See also

23.05.2025 12:23 AM

23.05.2025 12:23 AMCore inflation in April unexpectedly rose higher than forecast, rising from 2.2% to 2.5% year-over-year. Headline inflation slowed from 2.3% to 1.7%, slightly above the forecast. The decline in headline inflation is explained mainly by a sharp drop in gasoline prices—down 109% month-over-month and 18.1% year-over-year—and a 14.1% year-over-year decline in natural gas prices due to the removal of the carbon emissions tax. Without this factor, headline inflation would have been significantly higher.

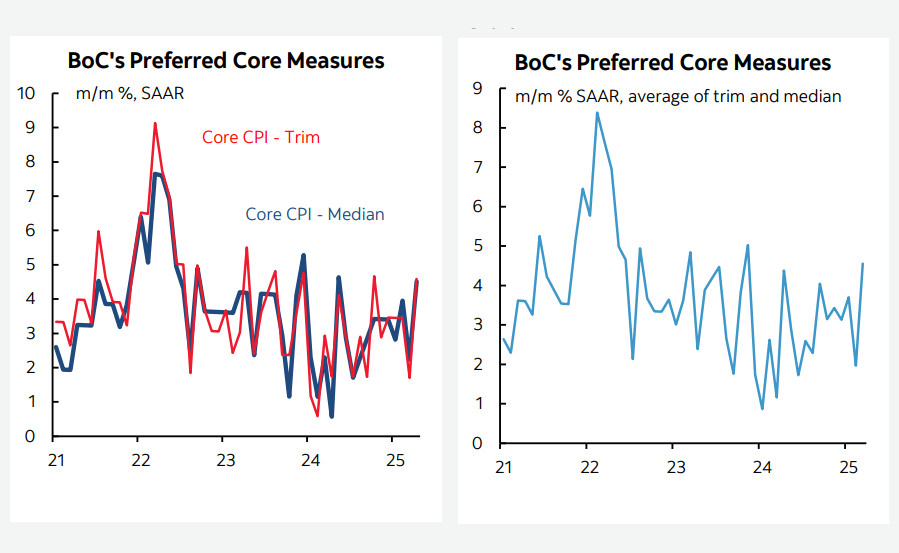

Two of the three key inflation indicators based on trimmed means and median metrics tracked by the Bank of Canada reached 13-month highs. This supports a strengthening CAD, as the rationale for further rate cuts by the Bank of Canada has weakened — even before the effects of the trade war begin to materialize. And they inevitably will, as the lion's share of the additional costs will eventually fall on consumers.

Q1 GDP data will be published before the Bank of Canada meeting on June 4, but the probability of a rate cut has already fallen from 65% to 48%. The BoC was among the first to start policy normalization in June last year, cutting rates seven times since and pausing in April. Now, it's becoming clear that the pause may last longer than previously expected.

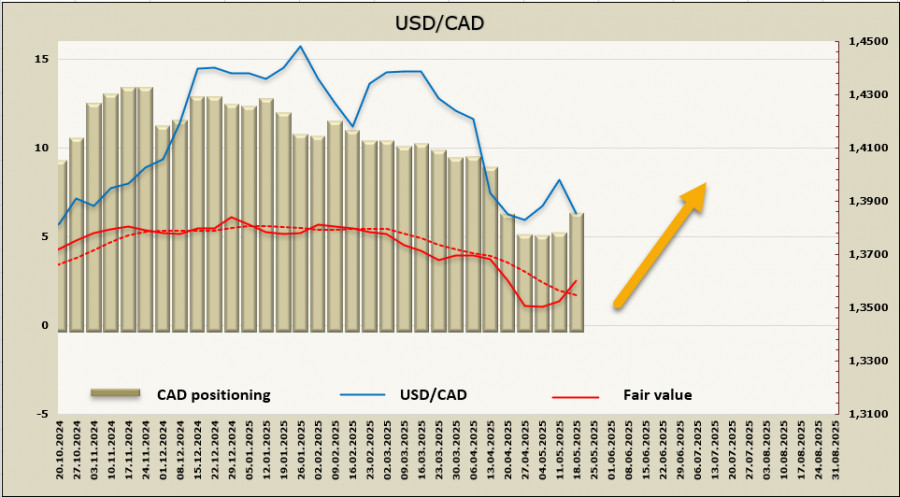

Net short positioning on CAD rose by $768 million over the reporting week, reaching -$5.9 billion. The estimated fair value has broken above the long-term average for the first time in a long period and is trending upward.

If markets interpret the inflation report as signaling a renewed price rise, USD/CAD will likely resume declining. This is not yet obvious: only the core index rose, while the headline index declined—albeit less than forecasted. Therefore, one can look at the behavior of the estimated price, which signals a potential upward reversal.

We expect an attempt to test the resistance zone at 1.3990/4010. A successful breakout would open the path toward 1.4150, while failure would not necessarily imply a reversal downward — more likely, it would lead to consolidation and another attempt to breach resistance. If the GDP report turns out to be strong enough, USD/CAD will gain additional reasons to fall, but we still see greater potential for a corrective upward move in the short term.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

At present, USD/CHF shows no clear intraday direction and fluctuates within a narrow range just above the 0.8155 level, reflecting market uncertainty during the European session. The Swiss franc

Six months into Donald Trump's presidency, it seems he has already thoroughly exhausted the world with his "brilliant" initiatives, groundbreaking actions aimed at making America great again, and his vivid

The GBP/USD currency pair traded relatively calmly on Thursday, given the fundamental backdrop available to the market. On Wednesday evening, the Federal Reserve announced the results of its latest meeting

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.