यह भी देखें

21.08.2025 10:42 AM

21.08.2025 10:42 AMUS stock indices closed mixed yesterday. The S&P 500 slipped 0.24%, Nasdaq 100 fell 0.67%, while the Dow Jones Industrial Average inched up 0.04%.

Asian indices showed slight gains after dip-buyers helped stabilize the Nasdaq 100 late in yesterday's session. Still, markets are treading cautiously ahead of the Federal Reserve's Jackson Hole meeting. Investors are watching closely for any signals on future US monetary policy, with Fed Chair Jerome Powell's upcoming speech expected to shed light on inflation and interest rate prospects. Traders will parse every word to gauge how aggressively the Fed intends to tackle inflation and what that could mean for growth.

The MSCI Asia Pacific Technology Index rose 0.1% for the first time in four days, supported by gains in Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co. US and European stock futures were little changed, while the dollar index added 0.1%. Oil prices held firm after US inventory data showed a drawdown. Treasury yields steadied after broad gains in the previous session. Meanwhile, Japan's 20-year government bond yield hit its highest since 1999, and China's 30-year yield climbed to its strongest since December amid a local equity rally.

Tech shares, particularly mega-cap names, have been under pressure for the past two sessions, as the sharp rally since April has fueled concerns it may have gone too far, too fast. With central bankers gathering in Jackson Hole, markets remain in wait-and-see mode, anticipating Powell's comments to reassess rate direction.

This cautious stance has kept equities tilted bearish. Elevated valuations are starting to reflect the risk of disappointment if Powell fails to signal a dovish pivot. Any unexpectedly hawkish remarks could trigger a swift selloff.

The S&P 500 has now posted losses for four consecutive sessions, despite rebounding from intraday lows. While most of the index's constituents closed higher, economists warn that the heavy concentration in tech giants leaves the broader market vulnerable to deeper declines.

Meanwhile, the minutes of the July 29–30 FOMC meeting showed most Fed officials see inflation risks outweighing labor market concerns. While acknowledging worries over both higher inflation and weaker jobs, a majority of policymakers judged inflation as the more pressing risk.

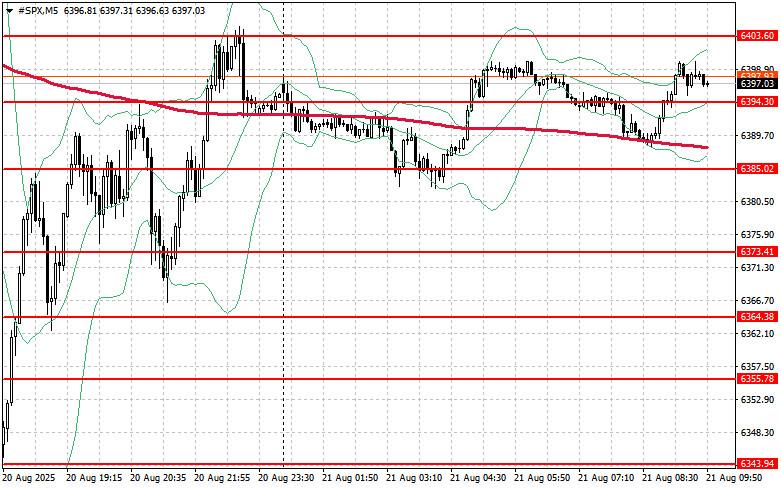

Technical outlook for S&P 500:For bulls, the immediate goal is to break through resistance at $6,403, which could pave the way toward $6,414. A push above $6,428 would further strengthen buyers' control. On the downside, should risk appetite weaken, buyers must defend $6,394. A break below this level could quickly drag the index back to $6,385 and potentially $6,373.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |