Vea también

15.07.2025 10:38 AM

15.07.2025 10:38 AMS&P500

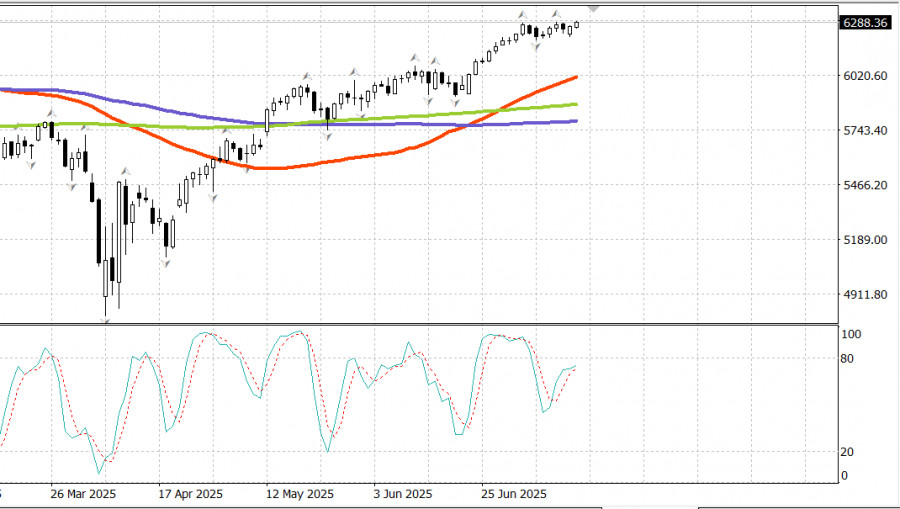

Major stock indices standing tall near all-time highs

Snapshot of the key US stock indices on Monday:

The US stock market bounced off early-session lows following new tariff headlines. Steady trading helped the major indices finish the day with modest gains, and the Nasdaq closed at a new all-time high.

The proposed 30% tariff on the EU and Mexico starting August 1 was enough to trigger a sluggish market opening. However, as expected, the market showed resilience to tariff-related news, which has yet to disrupt its uptrend.

The policymakers of the EU Commission and the President of Mexico expressed willingness to negotiate a more favorable trade deal before the August 1 deadline. This sentiment helped contain selling pressure during the session.

Additionally, markets remained unfazed by President Trump's announcement of new tariffs on Russia—up to 100% starting September 1—should Russia fail to agree to a ceasefire.

Despite the relatively positive tone around tariffs, Monday's gains were modest. Investor confidence was cautious ahead of key economic reports and a wave of corporate earnings this week.

High-impact reports due this week:

Several major banks, including Wells Fargo (WFC 83.43, +0.88, +1.1%), Citigroup (C 87.50, +0.77, +0.9%), and JPMorgan Chase (JPM 288.70, +1.84, +0.6%), will release earnings before Tuesday's market open.

Thanks to positioning ahead of earnings, the financial sector (+0.7%) was among the day's leaders. The communication services sector (+0.7%) also led on Monday:

Netflix (NFLX 1260.81, +15.70, +1.26%) traded higher ahead of Thursday's earnings report.

The sector also benefited from gains in Alphabet (GOOG 182.76, +1.45, +0.8%) and Meta Platforms (META 720.37, +2.86, +0.5%).

Large-cap stocks slightly outperformed the broader market.

The Vanguard Mega Cap Growth ETF rose 0.3%, compared to a 0.1% gain in the S&P 500.

Russell 2000 (+0.5%) and S&P Mid Cap 400 (+0.2%) also outperformed the S&P 500.

Seven sectors of the S&P 500 closed higher, with gains ranging from 0.1% to 0.7%.

The energy sector (-1.2%) was the only one to move more than 1%, dragged down by a 2.3% drop in oil prices to $66.90 per barrel.

Treasuries traded in a narrow range, reflecting a general wait-and-see stance ahead of this week's key economic reports. There were no major U.S. economic data releases on Monday.

Energy market

Brent crude fell to $68.60, failing to hold above $70 —a sign of weakness.

Conclusion The outlook remains unchanged—this could still turn into a new leg up or a healthy correction. Much depends on the major bank earnings and today's CPI report. If there's a sharp pullback, we'll be looking for buying opportunities.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.