Vea también

16.06.2025 07:57 AM

16.06.2025 07:57 AMPressure on risk assets has eased even though the situation in the Middle East continues to deteriorate. The euro, pound, and yen remain within their respective trading channels, and the market appears to be in a holding pattern, awaiting new and clearer signals.

Last Friday's release of the University of Michigan Consumer Sentiment Index, which showed growth, failed to support the dollar's continued rise against risk assets. Traders seem to have already priced in positive expectations for the U.S. economy, and further strengthening of the dollar will require more compelling arguments.

At the same time, the euro and the pound are showing resilience today, despite ongoing concerns about the escalation of the Iran-Israel military conflict. Only Italy's Consumer Price Index is scheduled for release in the first half of the day. Around midday, Bundesbank President Joachim Nagel is set to deliver a speech.

The Italian CPI will undoubtedly attract attention, although its impact on the overall dynamics of the eurozone is likely to be limited. Far more significant is the speech by Joachim Nagel, head of the Bundesbank. His comments on inflation, interest rates, and the outlook for the German and eurozone economies may significantly influence investor sentiment and the euro exchange rate.

The market will closely analyze the tone of Nagel's speech. This could support the euro if he expresses concern about persistently high inflation and signals that the European Central Bank is ready to pause its rate-cutting cycle. On the other hand, if he focuses on risks to economic growth and hints at further policy easing, it could pressure the European currency.

A mean reversion strategy is better if the data aligns with economists' expectations. A Momentum strategy is more suitable if the data significantly exceeds or falls short of expectations.

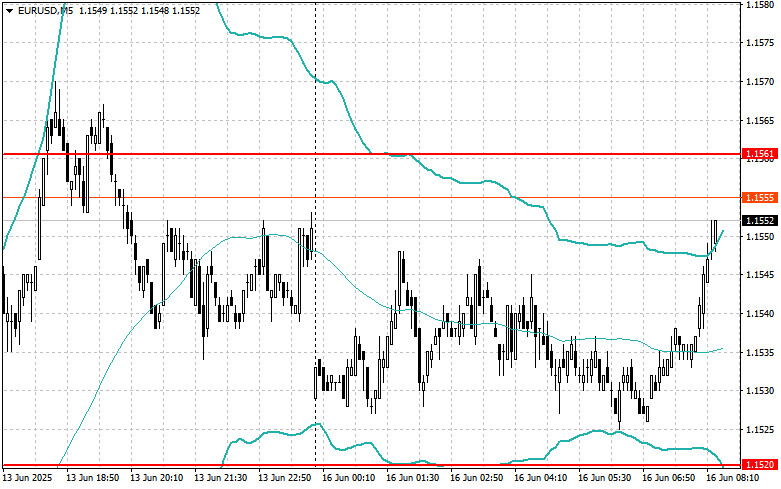

Buying on a breakout above 1.1566 may lead to a rise toward 1.1597 and 1.1628;

Selling on a breakout below 1.1545 may lead to a decline toward 1.1525 and 1.1505.

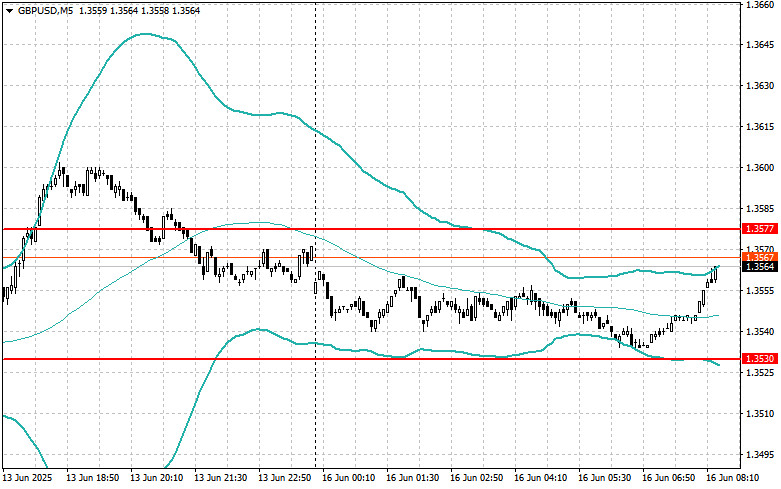

Buying on a breakout above 1.3575 may lead to a rise toward 1.3599 and 1.3629;

Selling on a breakout below 1.3555 may lead to a decline toward 1.3535 and 1.3503.

Buying on a breakout above 144.32 may lead to a rise toward 144.68 and 145.05;

Selling on a breakout below 144.00 may lead to a decline toward 143.66 and 143.25.

