Vea también

25.06.2025 12:49 PM

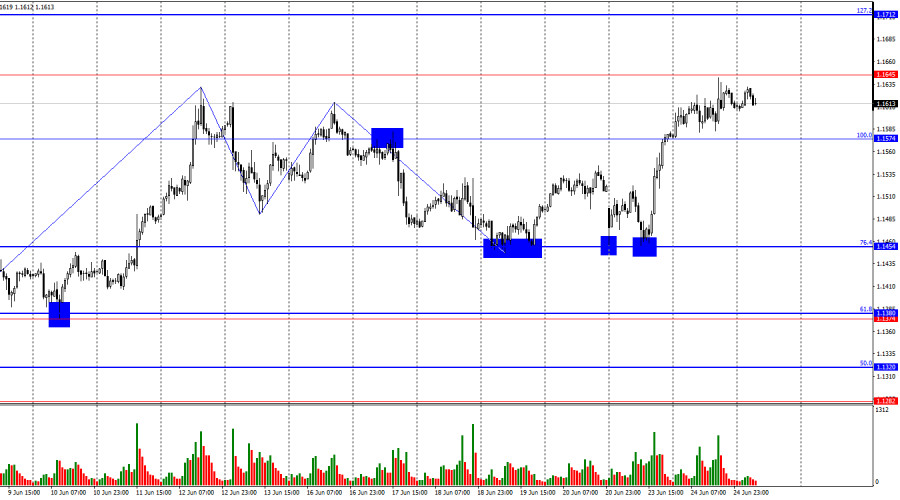

25.06.2025 12:49 PMOn Tuesday, the EUR/USD pair continued its upward movement and nearly reached the 1.1645 level. A rebound from this level would favor the US dollar and lead to a decline toward the 100.0% Fibonacci level at 1.1574. A firm close above 1.1645 would increase the likelihood of further growth toward the next corrective level of 127.2% at 1.1712.

The wave situation on the hourly chart remains simple and clear. The last completed downward wave broke below the previous low, while the new upward wave broke above the previous peak. Thus, the trend has once again turned bullish — or the market has shifted to a horizontal trend. The lack of real progress in the US–China and US–EU negotiations forces bears to stay cautious. The Fed meeting did not help the US dollar, and the Middle East conflict brought no benefit either. As I expected, the bearish trend was neither strong nor long-lasting.

The news background on Tuesday was not particularly interesting for traders. For half the day, Donald Trump, Israel, and Iran were deciding whether they had ended the war or would continue shelling each other. Conflicting reports were coming in every hour. However, by evening, peace was established, so this topic is no longer central for traders. Amid the Middle East developments, traders completely overlooked Jerome Powell's testimony before the U.S. Congressional Financial Committee. The FOMC Chair stated that the regulator should continue waiting to see the full impact of tariff policy on the economy before deciding on rate cuts — something he has said many times before. According to Powell, there is still a fairly high likelihood of rising inflation, and therefore the Fed cannot afford to ease monetary policy under current circumstances. However, not all FOMC members agree with him. Michelle Bowman and Christopher Waller are ready to support a rate cut as early as July if the Consumer Price Index remains at current levels. This would indicate that inflation is not accelerating due to Trump's tariffs, which have already been in effect for several months. However, Trump has not yet finalized those tariffs, and trade negotiations are ongoing.

