Lihat juga

27.06.2025 08:50 AM

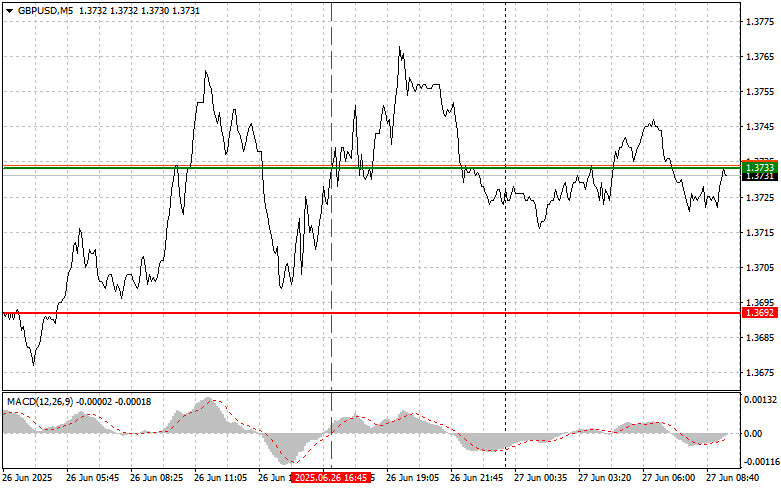

27.06.2025 08:50 AMThe test of the 1.3733 level occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upside potential. For this reason, I did not buy the pound. The second test of 1.3733 happened when the MACD was in the overbought area, which enabled the implementation of Sell Scenario #2. However, the pair ultimately did not decline.

The final Q1 data, revised downward, confirmed a U.S. GDP contraction of 0.5%, compared to the preliminary figure of 0.2%. This negative surprise exerted noticeable pressure on the U.S. dollar, increasing interest in alternative currencies—particularly the British pound. Investors, concerned by the slowdown in the U.S. economy, revised their expectations for future Federal Reserve policy. Rising expectations of further rate cuts reduced the dollar's appeal as a safe-haven asset.

There are no UK economic data releases today. The lack of fresh economic figures from the United Kingdom may leave the pound without support, making it vulnerable to speculative pressure and overall market pessimism. In uncertain conditions, traders often prefer to lock in profits, which could lead to a moderate decline in the pound's rate. However, it is worth noting that the fundamental factors influencing the pound remain unchanged. Inflation in the UK remains high, putting pressure on the Bank of England to proceed cautiously with interest rate cuts. This, in turn, supports demand for the pound in the long term.

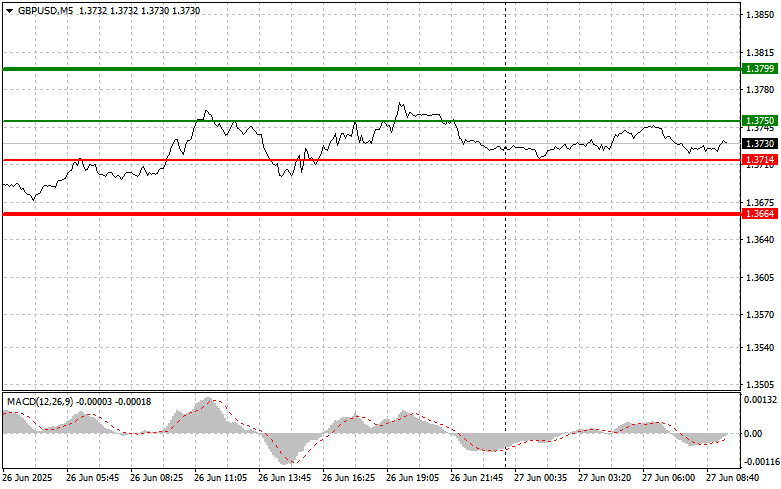

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: Today, I plan to buy the pound at an entry point of around 1.3750 (indicated by the green line on the chart), targeting a rise to 1.3799 (represented by the thicker green line). Near 1.3799, I intend to close the long position and open a short position in the opposite direction (anticipating a 30–35 pip pullback from that level). A bullish outlook on the pound today aligns with the ongoing uptrend.

Important! Before buying, ensure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.3714 level while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and trigger a reversal to the upside. A rise to the opposing levels of 1.3750 and 1.3799 can be expected.

Scenario #1: I plan to sell the pound today after a break below 1.3714 (red line on the chart), which should lead to a quick decline in the pair. The key target for sellers will be 1.3664, where I intend to close the short position and immediately open a long position (anticipating a 20–25 pip pullback). Selling the pound is appropriate after a failed attempt to rise above the daily high.

Important! Before selling, ensure the MACD indicator is below the zero line and is just starting to decline from it.

Scenario #2: I also plan to sell the pound in case of two consecutive tests of the 1.3750 level when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and may trigger a downward reversal. A decline toward 1.3714 and 1.3664 can be expected.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Uji level 146.75 bertepatan dengan saat indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang valid untuk membeli dolar. Akibatnya, pasangan ini naik sebesar

Uji level 1,3529 terjadi ketika indikator MACD baru saja mulai bergerak turun dari garis nol, mengonfirmasi titik entri yang valid untuk menjual pound. Akibatnya, pasangan ini turun lebih dari

Uji level 1.1757 terjadi pada saat indikator MACD baru saja mulai naik dari garis nol, mengonfirmasi titik masuk yang valid untuk membeli euro. Akibatnya, pasangan ini naik sebesar 30 pips

Euro Bertahan, Sementara Pound Kembali Melemah Setelah Data Inggris yang Lemah Kemarin, Presiden Bank Sentral Eropa, Christine Lagarde, menyatakan bahwa ECB mengambil pendekatan wait-and-see , dengan tidak mengubah suku bunga

Sejak awal minggu, pasar minyak tetap berada dalam keadaan keseimbangan yang tegang. Brent crude, setelah kehilangan tren naiknya pada bulan Mei, hanya berhasil pulih sebagian: setelah jatuh ke $68, harga

Analisis Trading dan Tips untuk Trading Yen Jepang Uji level 146.38 terjadi pada saat indikator MACD sudah bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini. Hari

Analisis dan Kiat-kiat Trading Pound Sterling Uji level 1,3555 bertepatan dengan indikator MACD yang telah bergerak jauh di bawah garis nol, yang membatasi potensi penurunan pasangan ini. Data PMI jasa

Analisis Trading dan Tips untuk Trading Euro Uji level 1.1756 bertepatan dengan indikator MACD yang bergerak jauh di bawah garis nol, yang membatasi potensi penurunan pasangan ini. Data PMI Zona

Uji level 146.56 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini—terutama dalam konteks pasar yang cenderung bearish. Para trader terus membeli

Level 1,3551 diuji ketika indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi validitas titik masuk untuk posisi long pada pound. Akibatnya, pasangan ini naik sebanyak 30 poin

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.