یہ بھی دیکھیں

05.11.2025 09:55 AM

05.11.2025 09:55 AMYesterday, amid a crash in risk assets, gold seized the opportunity to gain some weight. It is evident that gold has recovered as traders sought safe assets following a drop in the stock market amid concerns about inflated valuations.

Spot gold prices rose to $4,000 per ounce after falling nearly 2% in the previous session. Global stock indices fell on Wednesday, marking the sharpest decline in almost a month. Treasury bonds gained on the back of demand for safe-haven assets.

The fall in gold on Tuesday followed three members of the U.S. Federal Reserve who did not support further rate cuts in December, weighing the associated risks of inflation and a weakening labor market. This week, investors can expect to hear more opinions, including from St. Louis Fed President Alberto Musalem.

Since the beginning of the year, gold has appreciated by approximately 50%, reaching a record high last month, only to pull back slightly. The retracement, which followed several signals of overly rapid growth, was accompanied by outflows from exchange-traded funds backed by precious metals. Traders are now trying to assess whether the metal's price decline has finished.

Overall, the observed dynamics in the gold and bond markets reflect a complex relationship between changing expectations regarding future Federal Reserve policy, heightened levels of macroeconomic risks, and ongoing uncertainties related to the U.S. shutdown. Investors should remain vigilant and carefully monitor incoming economic data and official statements to make informed investment decisions amid heightened volatility.

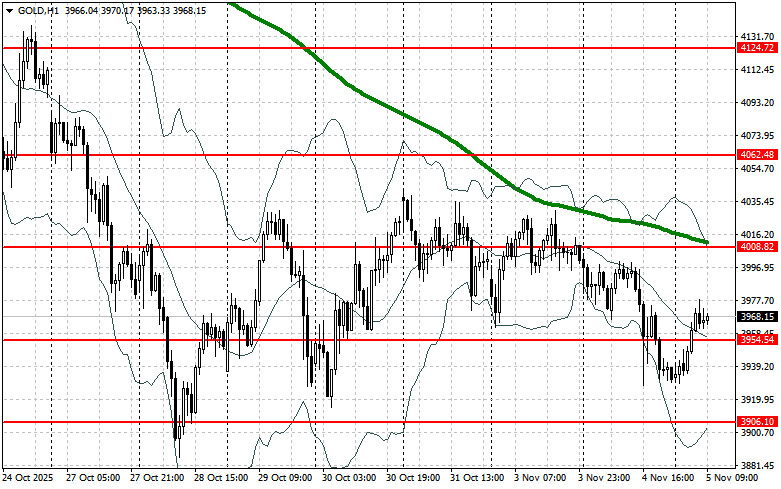

Even the consolidation of gold in a trading range from $3,800 to $4,050 per ounce does not pose a threat to the bull market observed this year. The factors that have driven gold prices higher this year largely remain unchanged, and active purchases from central banks and strong demand from private investors could lead to price increases following the consolidation phase.

As for the current technical picture of gold, buyers need to break the nearest resistance at $4,008. This will allow them to target $4,062, above which it will be quite challenging to penetrate. The furthest target will be around $4,124. If gold falls, bears will attempt to take control over $3,954. If successful, the breakout of this range will deal a serious blow to the bulls' positions and push gold down to a low of $3,906, with the potential to reach $3,849.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.