Vea también

19.06.2025 08:06 PM

19.06.2025 08:06 PMTrade Review and Advice for Trading the Euro

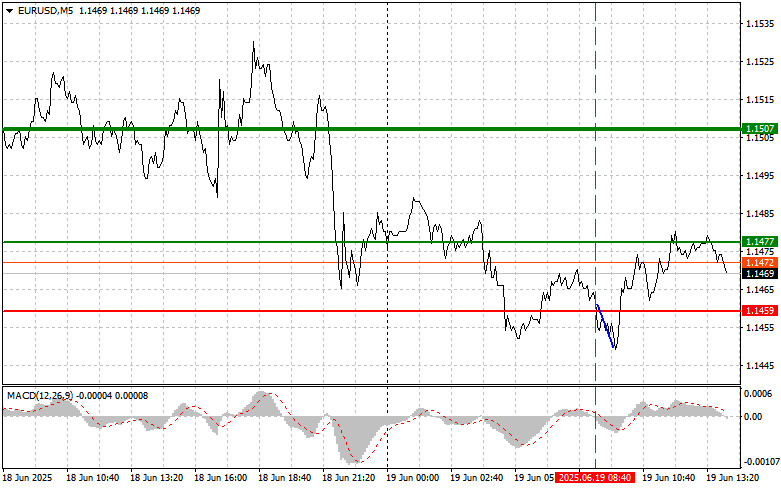

The test of the 1.1459 price level in the first half of the day coincided with the MACD indicator just beginning to move down from the zero line, confirming the correctness of the entry point. However, a major drop in the pair did not materialize.

Clearly, the euro received temporary support due to the absence of important economic data from the eurozone. Nevertheless, this is merely short-term stabilization. In the medium term, the euro remains under pressure due to several key factors. First is inflation, which may rise again in eurozone countries despite the recent decline. Second is the new energy crisis triggered by geopolitical instability, which could negatively affect the eurozone economy.

Today, due to the lack of significant U.S. economic news in the second half of the day and the upcoming holiday, major market fluctuations are not expected. However, this doesn't mean complete inactivity. Rather, we can expect fewer sharp moves and more moderate, predictable asset behavior.

Stay alert for news from the Middle East and statements from Trump regarding Iran, which could cause sudden and unexpected market movements at any moment.

As for intraday strategy, I will mostly rely on Scenarios #1 and #2.

Buy Signal

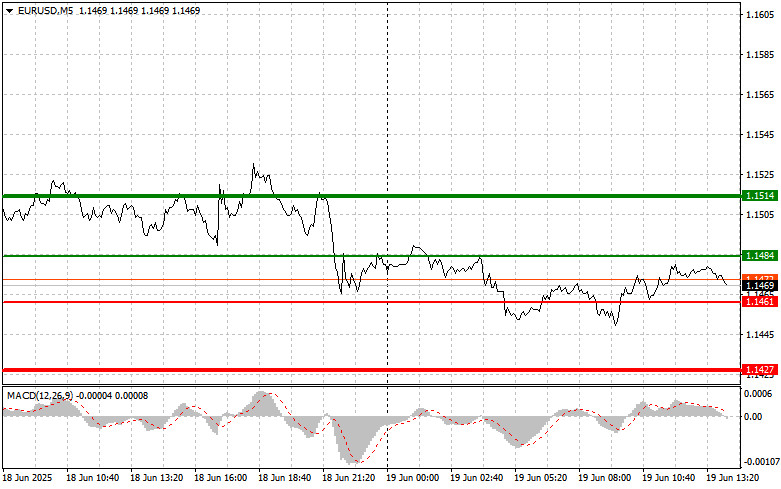

Scenario #1:You can buy the euro today upon reaching the price level of 1.1484 (green line on the chart) with a target of rising to 1.1514. At 1.1514, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30–35 point move from the entry point. A strong euro rally is unlikely today. Important! Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2:I also plan to buy the euro today if there are two consecutive tests of the 1.1461 price level, while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a market reversal upward. A rise toward 1.1484 and 1.1514 can be expected.

Sell Signal

Scenario #1:I plan to sell the euro after it reaches 1.1461 (red line on the chart). The target will be 1.1427, where I intend to exit the market and buy immediately in the opposite direction, aiming for a 20–25 point rebound from the level. Pressure on the pair may resume if the Iran situation worsens. Important! Before selling, ensure that the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2:I also plan to sell the euro today if there are two consecutive tests of the 1.1484 level, while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a downward reversal. A decline toward 1.1461 and 1.1427 can be expected.

Chart Guide:

Important:Beginner Forex traders must make market entry decisions with great caution. It's best to stay out of the market before the release of major fundamental reports to avoid being caught in sharp price fluctuations. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you could quickly lose your entire deposit, especially if you're trading large volumes without proper money management.

And remember, successful trading requires a clear trading plan, like the one outlined above. Spontaneous decisions based on current market movements are a losing strategy for intraday traders.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Desde principios de semana, el mercado del petróleo se mantiene en un equilibrio tenso. El Brent, que perdió su tendencia alcista de mayo, solo logró recuperar parcialmente la caída: tras

Ayer se formaron varios puntos de entrada al mercado. Vamos a mirar el gráfico de 5 minutos y analizar lo que ocurrió. En mi pronóstico de la mañana presté atención

Los futuros del petróleo Brent se acercaron a la zona de resistencia descendente, pero no lograron consolidarse por encima, retrocediendo hacia abajo. El panorama técnico sigue siendo tenso: el precio

El petróleo respira cambios. La política y la economía vuelven a entrelazarse en un nudo apretado, y los activos de materias primas —especialmente el petróleo y el gas— se convierten

Los futuros del petróleo Brent subieron a aproximadamente $71,3 por barril el martes, marcando la tercera sesión consecutiva de crecimiento, ya que la tensión en Medio Oriente eclipsó otros acontecimientos

El mercado bursátil vuelve a subir, con el S&P 500 en la cúspide de la euforia. ¿Qué será lo próximo? ¿Los aranceles y la política de la Reserva Federal reforzarán

El jueves, los futuros de las acciones estadounidenses permanecen prácticamente sin cambios después de un impresionante rally en la sesión de trading anterior, cuando el S&P 500 alcanzó máximos históricos

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.