Voir aussi

The Federal Reserve on Wednesday announced its widely expected decision to leave interest rates unchanged, highlighting increased uncertainty about the economic outlook.

In support of its dual goals of maximum employment and inflation at a rate of 2 percent over the longer run, the Fed said it decided to leave the target for the federal funds rate at 4.25 to 4.50 percent for the third straight meeting.

The Fed noted swings in net exports have affected the data but said recent indicators suggest economic activity has continued to expand at a solid pace.

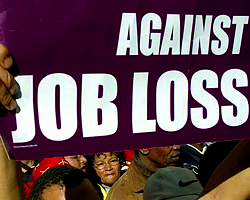

The central bank also said the unemployment rate has stabilized at a low level and labor market conditions remain solid while acknowledging inflation remains somewhat elevated.

The Fed said there are risks to both sides of its dual mandate and warned of increasing risks of higher unemployment and higher inflation.

In considering the extent and timing of additional adjustments to rates, the Fed said it will carefully assess incoming data, the evolving outlook, and the balance of risks.

The Fed reiterated it would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of its dual goals.

The central bank's next monetary policy meeting is scheduled for June 17-18, when Fed officials will also provide their latest projections for the economy, inflation and interest rates.

CME Group's FedWatch Tool is currently indicating a 71.6 percent chance the Fed will once again leave interest rates unchanged next month but a 27.8 percent chance of a quarter point rate cut.