Vea también

13.05.2025 04:49 AM

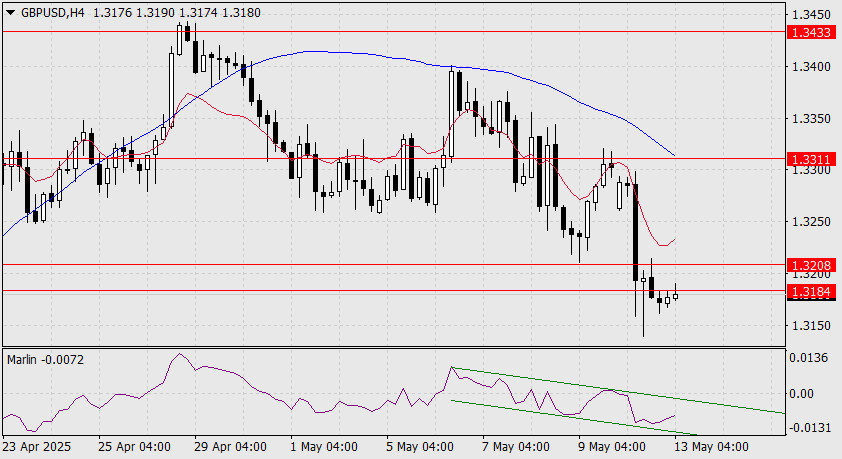

13.05.2025 04:49 AMBy the end of yesterday, the British pound declined by 129 pips, following a 1.43% increase in the dollar index. The support range of 1.3184–1.3208 was breached, and the movement paused at the daily balance indicator line. A short-term alternative scenario was realized.

Today, UK employment data for March will be released. Unemployment is expected to rise from 4.4% to 4.5%, and jobless claims for April are projected to increase from 18.7K to 22.3 K. The weakness in the pound will likely continue for another one to two days, potentially reaching the target support at 1.3101, which the MACD line will soon touch.

On the four-hour chart, the price has consolidated below the 1.3184 level. Both the indicator lines and the oscillator show a downward trend. For sentiment to turn optimistic again, the price must consolidate above the upper boundary of the 1.3208 range. However, the probability remains high for a move toward support at 1.3101, along with a decline in the Marlin oscillator's signal line to the lower boundary of its descending channel.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.