Veja também

25.06.2025 12:42 AM

25.06.2025 12:42 AMOn Tuesday morning, Donald Trump announced the end of the war between Iran and Israel. Notably, he made no mention of the U.S. in this conflict or ceasefire despite having personally ordered strikes on three nuclear sites in Iran on Saturday. Afterward, the U.S. President declared their complete destruction, and he claimed Iran had been denuclearized. According to Trump, Tehran no longer poses a "nuclear threat" to the world.

However, many experts—and even U.S. Vice President J.D. Vance—have expressed doubts that the nuclear facilities were completely destroyed. Satellite images show that the bombs and missiles struck locations where the sites are believed to be underground, but it remains unclear whether they reached their targets. Iran has admitted the strikes on its facilities but called the damage "insignificant." So whom should we believe?

Additionally, it was reported that Iran launched new missiles at Israel—though this was later labeled a "mistake." Was it a journalistic error or a military one? Israel immediately disregarded the ceasefire announced by Trump and dispatched fighter jets for a retaliatory strike. Despite Trump's appeals on social media not to proceed, Israeli officials declared they would deliver a "symbolic strike." Why and for what purpose? It's unclear. Is there a ceasefire or not? No one seems to know.

Meanwhile, demand for the U.S. dollar continues to decline. Even though many market participants remain skeptical, the Middle East smells of ceasefire. Still, nothing stops the market from reacting to the news. Yesterday, the market responded to the U.S. strike on Iranian facilities and Iran's retaliatory attack on U.S. military bases, particularly in Qatar. On Tuesday, trading has been more subdued, but the Middle East could "explode" again at any moment. And so could the currency market.

As I mentioned earlier, the U.S. has little reason to continue active military operations in Iran, as Trump aims to present himself as a peacemaker to the world. However, nothing prevents Israel and Iran from continuing their hostilities. The euro and pound are on the verge of updating their highs against the U.S. dollar.

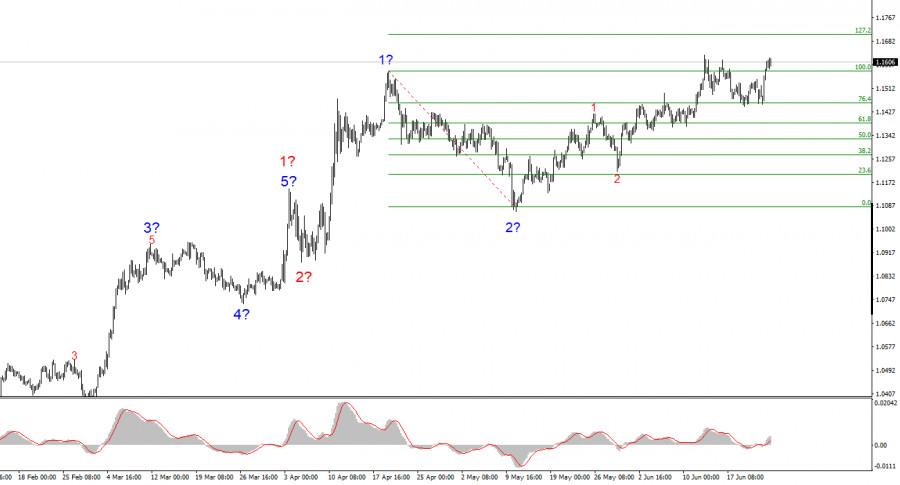

Based on the EUR/USD analysis, I conclude that the instrument continues to form an upward trend segment. The wave structure depends entirely on the news background related to Trump's decisions and U.S. foreign policy. Wave 3 could extend to the 1.25 level. Accordingly, I continue to view buying opportunities with initial targets around 1.1708, corresponding to the 127.2% Fibonacci extension. A de-escalation of the trade war could reverse the uptrend, but currently, there are no signs of a reversal or de-escalation. The war between Israel and Iran merely paused the dollar's decline for a couple of weeks.

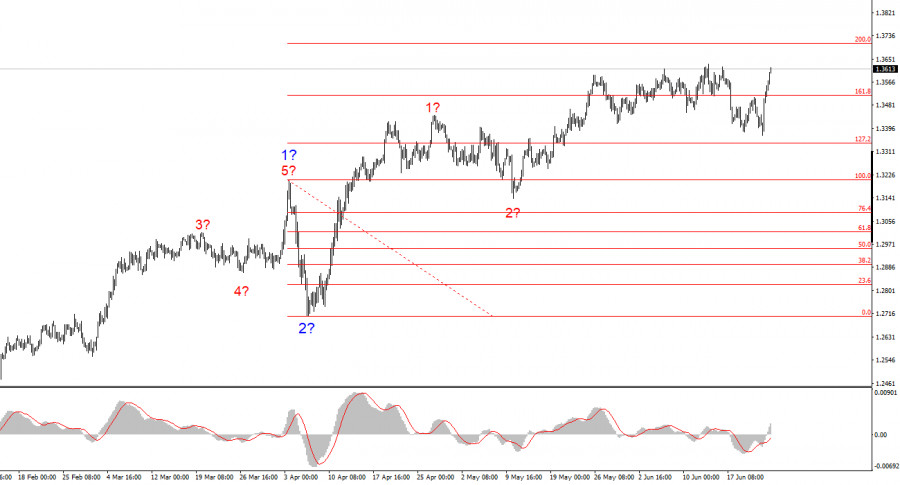

The GBP/USD wave structure remains unchanged. We are dealing with a bullish impulse segment. Under Donald Trump, the markets could experience many more shocks and reversals, which may significantly impact the wave pattern. But for now, the active scenario remains intact, and Trump continues to do everything he can to weaken dollar demand. The targets for upward wave 3 are around 1.3708, corresponding to the 200.0% Fibonacci extension from the supposed global wave 2. Therefore, I continue to consider long positions, as the market shows no intention of reversing the trend.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Os dados de inflação ao produtor divulgados na quinta-feira tiveram, de forma inesperada, um impacto perceptível, ainda que limitado, nos mercados financeiros. No entanto, o choque não foi nem profundo

Vídeo de treinamento

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.