Lihat juga

26.06.2025 07:17 PM

26.06.2025 07:17 PMTrade Review and Trading Advice for the Japanese Yen

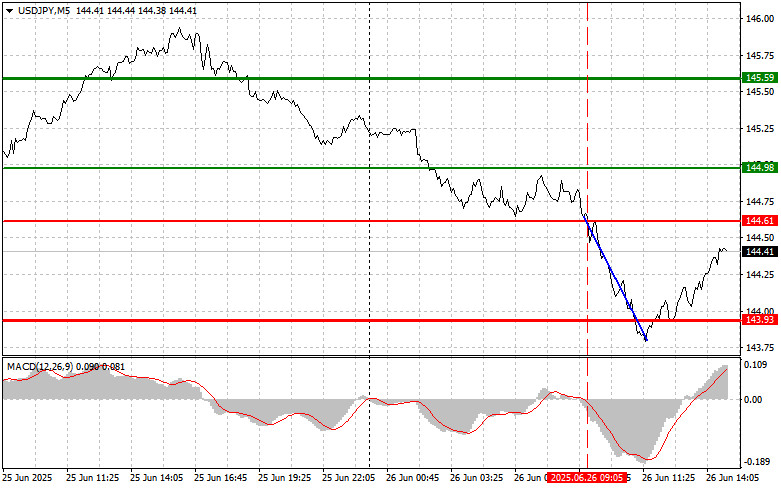

The price test at 144.61 occurred just as the MACD indicator began to move downward from the zero level, confirming a valid entry point for selling the dollar. This led to a decline toward the target level of 143.93.

Toward the beginning of the U.S. session, pressure on the dollar eased, resulting in a slight correction in the pair. This may be due to the anticipated release of key U.S. GDP and labor market data later in the day. Additional focus will be on the speeches of FOMC members Thomas Barkin and Michael S. Barr. Unlike Powell, these policymakers may openly express their views on current developments, which could influence currency market direction and the U.S. dollar. Their assessments of economic conditions, inflation outlook, and future monetary policy paths will be critical aspects of their speeches. In particular, investors will closely monitor any hints of further rate cuts or adjustments to the Fed's balance sheet reduction pace.

Barkin, known for his conservative stance on inflation, may clarify how seriously the Fed views sustained inflationary pressure. Barr, the Fed's Vice Chair for Supervision, is expected to focus on financial system resilience and banking regulation.

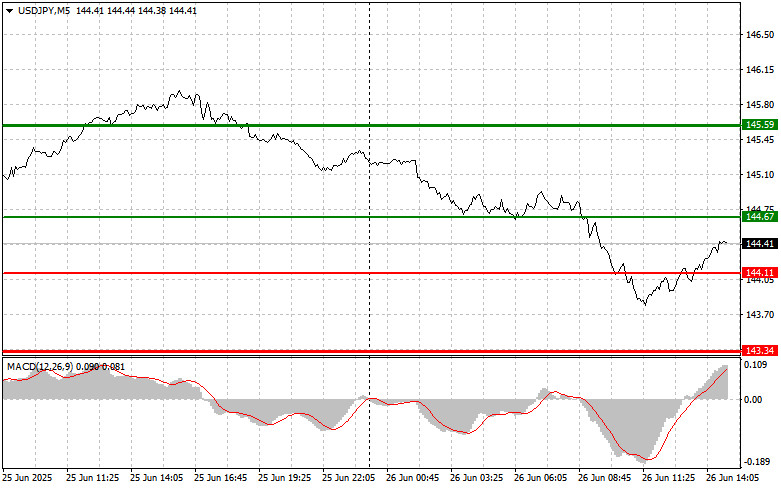

For intraday strategy, I will primarily rely on Scenarios #1 and #2.

Buy Signal

Scenario #1:I plan to buy USD/JPY today upon reaching the entry point around 144.67 (green line on the chart), aiming for a rise to 145.59 (thicker green line). At 145.59, I plan to exit long positions and open short positions in the opposite direction, expecting a 30–35 point move downward. A strong rally in the pair can only be expected if the data is strong. Important: Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise.

Scenario #2:I also plan to buy USD/JPY if the price tests 144.11 twice in a row while the MACD is in oversold territory. This will likely limit the pair's downward potential and lead to a reversal. A rise toward the opposite levels of 144.67 and 145.59 is expected.

Sell Signal

Scenario #1:I plan to sell USD/JPY after the price breaks below 144.11 (red line on the chart), which may lead to a sharp drop. The key target for sellers will be 143.34, where I will exit short positions and consider opening long positions in the opposite direction, aiming for a 20–25 point rebound. Selling pressure is expected to return in case of weak data.Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2:I also plan to sell USD/JPY if the price tests 144.67 twice in a row while the MACD is in overbought territory. This will likely cap the pair's upward potential and trigger a reversal. A decline toward 144.11 and 143.34 is expected.

Chart Key:

Important Note for Beginners

Beginner Forex traders must exercise extreme caution when entering the market. It's best to stay out of the market ahead of major fundamental releases to avoid sharp price swings. If you choose to trade during news events, always place stop-loss orders to minimize losses. Without stop-losses, you may quickly lose your entire deposit—especially if you neglect money management and trade with large volumes.

Remember, successful trading requires a clear trading plan, like the one provided above. Making spontaneous decisions based on the current market situation is an inherently losing strategy for intraday traders.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Uji level 146.75 bertepatan dengan saat indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang valid untuk membeli dolar. Akibatnya, pasangan ini naik sebesar

Uji level 1,3529 terjadi ketika indikator MACD baru saja mulai bergerak turun dari garis nol, mengonfirmasi titik entri yang valid untuk menjual pound. Akibatnya, pasangan ini turun lebih dari

Uji level 1.1757 terjadi pada saat indikator MACD baru saja mulai naik dari garis nol, mengonfirmasi titik masuk yang valid untuk membeli euro. Akibatnya, pasangan ini naik sebesar 30 pips

Euro Bertahan, Sementara Pound Kembali Melemah Setelah Data Inggris yang Lemah Kemarin, Presiden Bank Sentral Eropa, Christine Lagarde, menyatakan bahwa ECB mengambil pendekatan wait-and-see , dengan tidak mengubah suku bunga

Sejak awal minggu, pasar minyak tetap berada dalam keadaan keseimbangan yang tegang. Brent crude, setelah kehilangan tren naiknya pada bulan Mei, hanya berhasil pulih sebagian: setelah jatuh ke $68, harga

Analisis Trading dan Tips untuk Trading Yen Jepang Uji level 146.38 terjadi pada saat indikator MACD sudah bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini. Hari

Analisis dan Kiat-kiat Trading Pound Sterling Uji level 1,3555 bertepatan dengan indikator MACD yang telah bergerak jauh di bawah garis nol, yang membatasi potensi penurunan pasangan ini. Data PMI jasa

Analisis Trading dan Tips untuk Trading Euro Uji level 1.1756 bertepatan dengan indikator MACD yang bergerak jauh di bawah garis nol, yang membatasi potensi penurunan pasangan ini. Data PMI Zona

Uji level 146.56 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini—terutama dalam konteks pasar yang cenderung bearish. Para trader terus membeli

Level 1,3551 diuji ketika indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi validitas titik masuk untuk posisi long pada pound. Akibatnya, pasangan ini naik sebanyak 30 poin

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.