Vea también

13.05.2025 06:37 PM

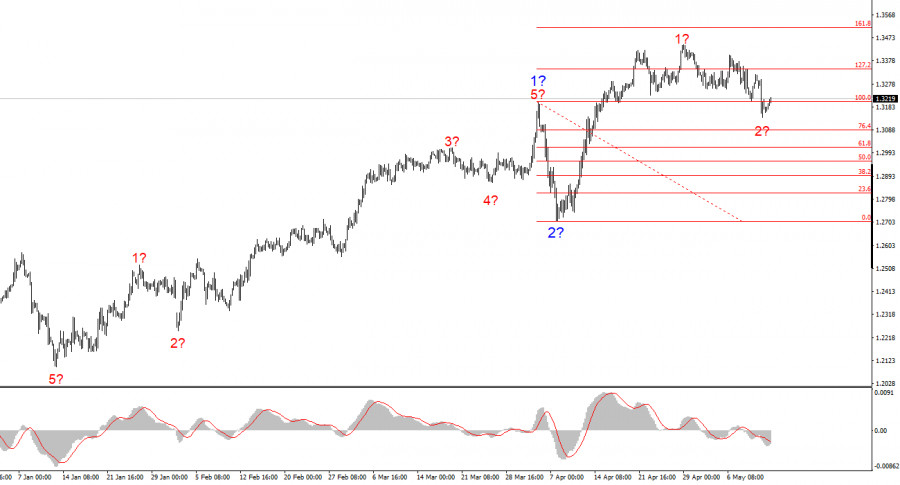

13.05.2025 06:37 PMThe wave pattern for GBP/USD has also transformed into a bullish, impulsive structure — "thanks" to Donald Trump. The wave picture is almost identical to that of EUR/USD. Until February 28, we observed the development of a clear corrective structure that raised no concerns. However, the demand for the U.S. dollar began to fall sharply, resulting in the formation of a five-wave bullish structure. Wave 2 took the form of a single wave and is now complete. Therefore, a further rise of the pound within wave 3 is expected, which has been unfolding over the past three weeks.

If we consider the fact that the British news backdrop did not contribute in any way to the strong growth of the pound, we can conclude that exchange rates are now being dictated solely by Donald Trump. If (theoretically) Trump's trade policy course changes, it's likely the trend will change too — this time to a bearish one. Hence, for the coming months (and perhaps years), close attention must be paid to every move made by the White House.

The GBP/USD pair dropped by 140 basis points on Monday, but by Tuesday, it had recovered 60 points even before the start of the U.S. session. Monday's decline was driven by news of initial trade agreements between China and the U.S., so the increased demand for the dollar was entirely expected. But was Tuesday's renewed demand for the pound justified?

In the morning, the UK's unemployment report for March was released, showing a rise to 4.5%, which was unexpected by the market. The rest of the data hardly matters in comparison, as this is the most critical indicator. This wasn't even the first time recently that British statistics disappointed. However, the market continues to ignore the economic backdrop, brushing aside most of the negative factors affecting the pound. As a result, instead of a logical new decline, we saw a rather swift recovery. The wave pattern supports further gains, but in this case, readers must once again overlook the news flow.

The U.S. dollar strengthens only when there is no alternative. Since last Wednesday, the pound has fallen 200 basis points, which is relatively modest given the prevailing news environment. On Wednesday evening, the Fed gave no indication that it was ready to resume monetary policy easing — even though the market had expected it. On Thursday, the Bank of England conducted its second round of easing for 2025. On Friday, news emerged of a U.S.-UK trade agreement. On Monday, it was revealed that tariffs between China and the U.S. had been lowered. And despite all of these major developments, the dollar gained only about 200 basis points — and has already lost most of that. Therefore, I continue to expect a further rise in the pair, as the market still sees no compelling positive drivers for the dollar.

The wave pattern for GBP/USD has changed. We are now dealing with a bullish, impulsive segment of the trend. Unfortunately, under Donald Trump, markets may face many more shocks and trend reversals that do not align with any wave or technical analysis. The formation of bullish wave 3 continues, with the next targets at 1.3541 and 1.3714. Therefore, I continue to consider buying opportunities, as the market shows no intention of reversing the trend again.

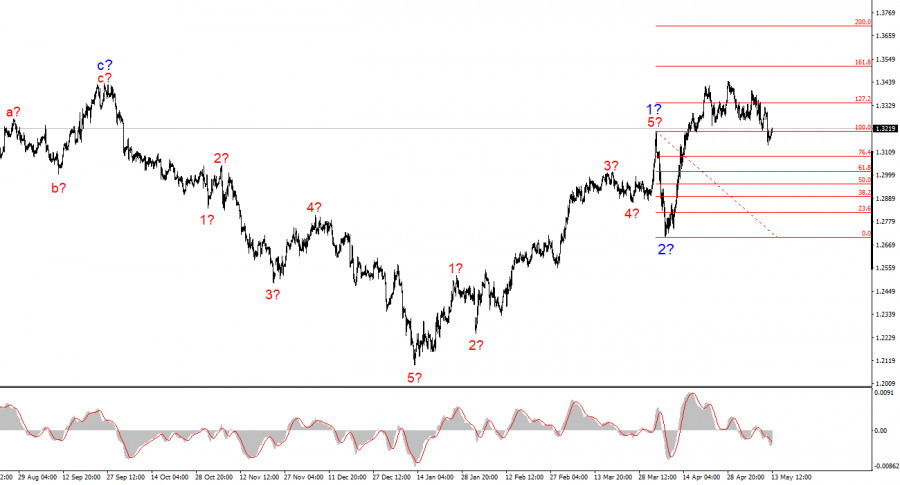

On the higher wave scale, the structure has also shifted to bullish. We can now assume a rising segment of the trend is unfolding. The nearest targets are 1.2782 and 1.2650.

Core Principles of My Analysis:

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Lo más probable es que se esté formando una tendencia alcista mayor en el panorama global del SP500, cuya estructura es similar a la del impulso. Si nos fijamos

La estructura de ondas del instrumento GBP/USD sigue siendo bastante complicada y muy confusa. Alrededor del nivel de 1.2822, que corresponde al 23.6% de Fibonacci y está cerca del pico

El patrón de onda para el instrumento GBP/USD sigue siendo bastante complicado y confuso. Un intento exitoso de romper el nivel de Fibonacci del 50,0% en abril indicó

El patrón de onda para el instrumento GBP/USD sigue siendo bastante complicado. El intento exitoso de romper el nivel de Fibonacci del 50,0% en abril indicó que el mercado está

El patrón de onda del gráfico de 4 horas para el instrumento EUR/USD se mantiene sin cambios. En este momento, estamos observando la construcción de la onda esperada

Indicador de

patrones gráficos.

¡Note cosas

que nunca notará!

Video de entrenamiento

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.