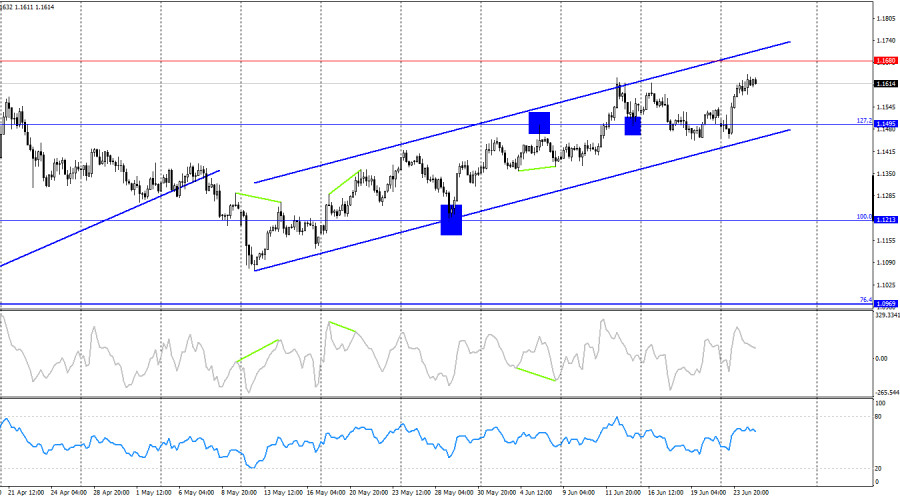

On the 4-hour chart, the pair turned in favor of the euro and resumed growth toward the 1.1680 level within the ascending trend channel. Only a break below the channel would allow for expectations of a bearish trend. No emerging divergences are observed on any indicator today.

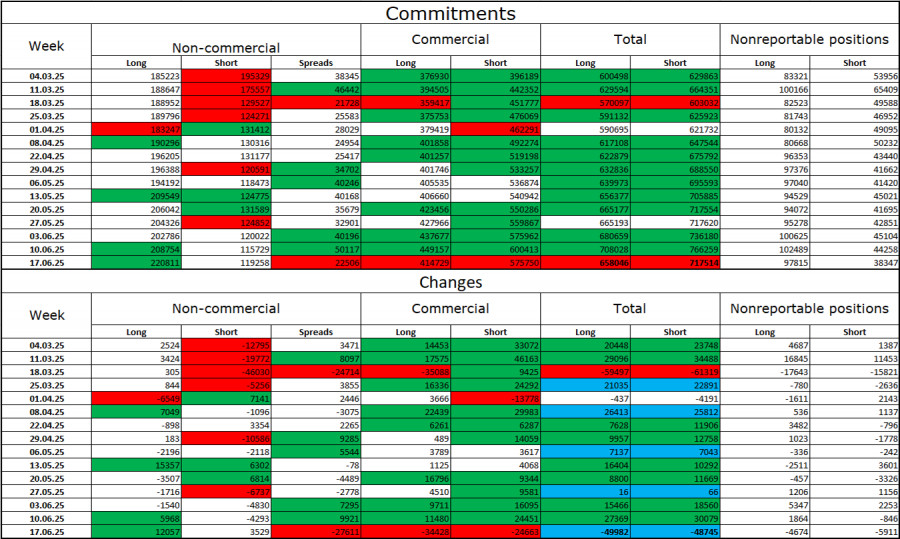

Commitments of Traders (COT) Report:

During the latest reporting week, professional traders opened 12,057 long positions and 3,529 short positions. Sentiment among the "Non-commercial" group remains bullish, thanks to Donald Trump, and is only strengthening over time. The total number of long positions held by speculators now stands at 221,000 versus 119,000 short positions — a gap that continues to widen (with few exceptions). Thus, the euro remains in demand, while the dollar does not. The situation remains unchanged.

For 20 weeks in a row, large players have been reducing short positions and increasing longs. The difference in monetary policy between the ECB and the Fed is already significant, but Donald Trump's policy is a more decisive factor for traders, as it could cause a recession in the U.S. economy and lead to numerous long-term structural problems for the country.

News Calendar for the U.S. and Eurozone:

USA – Speech by FOMC Chair Jerome Powell (14:00 UTC)

The June 25 economic calendar contains only one key entry — Powell's speech. Therefore, the market impact of the news background on Wednesday may be targeted and limited.

EUR/USD Forecast and Trader Recommendations:

Selling the pair was possible after a close below 1.1574 on the hourly chart, with a target at 1.1454. That target was achieved. I wouldn't consider new short positions for now, as the bullish trend seems to have resumed. I previously recommended buying from a rebound at 1.1454 with a target at 1.1574. That target has been reached, and a breakout above it allows for continued long positions with targets at 1.1645 and 1.1712 — the first of which was nearly reached yesterday.

Fibonacci levels are drawn from 1.1574–1.1066 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

InstaForex en cifras

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.