See also

11.09.2025 02:34 PM

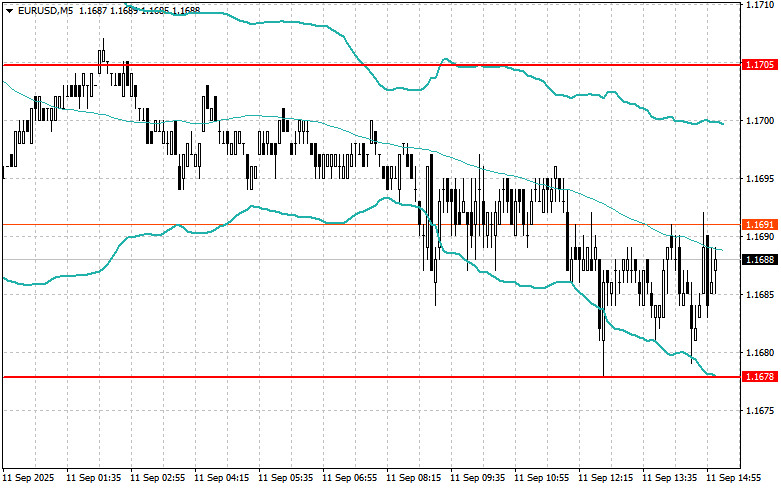

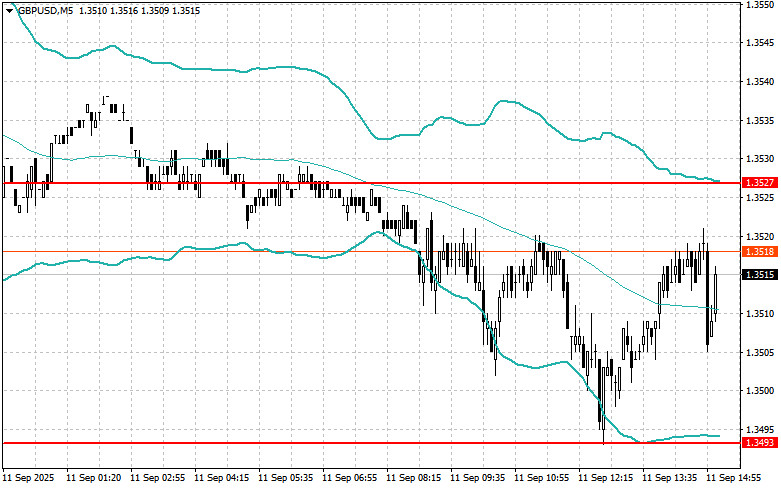

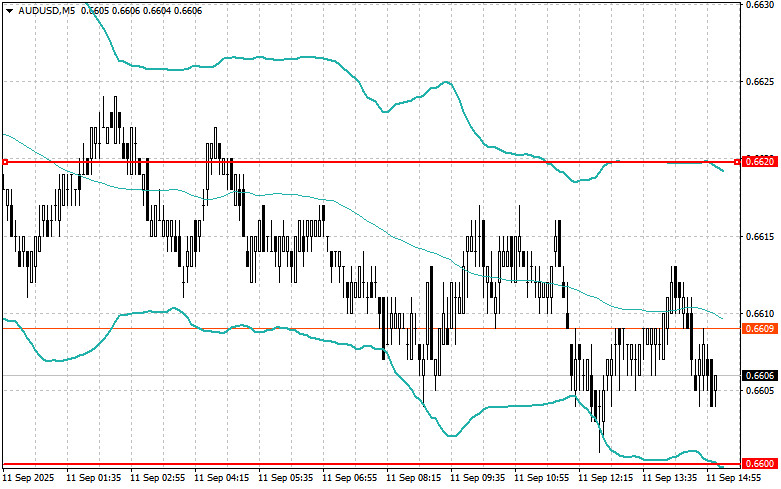

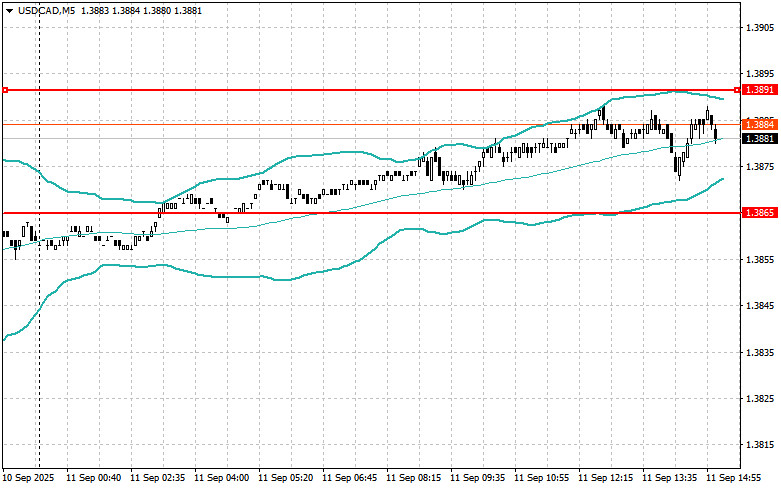

11.09.2025 02:34 PMIn low trading volume, none of the instruments worked out through the Mean Reversion strategy. I tried trading the pound (GBP) using Momentum, which worked out reasonably well.

Now all attention is on the US CPI and Core CPI data. Growth in these indicators will strengthen the dollar and push risk assets lower. In the case of a sharp drop in inflation, the dollar will weaken sharply again. Market participants are watching every slight data change, as it may provide clues about the Fed's next interest rate steps. The Fed is expected to cut rates if inflation slows sharply, which would weaken the dollar even further. Despite some deceleration in recent months, inflation still significantly exceeds the Fed's 2% target. This creates a dilemma for the central bank, which must balance fighting inflation with the risk of overtightening and causing a recession.

The impact of the inflation data on the FX market will depend on the "surprise" factor. If inflation is much higher than expected, an abrupt market reaction (dollar strength) is likely. Conversely, if inflation falls short of expectations, the dollar may weaken and the euro strengthen.

In case of strong data and a clear market reaction, I'll use the Momentum breakout strategy. If there's no pronounced reaction, I'll keep using the Mean Reversion approach.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.