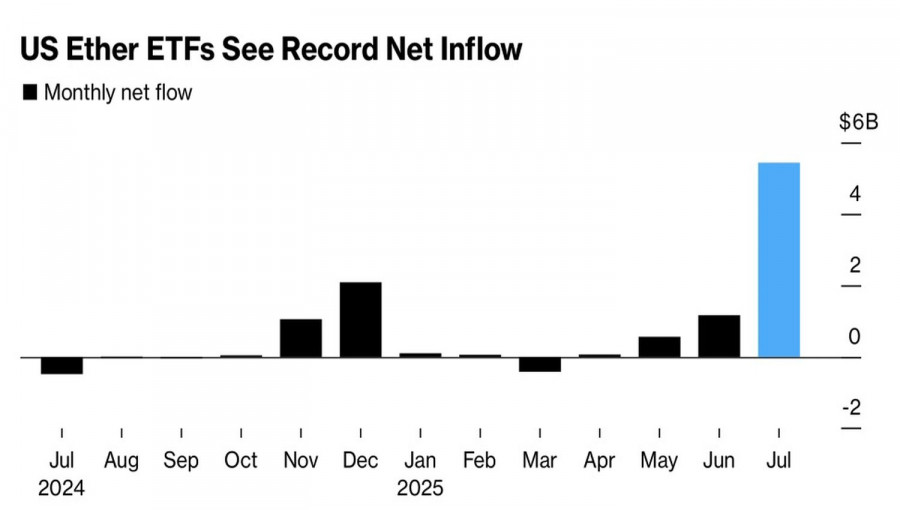

Capital inflows into Ether-focused ETFs

Bitcoin might have already rewritten its all-time highs were it not for the intensifying competition from Ether. Congressional approval of stablecoin legislation has boosted the market capitalization of stablecoins by 47% since Donald Trump's presidential election victory, reaching $255 billion. Much of this adoption is happening on the Ethereum blockchain, which in turn increases demand for Ether.

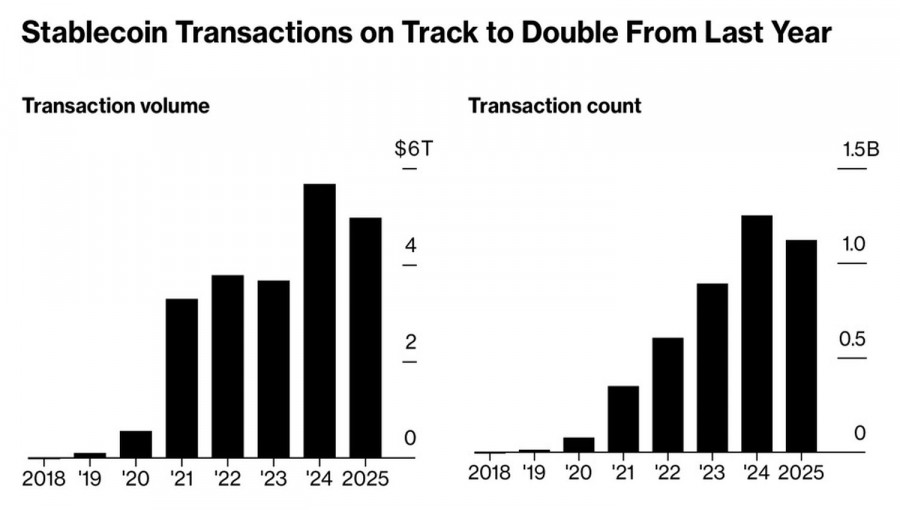

ETFs tied to Ether have attracted over $6.7 billion, while crypto treasuries have increased their Ether holdings by $12 billion. The competition is intense, especially as transaction volumes involving stablecoins are surging. Since the start of 2025, they have exceeded $5 trillion across 1 billion payments — only slightly below the full-year 2024 total of $5.7 trillion.

Stablecoin transaction dynamics

On the other hand, Bitcoin has its own sources of strength. The recent gold story has prompted investors to look for alternatives. Capital flows into the digital asset market are giving the bulls in BTC/USD an extra boost. First, the US floated rumors about imposing tariffs on imported precious metal bars weighing 100 ounces and 1 kilogram, only for the White House to later dismiss them as unfounded.

Thus, strong demand for Bitcoin is supporting higher prices. However, certain risks remain. If crypto treasuries sense trouble, they could begin offloading digital assets at an accelerated pace. The main driver for such selling would be the significant underperformance of their stock prices relative to BTC/USD. In that case, a "crypto winter" could arrive much sooner than in previous cycles. For now, however, it is too early to make such predictions.

From a technical viewpoint, the daily Bitcoin chart shows activation and execution of a "bull trap–throw-over" pattern. After the "spike-and-shelf" pattern failed to play out and prices returned to the middle of the 116,000–120,000 trading range, the odds of the uptrend resuming have increased. Long positions in BTC/USD from $117,900 should be maintained and increased now and then.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.