See also

19.05.2025 01:20 PM

19.05.2025 01:20 PMTrust in the financial world is not exclusive to the US dollar. News that scammers have stolen data from approximately 197,000 clients of Coinbase — the world's largest crypto exchange, the only publicly traded company of its kind, and a candidate for inclusion in the S&P 500 — has shaken the digital asset industry. Bitcoin has pulled back from recent bullish highs, even though US stock indices continue their rally.

Dynamics of the S&P 500, Bitcoin, and their correlation

Cryptocurrency theft has plagued the sector since its inception, with the volume of stolen funds rising in step with BTC/USD price growth. In February, Bybit was hacked with $1.5 billion stolen — a grim record. Just days earlier, Bitcoin had reached a new all-time high.

What was once considered a key strength of digital assets — transaction privacy — is now becoming a liability. While funds stolen from bank accounts can still be tracked, once money leaves a digital wallet, it becomes untraceable. Unsurprisingly, criminals have set their sights on the crypto industry. Their operations are evolving from online schemes to offline assaults, now dubbed "wrench attacks," where victims are physically coerced into revealing the assets stored in their digital wallets.

If you have a lot of money, you hire security. If not, you keep trading crypto at your own risk. Either way, confidence in Bitcoin and its peers is hardly being strengthened. Should we really be surprised by the recent false breakout in BTC/USD amid extreme risk appetite?

Investors are slowly realizing that the US stock indices can't keep rising forever. They are running out of new catalysts, and attempts by the White House to artificially stir favorable winds may soon wear thin for fans of riskier assets. Especially as the growing market cap of cryptocurrencies exposes them to new pressures like capital rotation.

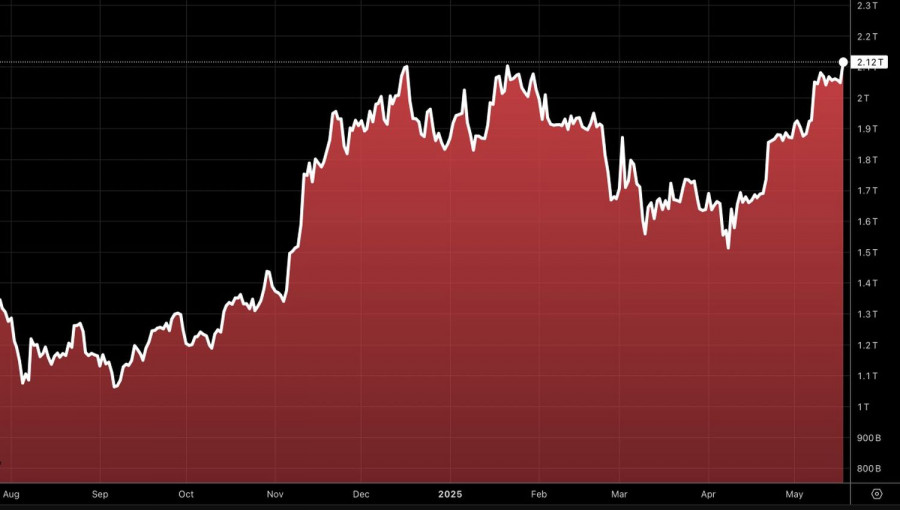

Bitcoin market capitalization trends

While Ethereum's technical upgrade and the de-escalation of the US–China trade conflict spurred capital flows from Bitcoin to Ether and US equities, Moody's downgrade of the US credit rating has driven investors back toward gold. Once again, the leader of the crypto sector is among the casualties.

Thus, declining trust in digital assets due to fraud, a lack of fresh S&P 500 rally drivers, and capital rotation into gold have become the key forces driving BTC/USD downward.

Technically, on the daily chart of BTC/USD, a bull trap pattern is forming. The bulls' attempt to push prices beyond the upper border of the trading range at 101,500–105,700 has failed. Bitcoin's return to the midpoint of that range has prompted traders to open short positions. These may be expanded further if the 101,500 level is broken.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.