আরও দেখুন

23.05.2025 12:23 AM

23.05.2025 12:23 AMCore inflation in April unexpectedly rose higher than forecast, rising from 2.2% to 2.5% year-over-year. Headline inflation slowed from 2.3% to 1.7%, slightly above the forecast. The decline in headline inflation is explained mainly by a sharp drop in gasoline prices—down 109% month-over-month and 18.1% year-over-year—and a 14.1% year-over-year decline in natural gas prices due to the removal of the carbon emissions tax. Without this factor, headline inflation would have been significantly higher.

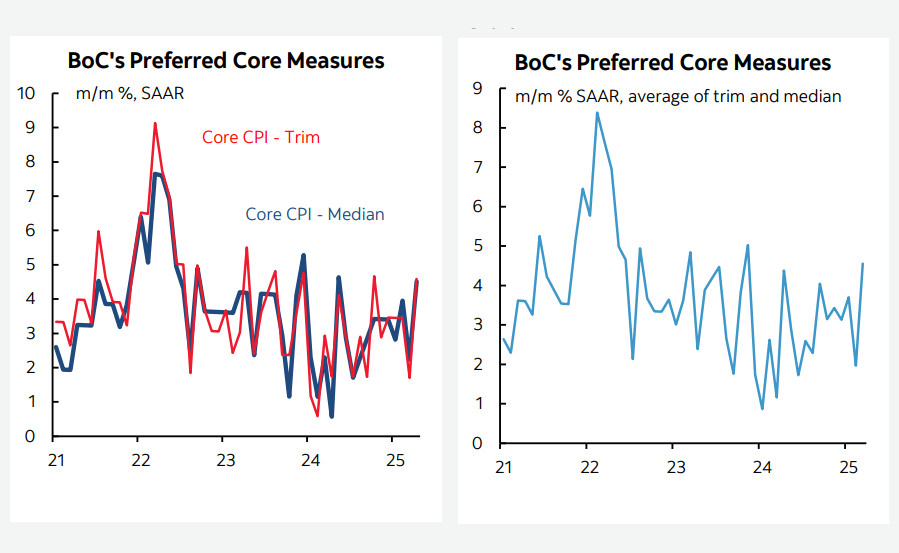

Two of the three key inflation indicators based on trimmed means and median metrics tracked by the Bank of Canada reached 13-month highs. This supports a strengthening CAD, as the rationale for further rate cuts by the Bank of Canada has weakened — even before the effects of the trade war begin to materialize. And they inevitably will, as the lion's share of the additional costs will eventually fall on consumers.

Q1 GDP data will be published before the Bank of Canada meeting on June 4, but the probability of a rate cut has already fallen from 65% to 48%. The BoC was among the first to start policy normalization in June last year, cutting rates seven times since and pausing in April. Now, it's becoming clear that the pause may last longer than previously expected.

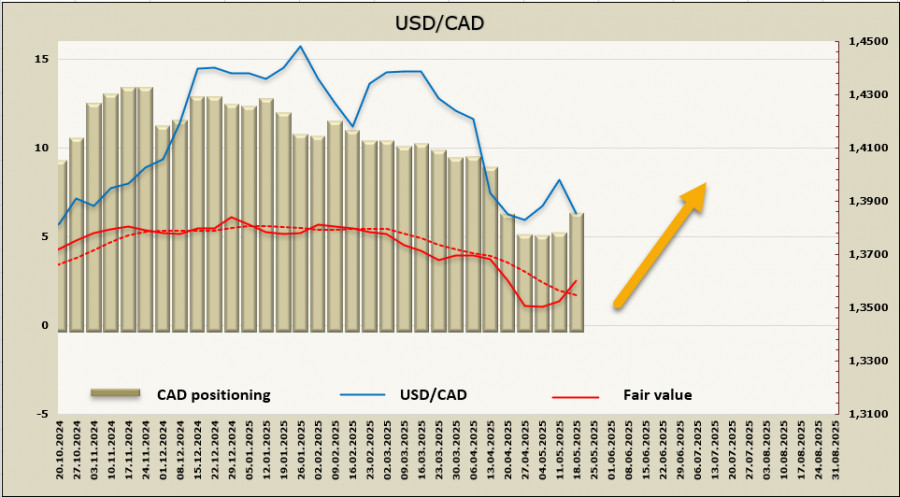

Net short positioning on CAD rose by $768 million over the reporting week, reaching -$5.9 billion. The estimated fair value has broken above the long-term average for the first time in a long period and is trending upward.

If markets interpret the inflation report as signaling a renewed price rise, USD/CAD will likely resume declining. This is not yet obvious: only the core index rose, while the headline index declined—albeit less than forecasted. Therefore, one can look at the behavior of the estimated price, which signals a potential upward reversal.

We expect an attempt to test the resistance zone at 1.3990/4010. A successful breakout would open the path toward 1.4150, while failure would not necessarily imply a reversal downward — more likely, it would lead to consolidation and another attempt to breach resistance. If the GDP report turns out to be strong enough, USD/CAD will gain additional reasons to fall, but we still see greater potential for a corrective upward move in the short term.

You have already liked this post today

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।