আরও দেখুন

02.09.2025 09:16 AM

02.09.2025 09:16 AMLabor Day gave markets time to chew over the ruling that Donald Trump's tariffs were declared illegal. The verdict of the Federal Appeals Court sowed real chaos in international trade. However, as often happens, the initial shock was replaced by acceptance. The US dollar first slipped against major world currencies and then regained lost ground. The dynamics of the US dollar index suggest that the reaction of the S&P 500 will also be muted.

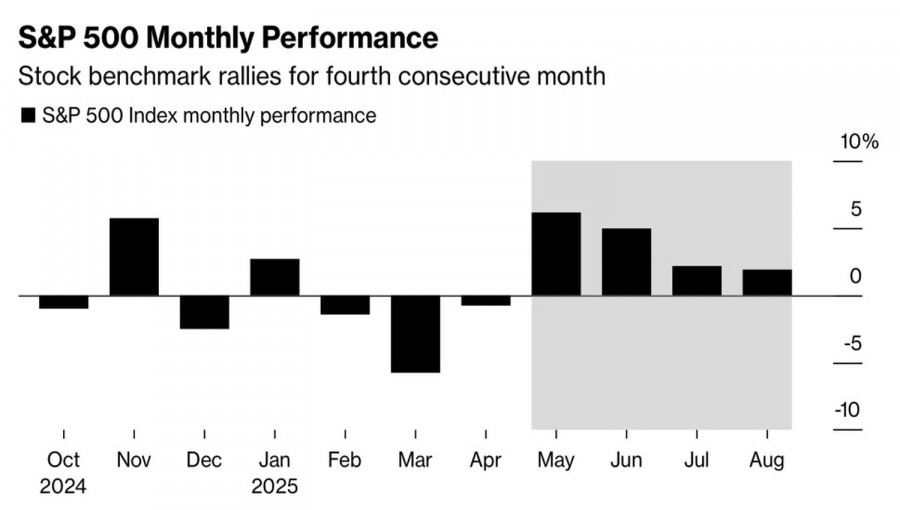

Monthly S&P 500 dynamics

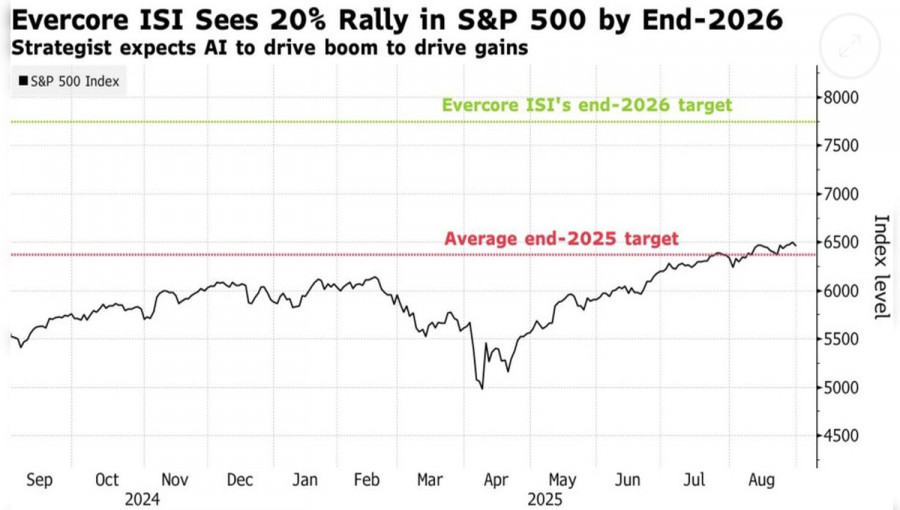

Despite the retreat on the last day of August, the broad stock index closed in the green for the fourth consecutive month, having set another record just the day before. According to Evercore, the S&P 500 could reach 7,750 by the end of 2026, which is 20% above current levels. This forecast is significantly above consensus. The company considers different scenarios. A prolonged combination of high inflation and slow US GDP growth would increase the risk of a decline to 5,000. In the opposite situation, the index could plunge to 9,000.

Evercore argues that investors should not fear buying the dips. And such an opportunity will almost certainly present itself. September will be packed with important events. Moreover, the first month of autumn is historically the weakest period for US equities. According to Bank of America research, since 1927, the S&P 500 has ended September in the red 56% of the time, with an average drawdown of 1.17%. In the first year of a presidency, the picture looked even worse: in 58% of cases, the broad stock index declined with an average drop of 1.62%.

Dynamics and forecasts for S&P 500

In theory, the removal of tariffs would reduce trade uncertainty, lower the risk of accelerating inflation, and free up international trade and US companies. On the other hand, the United States would have to return enormous sums of money. Budget problems would worsen. On the eve of the battle in Congress to keep the government running through the end of September, this would become a serious headache.

In practice, tariffs will not disappear, at least until mid-October. The White House could win an appeal in the Supreme Court. If not, the US administration will come up with new grounds to preserve old tariffs or impose new ones. The uncertainty is high, which will restrain S&P 500 bulls. Especially since no one knows what the upcoming US employment and inflation reports will show, or how the September FOMC meeting will conclude.

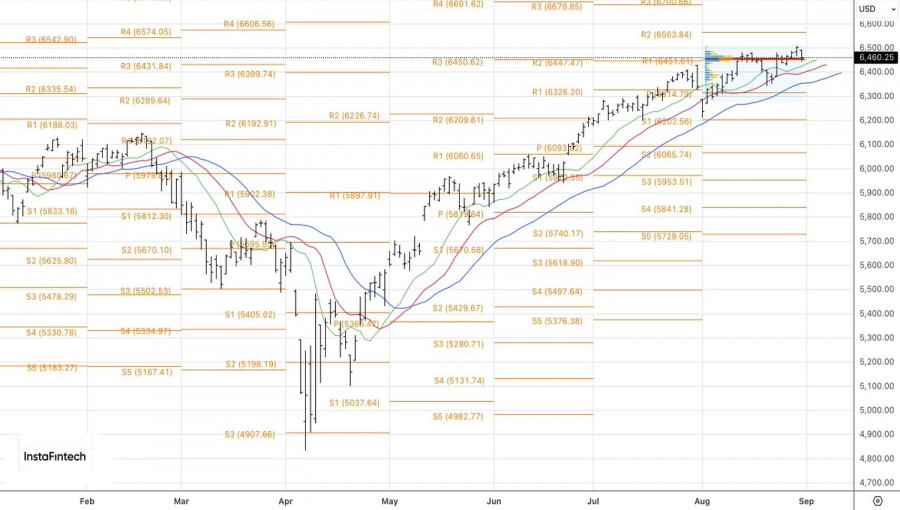

Rising uncertainty increases volatility and heightens the risks of multidirectional swings in the broad stock index.

Technically, on the daily chart of the S&P 500, there are risks of activation and execution of the Three Indians reversal pattern. A trigger for selling would be a breakout below fair value at 6,450 or the low of the second Indian at 6,438. Conversely, if bulls manage to hold 6,450, it would be worth considering index purchases.

You have already liked this post today

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।