Vea también

02.07.2025 12:48 PM

02.07.2025 12:48 PMAt the close of trading yesterday, US stock indices ended the day mixed. The S&P 500 declined by 0.11%, while the Nasdaq 100 fell by 0.82%. In contrast, the Dow Jones Industrial Average rose by 0.91%.

Today, markets traded fairly well, bouncing back after yesterday's minor correction. Futures on the S&P 500 rose by 0.2%, while European futures gained 0.5%. Asian indices remained largely flat, trimming most of their earlier losses. The Nikkei-225 Stock Average slipped 0.5% after former President Trump threatened to raise tariffs on Japan and intensified criticism over the country's refusal to accept US rice exports. The US dollar index stabilized, hovering near the three-year low reached on Tuesday.

Investors continue to closely monitor economic data and trade tensions after Trump stated he would not delay the July 9 deadline for imposing higher tariffs on US trading partners. This announcement caused only a mild wave of concern in financial markets, though escalating trade wars could undermine global economic growth and result in substantial losses for companies heavily reliant on international trade. Economists have repeatedly warned that further deterioration in trade relations could lead to slower growth, higher inflation, and reduced investment.

However, stock markets—once highly sensitive to trade-related headlines—no longer seem to perceive significant risk. The relative calm is supported by expectations that Trump may eventually extend the tariff deadline, following his usual pattern of threatening before pulling back.

Economists forecast that the June jobs report, due today (Thursday), ahead of the July 4th holiday on Friday, will show a slowdown in job creation to around 110,000 new positions, down from 139,000 the previous month. The unemployment rate is expected to rise to 4.3%. This could have a cooling effect on the stock market.

For the Federal Reserve, which is still assessing the potential inflationary impact of tariffs, any notable deterioration in the labor market would likely increase pressure to cut interest rates—a move that would be favorable for equities. Therefore, a sharp sell-off in indices is unlikely.

On the commodities market, gold continued its upward trend after a 2% gain over the previous two sessions, while oil prices stabilized during Wednesday's trading.

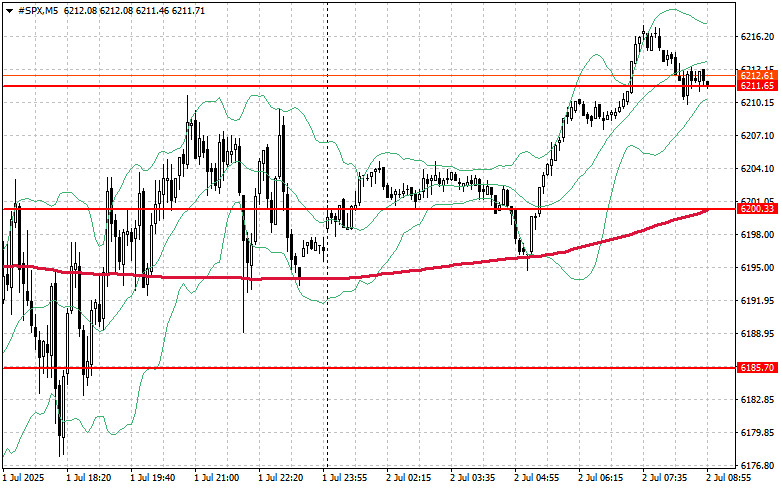

Technical outlook for the S&P 500

Today, the key objective for buyers will be to break through the nearest resistance at 6,223. A move above this level would support further gains and open the door to a potential rally toward 6,234. Another priority for bulls will be securing control above 6,245, which would further strengthen the buyers' position. If risk appetite weakens and the market moves lower, buyers must assert themselves around the 6,211 area. A break below this level would likely send the index back to 6,200 and possibly further down to 6,185.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.