I will look for selling opportunities after a failed breakout above 1.1561 and a return below this level;

I will look for buying opportunities after a failed breakout below 1.1520 and a return to this level.

I will look for selling opportunities after a failed breakout above 1.3577 and a return below this level;

I will look for buying opportunities after a failed breakout below 1.3530 and a return to this level.

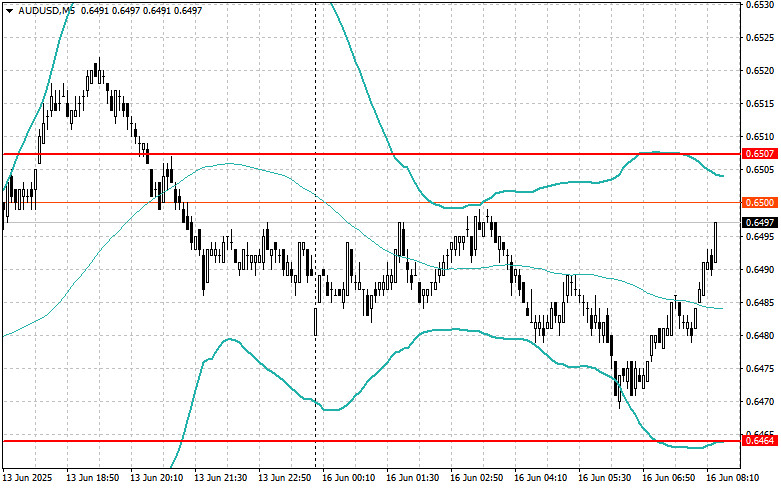

I will look for selling opportunities after a failed breakout above 0.6507 and a return below this level;

I will look for buying opportunities after a failed breakout below 0.6464 and a return to this level.

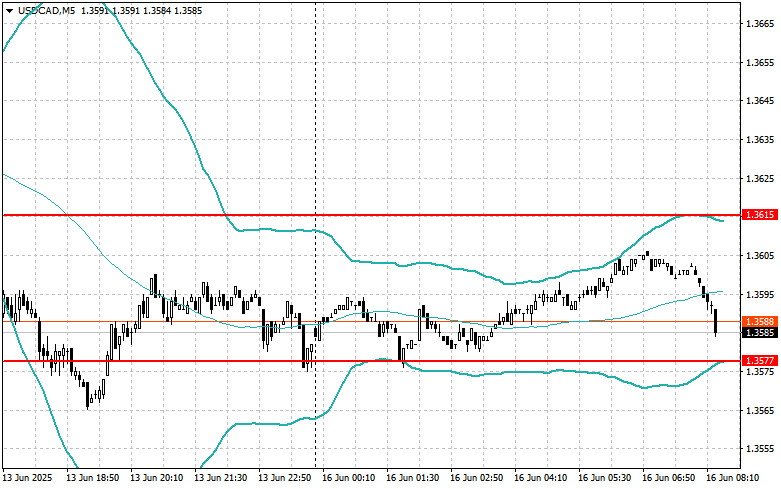

I will look for selling opportunities after a failed breakout above 1.3615 and a return below this level;

I will look for buying opportunities after a failed breakout below 1.3577 and a return to this level.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Los futuros del petróleo Brent se acercaron a la zona de resistencia descendente, pero no lograron consolidarse por encima, retrocediendo hacia abajo. El panorama técnico sigue siendo tenso: el precio

El petróleo respira cambios. La política y la economía vuelven a entrelazarse en un nudo apretado, y los activos de materias primas —especialmente el petróleo y el gas— se convierten

Los futuros del petróleo Brent subieron a aproximadamente $71,3 por barril el martes, marcando la tercera sesión consecutiva de crecimiento, ya que la tensión en Medio Oriente eclipsó otros acontecimientos

El mercado bursátil vuelve a subir, con el S&P 500 en la cúspide de la euforia. ¿Qué será lo próximo? ¿Los aranceles y la política de la Reserva Federal reforzarán

El jueves, los futuros de las acciones estadounidenses permanecen prácticamente sin cambios después de un impresionante rally en la sesión de trading anterior, cuando el S&P 500 alcanzó máximos históricos

Análisis de operaciones y consejos para operar con el yen japonés La prueba del precio 155.96 coincidió con el momento en que el indicador MACD apenas comenzaba a moverse hacia

Análisis de operaciones y consejos para operar con la libra esterlina. La primera prueba del precio 1.2184 en la segunda mitad del día coincidió con el momento

InstaForex en cifras

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.