Veja também

20.06.2025 03:36 PM

20.06.2025 03:36 PMTrade Review and Tips for the Euro

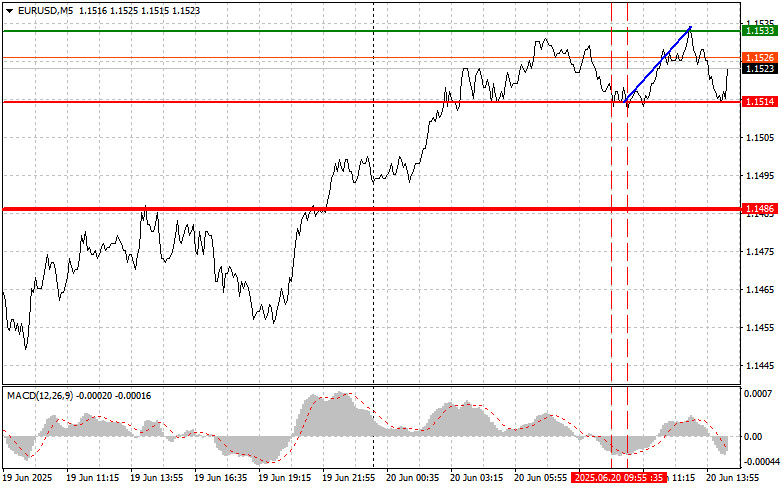

The first test of the 1.1514 price level in the first half of the day occurred when the MACD indicator had already dropped significantly below the zero mark, which limited the pair's downward potential. The second test of this level shortly thereafter coincided with the MACD being in the oversold zone, allowing Buy Scenario #2 to play out and resulting in a 20-point rise.

The market reaction to Germany's Producer Price Index was muted, as the data, while an important indicator of inflationary pressure, contained no surprises. The figures were somewhat disappointing, but nothing more. Going forward, the main focus will shift to inflation reports from the eurozone and the United States, as well as central bank decisions on interest rates.

In the second half of the day, we expect the release of the Philadelphia Fed Manufacturing Index and the Leading Economic Indicators Index. Although the Philly Fed index is a key regional industry indicator, its overall impact on the market tends to be limited. Traders usually consider it alongside broader macroeconomic indicators, such as national production indexes and general economic trends. The Leading Indicators Index is also unlikely to move markets, as it serves to forecast future economic conditions rather than affect the current situation. Overall, the market remains in a state of uncertainty and caution.

Market participants are awaiting more significant economic releases and political developments that could influence long-term economic prospects.

As for the intraday strategy, I will rely more on the execution of Scenarios #1 and #2.

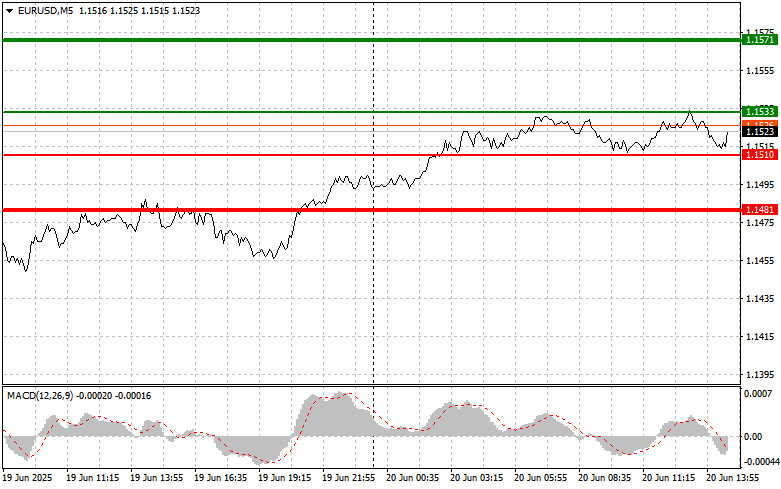

Buy Signal

Scenario #1: Today, buying the euro is possible after the price reaches the 1.1533 level (green line on the chart), with the target at 1.1571. At 1.1571, I plan to exit the market and sell the euro in the opposite direction, expecting a 30–35 point correction from the entry point. A strong rally in the euro is unlikely today. Important: Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1510 level while the MACD is in the oversold zone. This will limit the pair's downward potential and lead to a reversal upward. A rise toward the opposite levels of 1.1533 and 1.1571 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches the 1.1510 level (red line on the chart). The target will be 1.1481, where I plan to exit the market and immediately buy in the opposite direction (expecting a 20–25 point rebound from that level). Pressure on the pair is unlikely to return today. Important: Before selling, ensure that the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.1533 level while the MACD is in the overbought zone. This will limit the pair's upward potential and lead to a downward reversal. A drop toward the opposite levels of 1.1510 and 1.1481 can be expected.

On the Chart:

Important:

Beginner Forex traders must be very cautious when making market entries. Before the release of key fundamental reports, it's best to stay out of the market to avoid sudden price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Trading without stop-loss orders can result in quickly losing your entire deposit, especially if you don't apply money management and trade with large volumes.

And remember: successful trading requires a clear trading plan—like the one presented above. Making spontaneous decisions based on current market conditions is a losing strategy for intraday trading.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Análise da negociação e dicas de negociação da libra esterlina O teste do nível de 1,3378 ocorreu quando o indicador MACD já havia se movido significativamente acima da linha zero

Análise das operações e recomendações para negociar o iene japonês O teste do nível 147,36 ocorreu quando o indicador MACD já havia se movido significativamente acima da linha zero

Análise das negociações e recomendações para negociar a libra esterlina O teste do nível 1,3267 ocorreu justamente quando o indicador MACD começava a se mover para baixo a partir

Análise das operações e recomendações de negociação para o Euro O teste do nível 1,1543 ocorreu quando o indicador MACD acabava de começar a se mover para baixo a partir

Gráfico de Forex

Versão-Web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.