Lihat juga

19.06.2025 12:43 PM

19.06.2025 12:43 PMS&P500

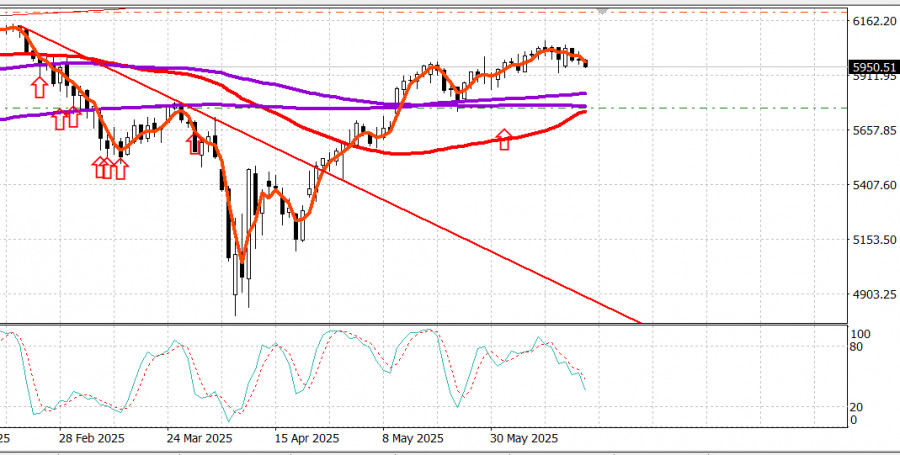

Snapshot of major US stock indices on Wednesday Dow -0.1%, NASDAQ +0.1%, S&P 500 -0.1%, the S&P 500 closed yesterday at 5,981 trading within the range of 5,600 to 6,200

To the outsider of financial markets, Wednesday might have seemed like just another regular trading day. The main indices showed little change — but it was anything but ordinary.

The day was filled with geopolitical tension and unexpected insights into the Federal Reserve's outlook. The Israel-Iran conflict dominated headlines early in the session. Equities pushed higher on President Trump's statement that Iran still had time for negotiations. Investors found evidence that diplomacy hadn't yet been ruled out despite the US president's earlier comment about running out of patience. So, it was a welcomed development.

Importantly, the president also insisted Iran must not obtain nuclear weapons, adding that the end of this week or next would be memorable, tempering market optimism.

Still, stocks held gains ahead of the FOMC decision and the release of the Summary of Economic Projections (SEP) at 2:00 p.m. ET.

Federal Reserve's policy decision As widely expected, the FOMC unanimously voted to keep the federal funds target range unchanged at 4.25–4.50%. However, the SEP painted a mixed picture. While the Federal Reserve still projects two rate cuts by year-end (same as March), it revised its 2025 forecasts upward:

Powell's press conference At 2:30 p.m., Fed Chairman Jerome Powell emphasized ongoing uncertainty and stated that more time is needed to evaluate incoming data before adjusting monetary policy. He also warned that inflation could tick higher in the coming months due to new tariffs.

Following the Fed's decision and Powell's comments, stocks pulled back from session highs, and Treasury yields edged up. However, market reaction was relatively muted given the scale of the event.

S&P 500 closed flat. 2-year Treasury yield held steady at 3.95%. 10-year yield rose one basis point to 4.40%.

Investor sentiment was mixed — buying momentum faded, but selling pressure lacked conviction. Of the 11 S&P sectors, four posted gains.

Top-performing sector: information technology (+0.4%). The weakest sectors: energy (-0.7%) and communication services (-0.7%)

WTI crude, which had traded above $75 per barrel earlier, ended up just 0.4% at $73.56. The dip followed Trump's signaling of possible diplomacy with Iran.

Other highlights:

CBOE Volatility Index (VIX) fell 6.2% to 20.26. Weekly jobless claims remained relatively low at 245,000. Housing starts in May dropped to a five-year low

Year-to-date performance:

Economic calendar:

Initial jobless claims (week ending June 14): down 5,000 to 245,000 (vs. consensus 253,000)

Continuing claims (week ending June 7): down 6,000 to 1.945 million

Takeaway: Jobless claims remain low, suggesting another strong non-farm payroll gain is likely.

May housing starts: down 9.8% MoM to 1.256 million (consensus: 1.356 million)

Building permits: down 2.0% to 1.393 million (consensus: 1.411 million)

Takeaway: The weakest housing starts since May 2020 as well as a decline in single-family permits (-2.7% MoM) signal subdued near-term construction activity.

Energy market. Brent crude is now trading at $77 a barrel.

Conclusion A correction in the US stock market appears realistic. However, it makes sense to maintain long positions from support levels. New buy positions should be opened only on pullbacks — around 5,760 for the S&P 500, but not above.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Indeks saham AS ditutup bervariasi pada Jumat lalu. S&P 500 naik tipis sebesar 0,02%, sementara Nasdaq 100 menguat 0,33%. Dow Jones industri turun sebesar 0,14%. Saham-saham Asia mengalami penurunan untuk

Pada hari Jumat lalu, indeks saham AS ditutup lebih tinggi. S&P 500 naik sebesar 0,40%, sementara Nasdaq 100 bertambah 0,20%. Dow Jones Industrial Average menguat sebesar 0,47%. Lonjakan yang memecahkan

Per tanggal 25 Juli, indeks ekuitas AS menunjukkan kinerja yang beragam. S&P 500 naik tipis sebesar 0,07%, sementara Nasdaq 100 meningkat 0,17%. Dow Jones Industrial Average turun 0,40%. Reli tujuh

Pasar bersiap menghadapi gelombang gangguan baru: Trump menyegel kesepakatan tarif dengan Jepang, Apple menghindari denda jutaan dolar, Amazon menantang Meta dan OpenAI, dan AstraZeneca membangun kerajaan farmasi

Hingga penutupan kemarin, indeks saham AS ditutup bervariasi. S&P 500 naik sebesar 0,06%, sementara Nasdaq 100 turun sebesar 0,39%. Dow Jones industri naik sebesar 0,40%. Rally global yang memecahkan rekor

Indeks saham AS ditutup bervariasi kemarin. S&P 500 naik sebesar 0,14%, dan Nasdaq 100 meningkat 0,38%. Namun, Dow Jones industri turun sebesar 0,04%. Hari ini, saham-saham Asia mengalami penurunan karena

Pasar kembali berada dalam keadaan turbulensi. Yen Jepang berfluktuasi dengan liar setelah runtuhnya koalisi Perdana Menteri Shigeru Ishiba, yang semakin memperdalam ketidakpastian di Jepang. Sementara itu, total kapitalisasi pasar cryptocurrency

S&P500 Gambaran indeks saham utama AS pada hari Kamis Dow +0,5%, NASDAQ +0,7%, S&P 500 +0,5%, S&P 500 ditutup pada 6.297, trading dalam rentang 5.900 hingga 6.400. Pasar saham didorong

Hingga kemarin, indeks saham AS ditutup lebih tinggi. S&P 500 naik sebesar 0,54%, sementara Nasdaq 100 tumbuh 0,75%. Dow Jones industri menguat sebesar 0,52%. Hari ini, kontrak berjangka indeks saham

Indikator pola

grafis.

Lihat hal-hal

yang belum pernah anda lihat!

Video pelatihan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.