Vea también

18.06.2025 01:09 PM

18.06.2025 01:09 PMInvestors are in no rush to buy the Japanese yen. The escalation of armed conflict in the Middle East has not helped USD/JPY bears. Fears of Brent crude soaring past $100 per barrel should have prompted a rush into safe havens. Instead, the US dollar is rising despite having supposedly lost its safe-haven status. Has the Forex market flipped upside down again?

In reality, everything is unfolding as it should. At the G7 summit in Canada, Japan failed to secure a trade agreement with the United States. Now Tokyo awaits a letter from the White House, the so-called black mark, which will outline the new tariff terms. It is highly unlikely the letter will propose lowering import duties on automobiles. A 25% tariff would be extremely damaging for Japan's economy. The automotive sector generates 10% of GDP and employs 5.6 million people, or 8.3% of the country's workforce.

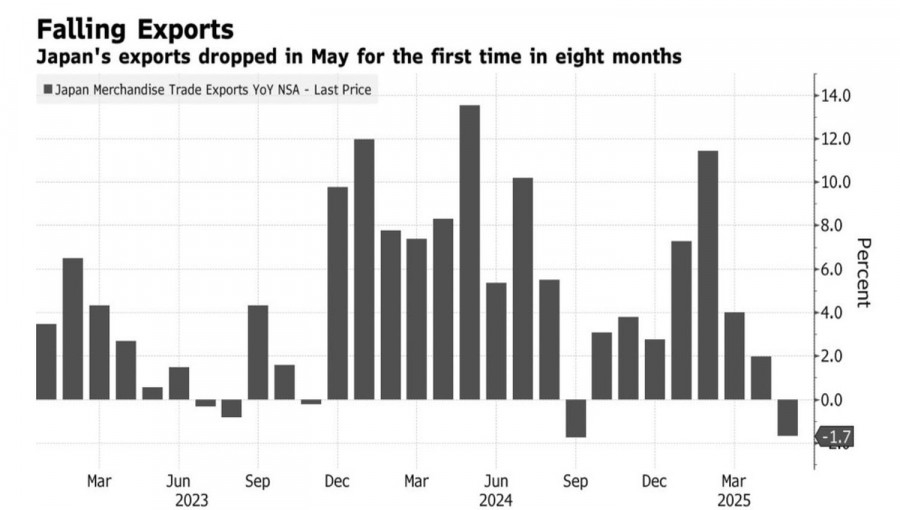

Japan's export dynamics

Is it any wonder that Japan's exports shrank by 1.7% in May? This marked the first decline since September of last year. Exports to the US dropped by 11.1%, mainly due to falling shipments of cars, auto parts, and semiconductor equipment. The negative impact from foreign trade increases the risk of a recession in the Japanese economy and discourages USD/JPY bears.

Especially considering the Bank of Japan is in no hurry to tighten monetary policy. At its June meeting, the BoJ kept the overnight rate at 0.5% and announced an additional £200 billion reduction in QE asset purchases starting in April 2026. On one hand, this calmed investors after recent jitters tied to rising domestic bond yields. On the other hand, the longer quantitative easing persists, the worse it is for the yen.

The yen's failure to strengthen in response to geopolitical conflict in the Middle East points to a geographic logic behind safe-haven flows. Investors had previously stopped treating the US dollar as a refuge, since risks were emanating from the United States. However, once a new global flashpoint appeared, the greenback regained favor.

USD/JPY bears are also under pressure from fears of a hawkish surprise by the Fed. If two or three FOMC officials revise their outlook on the federal funds rate, the consensus for two rate cuts by the end of 2025 could drop to just one. That would give the US dollar another boost, as would any upward revisions to the Fed's inflation forecasts.

On the daily chart, USD/JPY is consolidating within a 142.5–145.5 range. A breakout above the upper boundary would be a signal to buy. A break below would justify selling. An aggressive strategy would involve opening short positions on the US dollar against the yen if the pair fails to hold the fair value level around 144.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.